Audio By Carbonatix

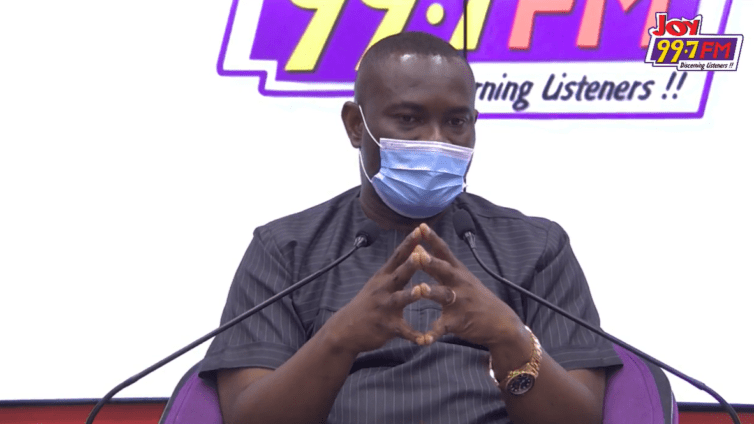

Deputy Finance Minister, Dr. John Kumah, says the government has provided a liquidity buffer for institutions to fall on during the debt exchange programme.

According to him, while the debt exchange programme was not targeted at individuals but rather institutions, some individuals will be affected due to their investing through certain institutions, for example pension funds.

He explained that with government recognizing the fact that some of these institutions will have to make payments to clients, it has created several buffers to provide support to such institutions should they come into difficulties.

Speaking on JoyNews’ PM Express, he said, “Institutions are made up of individuals, but in treating institutions they are separate personalities as far as the legal definition of institutions are concerned. So we want to deal with institutions. But of course we understand that some individuals may be affected by the institutional arrangement that we have done so we’ve provided buffers.

“And I heard you talk about the financial stability fund which is going to be a liquidity buffer from the Bank of Ghana to support such institutions that may face difficulty. So that is how we want to deal with the impact of how the debt exchange programme may have on these institutions. So these are banks, the pension funds, and any other institution that wants to take advantage of the FSF.”

He stated that the liquidity buffer is available for every other institution affected by the debt exchange programme.

“Yes, if you have to pay let’s say your customers or your beneficiaries and you’re facing challenges you can apply to the Bank of Ghana, make a case for it and then depending on the arrangements you’ll be considered,” he said.

Meanwhile, Ghana is inviting eligible holders to exchange GH₵137.3 billion of the domestic notes and bonds, including Energy Sector Levy Act Plc and Daakye Trust Plc, for a package of New Bonds to be issued by the country.

It said offers may only be submitted starting from December 5, 2022, and ending at 4:00 p.m. (Greenwich Mean Time (GMT)) on December 19, 2022.

However, Ghana may at its sole discretion extend the expiration date, including for one or more series of eligible bonds.

The invitation is available only to registered holders of eligible bonds that are not individual investors or that are otherwise authorised by the Government of Ghana, in its sole discretion, to participate in the Invitation.

Latest Stories

-

Mahama calls for prosperity, peace and progress in New Year Message

22 minutes -

Tema police foil armed robbery attempt at Afienya; Four suspects killed

3 hours -

Two dead, two in custody over fatal family land feud

4 hours -

Anthony Joshua discharged from hospital after fatal road crash

4 hours -

Trump media firm to issue new cryptocurrency to shareholders

4 hours -

Ebo Noah arrested over failed Christmas apocalypse and public panic

6 hours -

‘Ghana’s democracy must never be sacrificed for short-term politics’ – Bawumia

6 hours -

Bawumia congratulates Mahama but warns he “cannot afford to fail Ghanaians”

6 hours -

CICM backs BoG’s microfinance sector reform programme; New Year Debt Recovery School comes off January-February 2026

6 hours -

GIPC Boss urges diaspora to invest remittances into productive ventures

6 hours -

Cedi ends 2025 as 4th best performing currency in Africa

6 hours -

Fifi Kwetey brands calls for Mahama third term as ‘sycophancy’

6 hours -

Bawumia calls for NPP unity ahead of 2028 elections

7 hours -

Police restore calm after swoop that resulted in one death at Aboso

7 hours -

Obaapa Fatimah Amoadu Foundation launches in Mankessim as 55 artisans graduate

7 hours