Audio By Carbonatix

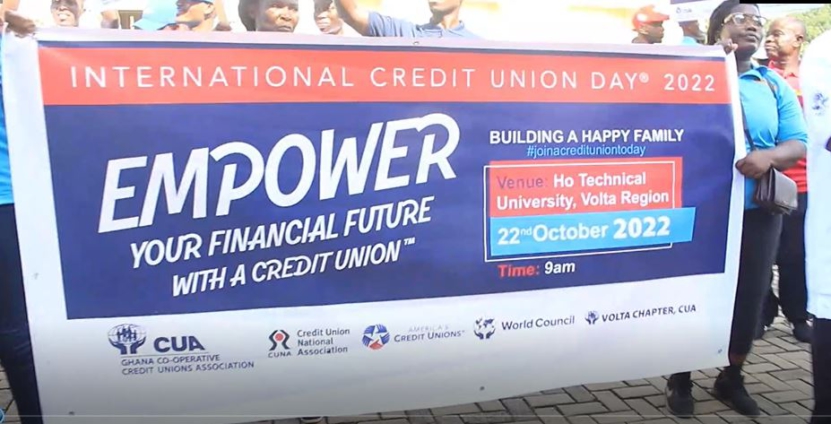

The International Credit Union Day has ended with national celebrations by its members in Ho with a call on members to work harder to achieve their goals of becoming the best in the financial industry.

In an interview with Joy Business, Dr. Johnson Wotu, the Deputy General Manager for Credit Union Association, stated that in order to meet the current economic trend gained over the years, they have supported those who are considered vulnerable in society.

This he explained is because credit unions are meant for the downtrodden and middle class and have the capacity in terms of business in terms of social impact, and other impacts such as medicals to help its members.

“Currently, we talk about between 1 million and 1,000,001.2 members which cut across varied membership in terms of the elites, the vulnerable, the downtrodden, the poor as you may want to term it,” he said.

Dr. Wotu stated that the community in which credit unions operate is capable of supporting and creating a recreational facility for members in order for them to experience the impact of creation.

He noted that credit unions have also helped the economy by increasing their contribution by over 2.5 billion to GDP. With credit unions playing a major role in the nation's economic development, he stated that one cannot do without insurance which plays a significant role in the economy.

The Volta Regional Chapter Manager, Ignatius Agamah noted that there are 26 credit unions in the Volta Chapter with Akatsi South having the most members.

He noted that, as of September 2021, the Volta Chapter had an asset of GHC120 million which is making a significant impact on the lives of the people.

Mr. Agamah noted that joining a credit union is one good decision that all must endeavor to make in order to help improve their financial status.

He urged residents of both the Volta and Oti regions to take their financial journey to a step higher by joining a credit union to improve their lives and that of their families.

The Volta Regional Minister, Dr. Archibald Yaw Letsa in his address noted that the increasing number of credit unions in Ghana helps improve the economic status of the country.

Dr. Letsa noted that it is utterly clear that credit unions do not only create opportunities for people to save money but also for them to get financial assistance or lower rates and subsequently enjoy any return on savings.

The programme was sponsored by the Credit Union National Association, The American Credit Union, World Council and The Volta Chapter, CUA.

Latest Stories

-

Alhaji Agongo builds lifeline facility for Ghana Police Hospital’s ‘Unknown Patients’

9 minutes -

Removal of Chief Justice Torkonoo had economic implications – Samson Lardy Anyenini

11 minutes -

Ronaldo will not retire until he scores 1,000 goals

13 minutes -

Amerado shuts down Okese Park with third edition of My Motherland Concert in Ejisu

17 minutes -

Man City close to agreeing terms Bournemouth to sign Semenyo

38 minutes -

Time is right to change Man Utd formation – Amorim

46 minutes -

Akufo-Addo’s record not entirely negative despite economic challenges – Anyenini

49 minutes -

Dafeamekpor chairs Kenpong Travel’s 2026 World Cup Travels management team

1 hour -

Group petitions OSP, EOCO,AG, over alleged unlawful role of unlicensed firm in GoldBod operations

2 hours -

Ghana in Praise 2026 set to open new year with national worship gathering

2 hours -

Keeping Ofori-Atta for 8 years was Akufo-Addo’s worst decision – Winston Amoah

3 hours -

Whose security? whose interest?: U.S. military action, Nigeria’s internal failure, and the dynamics of ECOWAS in West Africa

3 hours -

Abuakwa South MP names baby of 13-year-old teenage mother after First Lady

3 hours -

Police thwart robbery attempt at Afienya-Mataheko, 4 suspects dead

3 hours -

Don’t lower the bar because things were worse before – Kojo Yankson on Mahama gov’t

4 hours