Audio By Carbonatix

Cryptocurrency is referred to by many as money that exists only electronically. A digital currency is also one in which transactions are verified and records maintained by a decentralized system using cryptography, rather than by a centralized authority.

Digital or virtual currency is secured by cryptography, which makes it nearly impossible to counterfeit or double-spend. To put it more simply, it is money that exists virtually and mostly anonymously.

The most popular cryptocurrency is Bitcoin-State. This is because Bitcoin continues to lead the pack of cryptocurrencies in terms of peer-to-peer blockchain technology, market capitalization, user base, and popularity.

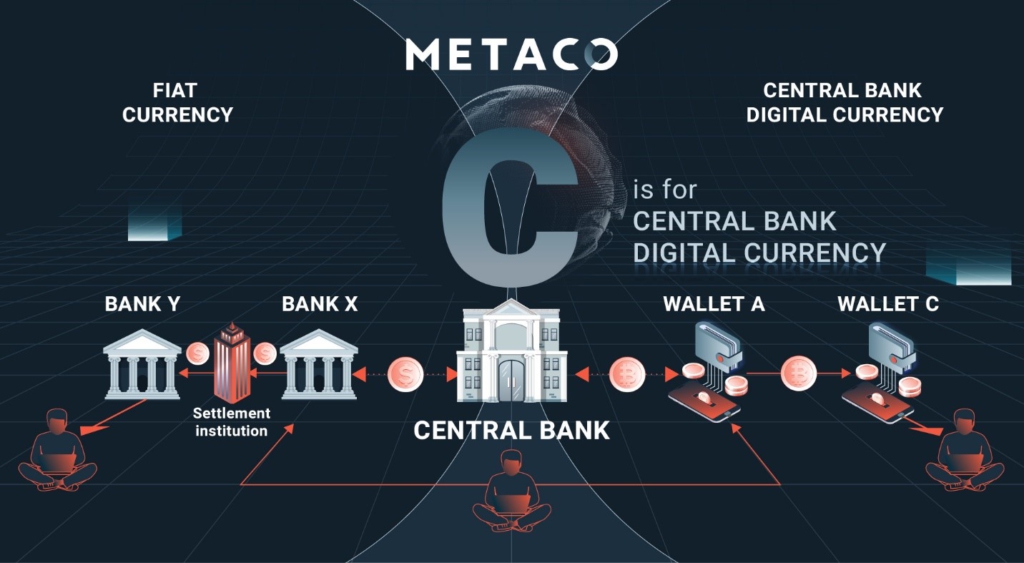

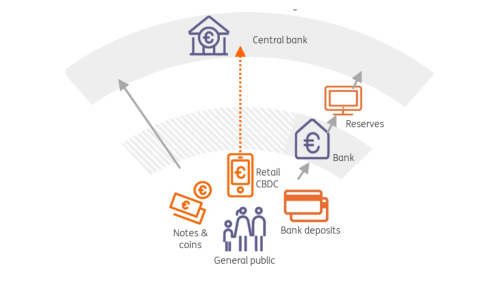

Central Bank Digital Currencies popular written abbreviated as CBDCs is virtual or digital money backed and issued by the central bank.

The surge of Cryptocurrency has moved the central bank of the usual setting and comfort zone. As such the “central banks” have developed a virtual currency initiative that is backed as legal tender.

CBDCs may come across as something new or innovative, but this is one I disagree with — would have agreed if it came some years before the ’90s. The reason is pretty simple.

History has it that the Bank of Finland issued the first Digital Currency by the central bank known as the Avant through a card in the 1990s ( Aleksi Grym, P. Heikkinen, K. Kauko, K. Takala (2017). “Central bank digital currency” ) Interestingly, CBDCs have evolved to what it is now — Cryptocurrency and Bitcoin have become leverage.

THE GLOBAL STATE OF CBDCs

As of now, there are 5 countries namely the Bahamas, Saint Kitts and Nevis, Antigua and Barbuda, Saint Lucia, and Grenada that have fully launched a digital currency.

Interestingly, the countries mentioned above are shrouded in tax havens laws and are masters of “concealing” identities of owners of offshore accounts.

The Bahamian Sand Dollar is the first CBDC to become widely available. The rest are, however, not considered to be CBDC.

China, one of the global giants in everything Technology is leading the space of CBDCs by allowing foreign visitors to use digital Yuan.

There are a little over 81 countries that are currently exploring Central Banks Digital Currencies. (https://www.bis.org/publ/arpdf/ar2021e3.htm) This represents over 90% of the global total monetary or market value of all the finished goods and services produced.

However, as of last year, May 2020 only 35 countries were considering a CBDC. This can be attributed to the massive move from physical to virtual currency. Aided by covid, most people made the huge leap from having physical money to virtual currency to limit the amount of contact with a potential covid patient.

The Atlantic council conducted a reach on 83 countries stand and progress on CBDCs and here are the numbers in perspective considering their tracker- 6% have launched, 17% are piloting,18% are in the development stage, 40% are researching, 12% are inactive, 2% have cancelled and 5% were categorized as other.

THE BANK OF GHANA’S STATEMENT

In 2018, referencing Notice No. BG/GOV/SEC/2018/02 and signed by Mrs Caroline Otoo (the secretary), highlighted some great concerns about digital and virtual currencies operations in Ghana.

This notice spoke about cryptocurrencies in Ghana, the investment of resources to further enhance the payments and settlements systems. It also highlighted some changes in the Payment System and Service Bill.

All these were aimed at significantly transforming the payments system landscape and promote financial inclusion.

On 12th July 2021, www.myjoyonline.com published an article indicating that the Bank of Ghana was ready to pilot Ghana’s first digital currency in September.

This publication came to me with mixed feelings — triumph, uncertainty, scepticism, and yet assuring. Comment on the Bank of Ghana to pilot CBDC using G+D technology.

Just about a week ago, on 11th August 2021, The Bank of Ghana (BoG) issued a statement it is partnering with Giesecke+Devrient (G+D) to pilot a retail central bank-issued digital currency in Ghana. The issue indicated this be the creation of the first “general purpose” CBDC in Africa.

This from a digital finance enthusiast’s perspective this sounds like Ghana leading the way. Which is a good one. This is most defiantly a precursor to the issuance of a digital form of the national currency, to be known as the e-cedi.

SHOULD BOG GET INTO VIRTUAL CURRENCIES?

I will give a straight answer — YES. The reason for this is enormous considering our economic situation as a country. Beyond the lessons of the COVID-19 pandemic here are a few to tease our thoughts on.

We can reach the unbanked through Virtual currencies and this will raise our Financial Inclusion Index. The upsurge in the number of mobile money accounts suggests a lot more people are moving away from the traditional banks to easily accessible forms.

The transaction and printing cost of Fiat currency is high — Just in 2019, the finance minister indicated, Ghana spent $8.97m in printing 100 and 200 cedis notes. This move will bring forth the state of our Electronic Know Your Customer (e-KYC) and Anti-Money Laundering (AML) process

This can also help with our monetary policy flow and make it seamlessly while giving Ghana a footing at the International Monetary Fund.

THE PROS, THE “POSITIVE FEARS” AND THE SPARK

The benefits of a virtual currency in the 21st century consider the impact of the recent pandemic is one we can write a thesis on. Below are several I can think of –

- Financial Inclusion -Ghanaians can be provided with free and zero cost basic bank account. This also helps resolve our last mile

- Tax Collection and GoG Payments — This will strengthen our tax collection matrix and make evasion extremely difficult. The government also get the advantage of making payment efficiently.

- Combating Crime and Illicit Activity — Virtual currency gives you the visibility of your financial ecosystem and can instantly reverse or flag fraudulent and illicit transactions.

- Traceability — Funds in this ecosystem have proof of transaction which helps avoid inherent fiat currency problems such as changing, cash theft, etc

- Preservation of seigniorage income: Virtual currency issuance would avoid a predictable reduction of seigniorage income for governments in the event of the disappearance of physical cash

- Risk Reduction — There is no need for intermediaries for payments as these will be done in real-time and instantly with verifications.

- Elimination and reduction of some Transaction Fees — current payment systems like Visa, Mastercard, American Express etc. have a fee attached to each transaction and lowering or eliminating these fees could lead to widespread price drops and increased adoption of digital payments.

What are the impacts of the countries monetary policy? — This could lead to rapid and huge reductions in reserve balances when there is a flight to quality, driving up money-market interest rates and potentially destabilizing financial markets

We can not get to the mountain top without valleys, neither can we get to the promised land without meanders and some tribulation. Technology is a disruptor, so are the CBDC. They also have cons we can not disregard. Top of mind, here are a few –

- Banks could go down: Should citizens buy into this and jump into the crazy without proper transition and position by the banks, we could be writing another “BlackBerry” or “Nokia” story.

- Centralization : The control by the Bank of Ghana is ……( help me fill that gap). This is one of my biggest fear. Until proven otherwise, I will ask, should a user be suspected of something not “true” Guess the control.

- Digital Dollarization: As a friend puts it, a well-run foreign currency could become the replacement for the Ghana Cedis. Let’s not forget the announcement of Libra contributed to the increased attention to CBDCs by most central banks and with China comfortably making progression — my thoughts on this will have to be held and discussed later. The central bank can preserve the oligopoly power of financial institutions.

Some other risks to evaluate and try eliminating are related Cyber threats and single point of failure, privacy and consumer protection, technology risk and obsolesce.

The SPARK

Ghana can take advantage of Technology and Virtual CBDCs to “leapfrog” considering the well taunted Digitization Agenda of the government.

More so, consider the revenues earned from remittance this can be a good position for “greater works”

RECOMMENDATIONS

The design of Ghana first virtual currency should consider strong and better governance, backing, issuing, programmability, Interoperability with existing platforms and Mobile Money specifically and Circulation.

This new payment system could limit the ability of policymakers to track cross-border flows and hence policymaking process for this should be broadly consultative and inclusive

In the long term, the absence of leadership by the creator and standards-setting can have geopolitical consequences.

CONCLUSION

CBDCs and virtual currencies will be the new global normal when it comes to currencies and trading in the next 10 years and beyond (my prediction). However, I do not believe fiat will completely be out of the system.

However, the Central Bank of Ghana’s move is novel — it does not have a choice. It has to watch and learn well considering it’s a progress space. This should be a win!

PostScript:

Did Ghana not unintentionally experiment with a CDBC by introducing and implementing e-zwich? Taking a clue from Avant, the world’s first CBDC. 🤔

Medaase!

#WeComeFromWinneba

-

The author, Precious Baidoo, is a member of Digital Finance Practitioners Ghana and a student of Digital Frontiers Institute. Thoughts expressed in this piece are personal.

The writer can be reached via: preciousbaidoo@gmail.com

Latest Stories

-

Today’s Front Pages: Tuesday, March 3, 2026

16 minutes -

Gov’t to issue long-dated domestic bonds following expiration of DDEP restrictions – Dep Finance Minister

21 minutes -

From communities to classrooms: Hearing care for all children-2026

22 minutes -

Buffer Stock CEO tours schools and warehouses in Eastern Region

26 minutes -

Are we tying down growth? – Finance professor flags on gold reserve policy

41 minutes -

Lands Minister endorses Petroleum Hub Project to generate sustainable employment opportunities

1 hour -

Government to build 600 new basic schools to end ‘Schools Under Trees’

1 hour -

Kumasi Mayor vows to keep Kejetia Market free from highly inflammable materials

1 hour -

Gov’t to open enrolment for affordable homes under National Homeownership Fund

1 hour -

Cashew farmers remind Mahama to fulfil promise to establish Cashew Development Board

2 hours -

National Ambulance Service moves to acquire 400 new ambulances and 500 motorbikes

2 hours -

Gov’t urges Ghanaian pilgrims to defer travel over Middle East tensions

2 hours -

Ghana to create the largest converging centre for mineral discussions

2 hours -

11 foreigners face trial over counterfeit dollar operation in Ga South

2 hours -

GRIDCo chief leads team to inspect Genser’s Prestea Gas facility

2 hours