Audio By Carbonatix

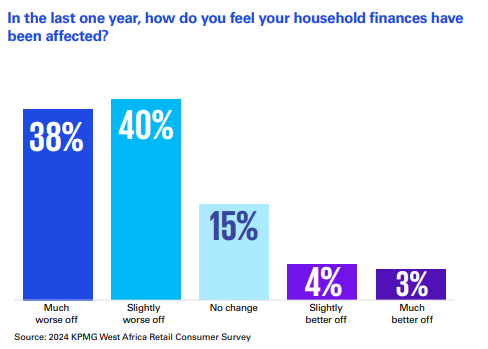

Thirty eight percent of Ghanaian retail consumers feel their finances have worsened in the last one year.

According to the 2024 West Africa Banking Industry Customer Experience Survey by KPMG, the rising costs of fuel and essential goods have further squeezed budgets, leaving little room for discretionary spending or long-term financial planning.

In response to these challenges, the report said many Ghanaians are adopting cost-saving strategies, such as seeking cheaper alternatives for food and clothing.

The financial pressure has also influenced personal decisions, with half of respondents in the retail consumer survey considering emigration to escape lasting economic hardship.

When respondents were asked respondents how they intend to adapt to the economic hardships, 36% indicated that they intend to increase their workload to cope with financial pressures while 29% remain hopeful about starting businesses, despite the economic climate.

However, 6% of respondents expressed reluctance to venture into entrepreneurship due to the uncertainties of the current environment.

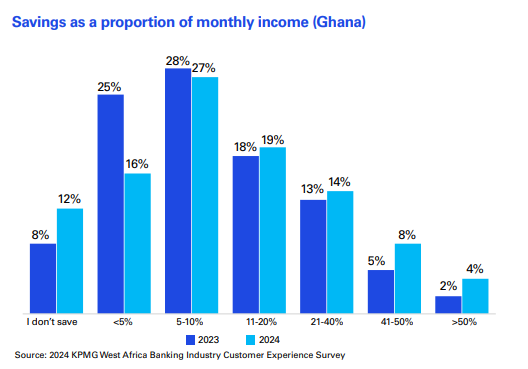

While aggregate level of savings remained largely the same compared to last year, the survey observed that respondents who do not save increased from 8% to 12% this year.

“We observed that savings and investments which was the fourth largest expense area last year for Millennials shifted to sixth place”, the report added.

6% Millennials Do Not Save

There were also fewer millennials who indicated that they do not save – a drop from 11% to 6% this year.

Contrary to the Nigerian situation, Baby Boomers had the largest proportion of people who do not save – 41%.

A review of their expenditure showed a focus on their health as well as fitness and catering to their family obligations. For Gen Zs, who are most likely students and early career starters, an impressive 13% indicated that they were able to save 21% to 40% of their monthly income.

The survey findings reveal that the top two expense areas for Ghanaians were food and dining (66%) and transportation (44%), same as in 2023.

Whereas savings and investments was considered a top five spending category last year, we observed a displacement by airtime and data expenses (35%) this year.

Latest Stories

-

MTN FA Cup: Defending champions Kotoko knocked out by Aduana

3 hours -

S Korean crypto firm accidentally pays out $40bn in bitcoin

3 hours -

Washington Post chief executive steps down after mass lay-offs

4 hours -

Iranian Nobel laureate handed further prison sentence, lawyer says

4 hours -

U20 WWCQ: South Africa come from behind to draw against Black Princesses in Accra

4 hours -

Why Prince William’s Saudi Arabia visit is a diplomatic maze

4 hours -

France murder trial complicated by twin brothers with same DNA

4 hours -

PM’s chief aide McSweeney quits over Mandelson row

4 hours -

Ayawaso East primary: OSP has no mandate to probe alleged vote buying – Haruna Mohammed

5 hours -

Recall of Baba Jamal as Nigeria High Commissioner ‘unnecessary populism’ – Haruna Mohammed

5 hours -

Presidency, NDC bigwigs unhappy over Baba Jamal’s victory in Ayawaso East – Haruna Mohammed

5 hours -

Africa Editors Congress 2026 set for Nairobi with focus on media sustainability and trust

6 hours -

We are tired of waiting- Cocoa farmers protest payment delays

6 hours -

Share of microfinance sector to overall banking sector declined to 8.0% – BoG

7 hours -

Ukraine, global conflict, and emerging security uuestions in the Sahel

7 hours