Audio By Carbonatix

The Finance Minister, Dr Cassiel Ato Forson on Thursday, March 13, presented eight bills to Parliament aimed at abolishing several taxes, including the Electronic Transaction Levy (E-Levy), the betting tax, amongst others.

The bills also seek to uncap statutory funds such as the National Health Insurance Levy (NHIL) and the GETFund levy.

These proposed tax repeals and amendments align with the National Democratic Congress’s (NDC) manifesto pledge to ease the financial burden on Ghanaians.

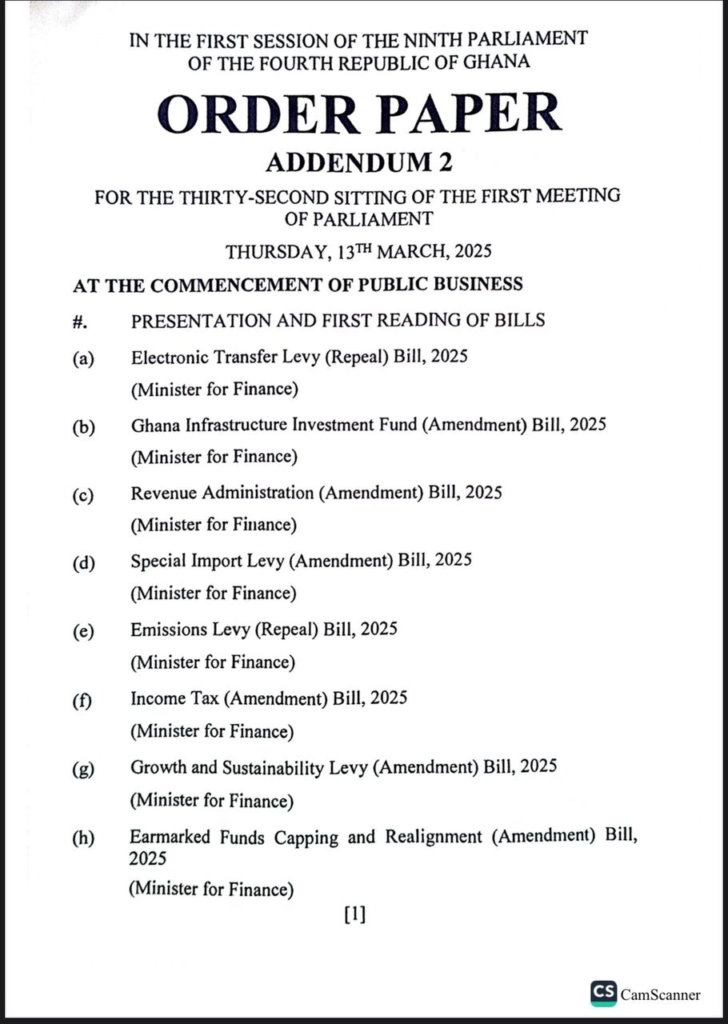

The proposed bills include Electronic Transfer Levy (Repeal) Bill, 2025, Ghana Infrastructure Investment Fund (Amendment) Bill, 2025, Revenue Administration (Amendment) Bill, 2025, Special Import Levy (Amendment) Bill, 2025, Emissions Levy (Repeal) Bill, 2025, Income Tax (Amendment) Bill, 2025, Growth and Sustainability Levy (Amendment) Bill, 2025, and Earmarked Funds Capping and Realignment (Amendment) Bill, 2025.

This move follows the Finance Minister's announcement during the presentation of the government’s first budget statement on March 11, 2025.

In addition to scrapping the E-Levy and betting tax, the government has also proposed abolishing the Emissions Tax and making amendments to other levies that have been deemed excessive.

Speaking on JoyNews PM Express on Tuesday, March 11, Dr Forson stated that he expects Parliament to consider the bills under a certificate of urgency to ensure their swift passage.

He expressed confidence that the process would be smooth due to the simplicity of the repeals, adding that each of the taxes to be scrapped only requires a single clause in the legislative process.

“Repealing these taxes will be straightforward. Each repeal is just a single clause. Removing the betting tax, the E-Levy, and others will be a simple process,” he assured.

He further stated that as revenue-related bills, they qualify to be presented under a certificate of urgency, which allows for expedited consideration.

Dr Forson also assured that once Parliament passes the bills, President John Dramani Mahama will sign them into law immediately, marking a significant step in fulfilling the government’s promise to alleviate the tax burden on citizens.

Latest Stories

-

Keeping Ofori-Atta for 8 years was Akufo-Addo’s worst decision – Winston Amoah

32 minutes -

Whose security? whose interest?: U.S. military action, Nigeria’s internal failure, and the dynamics of ECOWAS in West Africa

41 minutes -

Abuakwa South MP names baby of 13-year-old teenage mother after First Lady

52 minutes -

Police thwart robbery attempt at Afienya-Mataheko, 4 suspects dead

1 hour -

Don’t lower the bar because things were worse before – Kojo Yankson on Mahama gov’t

2 hours -

Jefferson Sackey rallies support for Dr. Bawumia

2 hours -

2024 elections helped stabilise Ghana’s democracy – Sulemana Braimah

2 hours -

Livestream: 2025 Year in Review

3 hours -

Ghana’s crypto transactions hit $10bn by November – SEC

3 hours -

SEC says VASP law will protect investors, ensure market integrity

3 hours -

Mandatory Smart Port note will increase cost of doing business – Coalition of exporters, importers and traders

3 hours -

Banda MP hands over police station, quarters to Banda Boase community

3 hours -

I’m going to spend a lot more energy to make Kumasi clean – KMA boss

3 hours -

We’re on a journey together to restore our party to its rightful place – Dr. Bawumia to NPP delegates

3 hours -

Thieves use drill to steal €30m in German bank heist

3 hours