Audio By Carbonatix

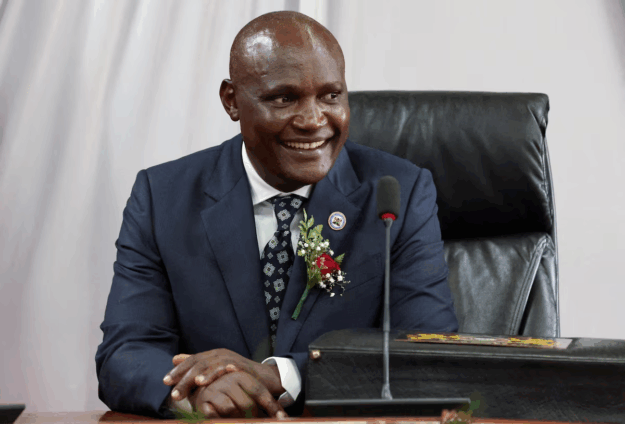

Kenya has completed converting three railway construction dollar-denominated loans from China into yuan in order to save on interest payments, its Finance Minister John Mbadi said on Tuesday.

The swap, which allows the floating, dollar-based interest rates across the three loans from China Exim Bank to drop into their lower, yuan-based rates, will save the country about $215 million a year, Mbadi told reporters.

The Reuters Daily Briefing newsletter provides all the news you need to start your day. Sign up here.

"It kicks off immediately, and it is a saving in our fiscal space," Mbadi told journalists at a briefing, without providing a figure for the outstanding loan amounts that were converted.

The East African nation borrowed three loans amounting to $5 billion in 2014 and 2015 for the construction of a modern railway line from the port city of Mombasa to a station near the Rift Valley town of Naivasha in the hinterland.

The outstanding loans stood at a total of $3.5 billion by June last year, figures from the finance ministry showed. China has not commented on the currency switch.

Apart from the financial relief, Kenyan officials attribute the currency switch to the fact that the East African nation's debt is concentrated in dollars, exposing the government to higher currency and interest rate risks.

About 68% of the stock of Kenya's external debt is denominated in dollars, according to government officials.

President William Ruto's government has been trying to cut its overall debt, which stands close to 70% of gross domestic product, in order to make repayments more manageable.

The government has revamped its debt management strategy to smooth out its maturity curve and lighten the pressure on public coffers.

It has also been turning to securitisation of revenue to raise funds for key projects like the extension of the railway from Naivasha to the Ugandan border, and the upgrading of its main airport in Nairobi.

A team from the International Monetary Fund is currently in Kenya for talks on a new Fund-supported programme after the expiry of the last one in April.

Mbadi said the talks were going well.

"We need the IMF," he said. "Yes, our economic conditions have improved, but we must not lose sight that we need more concessional loans and they come from multilaterals like the IMF and the World Bank."

Latest Stories

-

MTN FA Cup: Defending champions Kotoko knocked out by Aduana

2 hours -

S Korean crypto firm accidentally pays out $40bn in bitcoin

2 hours -

Washington Post chief executive steps down after mass lay-offs

2 hours -

Iranian Nobel laureate handed further prison sentence, lawyer says

2 hours -

U20 WWCQ: South Africa come from behind to draw against Black Princesses in Accra

3 hours -

Why Prince William’s Saudi Arabia visit is a diplomatic maze

3 hours -

France murder trial complicated by twin brothers with same DNA

3 hours -

PM’s chief aide McSweeney quits over Mandelson row

3 hours -

Ayawaso East primary: OSP has no mandate to probe alleged vote buying – Haruna Mohammed

4 hours -

Recall of Baba Jamal as Nigeria High Commissioner ‘unnecessary populism’ – Haruna Mohammed

4 hours -

Presidency, NDC bigwigs unhappy over Baba Jamal’s victory in Ayawaso East – Haruna Mohammed

4 hours -

Africa Editors Congress 2026 set for Nairobi with focus on media sustainability and trust

4 hours -

We are tired of waiting- Cocoa farmers protest payment delays

5 hours -

Share of microfinance sector to overall banking sector declined to 8.0% – BoG

5 hours -

Ukraine, global conflict, and emerging security uuestions in the Sahel

6 hours