Audio By Carbonatix

The 2024 KPMG Customer Experience Survey has revealed that the Ghanaian investment landscape reflects a cautious approach to investments with interests in both low and medium risk opportunities as individuals navigate economic challenges in pursuit of financial security and independence.

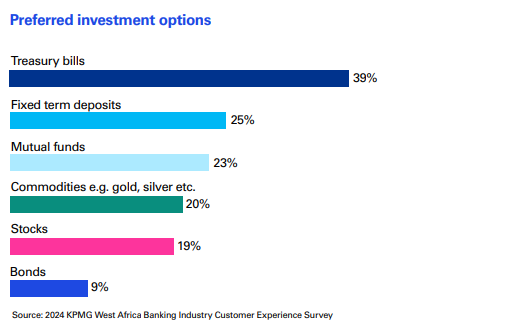

According to the report, the recent insights reveal that treasury bills remain the most preferred investment option, with 39% of respondents opting for these low-risk instruments.

Fixed or term deposits closely follow at 25%, further reinforcing the cautious approach among many Ghanaians, who prioritise stability and guaranteed returns amidst economic uncertainty.

However, the report said there are signs of gradual diversification in investment choices.

Mutual funds, selected by 23% of respondents, are gaining traction as a medium-risk option offering balanced returns.

Additionally, commodities such as precious metals and agriculture products, accounted for 20%, which demonstrated a growing appetite for alternative investments as a hedge against inflation and economic instability.

Expectedly, higher-risk instruments such as stocks (19%) and bonds (9%) remain underutilised, pointing to limited confidence.

The report added that the hesitancy of Ghanaians to adopt these investment options highlights the need for banks to provide education and solutions to bridge knowledge gaps and demystify complex financial products.

Despite these trends, the survey also revealed that 34% of respondents are willing to take risks with their investments, signalling an underlying desire for wealth creation and financial independence.

Despite these challenges, the survey also highlighted how Ghanaians are channelling resources toward personal growth, financial security and family welfare.

24% Ghanaians Invest in Skills Acquisition, Businesses

When asked about their top three priorities, approximately 24% of respondents are investing in skill acquisition and business ventures reflecting a desire for career advancement and financial independence.

Family obligations remained a central priority, with 24% dedicating funds to education, healthcare and general welfare.

Similarly, wealth generation through investments and property sales also gained traction, with 22% of respondents pursuing these strategies.

Latest Stories

-

Sesi Technologies launches AI-Powered soil testing services for smallholder farmers

8 minutes -

Ghana Chamber of Shipping calls for a 3-month grace period on cargo insurance directive

13 minutes -

NACOC to begin licensing for medicinal and industrial cannabis cultivation

28 minutes -

It’s easier to move from GH₵100k to GH₵1m than from zero to GH₵100k- Ecobank Development Corporation MD

32 minutes -

Between faith and rights: A nuanced strategic view on the debate over an Islamic widow’s political ambition

44 minutes -

At least Baba Jamal should have been fined – Vitus Azeem

51 minutes -

Gender Minister visits the 31st December Women’s Day Care Centre and the Makola clinic

52 minutes -

Ayawaso East NDC primary: Why feed people for votes? Are they your children? – Kofi Kapito

57 minutes -

Ziavi Traditional area begins final funeral rites for Togbega Kwaku Ayim IV

1 hour -

Photos: Mahama swears in Presidential Advisory Group on Economy

1 hour -

Ghana intensifies boundary pillar construction with Côte d’Ivoire

1 hour -

NHIA settles December–January claims worth GH¢400m for service providers

1 hour -

Mahama warns economic advisers of ‘rough road ahead’ amid debt distress

1 hour -

EC engages political parties in preparatory meeting for March 3 Ayawaso East by-election

1 hour -

Forgiveness key to restoring broken relationships – Rev. Daniel Annan

1 hour