Audio By Carbonatix

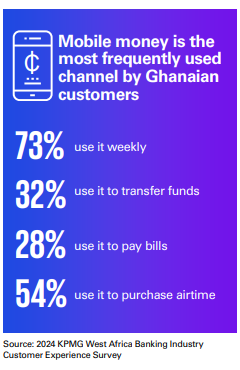

Mobile money is the most frequently used digital platform in 2024, the 2024 West Africa Banking Industry Customer Experience Survey has revealed.

This represented a 7-percentage point increase compared over the previous year.

According to the report, 73% of Ghanaian consumers use it weekly. Thirty two percent use it for transfer of money, while 28% use to pay bills and 54% use it to purchase airtime,

For the second consecutive year, retail banking customers ranked the ease of transferring money between their account and mobile wallet as the most important experience metric highlighting the importance of interoperability between systems.

The survey said mobile money interoperability continues to be a key driver of its adoption with the total value of mobile money interoperability transactions increasing by 23% as of October 2024.

Again, the USSD banking is also driving payment interoperability.

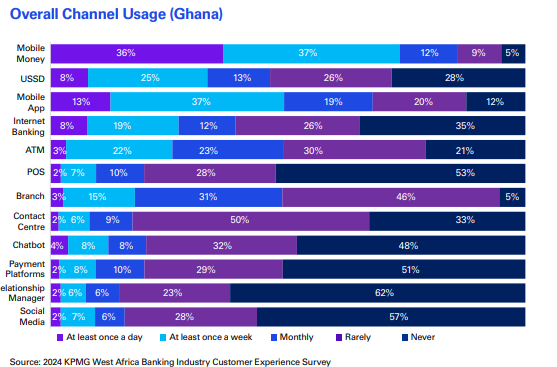

The survey revealed that 33% of retail banking customers use USSD banking services weekly as compared to 28% of respondents in 2023. However, concerns over service reliability persist, with customers reporting intermittent downtime of their USSD banking channels.

Mobile apps, the second most used channel after mobile money, saw a slight decline in usage, with 50% of respondents indicating weekly usage compared to 53% last year.

Availability of service, ease of use and variety of features of mobile apps ranked among the ten most important experience measures for retail customers. While customers appreciate the convenience and features of banking apps, concerns around reliability remain prevalent.

There was a decline in Automated Teller Machines (ATM) usage, with monthly usage dropping from 59% in 2023 to 48% in 2024.

Despite this decrease, customers generally expressed satisfaction with the availability of cash and the service uptime when using ATMs.

While overall usage declined, ATMs remained the second most-used channel among Gen X and Baby Boomers highlighting a generational divide in channel preferences, with older customers continuing to rely on traditional channels for their banking needs while the younger generations prefer digital channels.

Latest Stories

-

GRA assures it will meet GH¢225bn target for 2026 despite tax reform concerns

5 minutes -

Ofori-Atta Saga : Ex-appointees must face probes when invited – John Darko

11 minutes -

Haruna Mohammed rules out removal of names from NPP album

13 minutes -

Volta House of Chiefs nullifies enstoolment of Roland Adiko as paramount chief of Tanyigbe, affirms rotational succession

14 minutes -

FACT CHECK: Kennedy Agyapong’s claim that Adenta is a traditional NPP seat and that Bawumia did not campaign there is false

15 minutes -

Iran: Videos from mortuary show how deadly protests have become

17 minutes -

Over 2,000 screened as Ashanti Region Police recruitment exercise progresses

27 minutes -

Mallam Market chaos: Traders flout rules, crippling Accra-Kasoa Highway

27 minutes -

Preparations for NPP presidential primaries nearly complete — Haruna Mohammed

45 minutes -

AFCON 2025: the dominance of African coaches

47 minutes -

31 granted bail over illegal mining in Apramprama forest reserve

1 hour -

Son of Iran’s exiled late monarch urges supporters to replace embassy flags

1 hour -

Gold Empire Resources applauds gov’t crackdown on illegal mining; calls for prosecution of financiers and sponsors

1 hour -

Western North NPP raises alarm over cocoa sector neglect, cites lack of funds and jute sacks

2 hours -

Government still owes IPPs over $700m in legacy debt — JoyNews Research

2 hours