Audio By Carbonatix

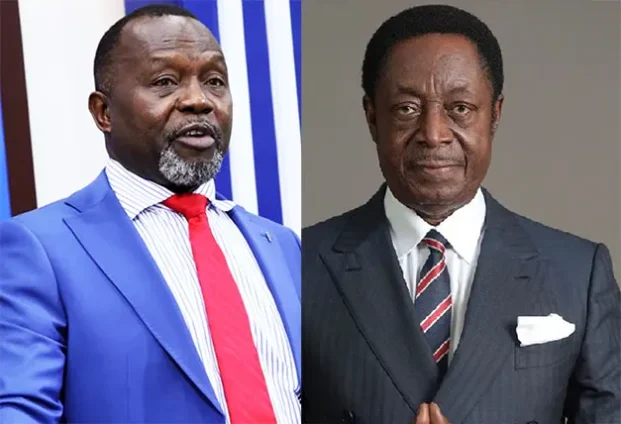

Attorney‑General and Minister for Justice Dr Dominic Akuritinga Ayine has provided a detailed account of why criminal charges earlier brought against former Finance Minister Dr Kwabena Duffour and other directors of the defunct Unibank Ghana Limited could not be sustained, insisting that investigations uncovered no evidence of theft or personal enrichment.

Dr Ayine said public debate around the Unibank collapse had been shaped more by the prominence of the Duffour family than by the actual legal and evidential thresholds required to sustain criminal prosecution.

According to him, when the cases arising from Ghana’s financial sector clean‑up were reviewed, it became clear that Unibank’s situation was fundamentally different from those of others, where criminal convictions were properly pursued.

To illustrate the distinction, the Attorney‑General contrasted the Unibank matter with the prosecution of Capital Bank, where investigators uncovered what he described as unmistakable evidence of criminal conduct.

“In the Capital Bank trial, there was evidence that whenever liquidity support was given by the Bank of Ghana, the former managing director dishonestly appropriated those funds,” the Attorney‑General said on Starr Chat during an interview with broadcaster Bola Ray within the week.

He explained that prosecutors were able to trace how some of the liquidity support provided by the central bank was physically diverted for private use.

“According to him, prosecutors presented evidence showing that some of the liquidity support was physically transported in a vehicle to a private garage at the managing director’s residence, complete with geographic tracking of the movement of funds.”

“That is pure stealing,” he stressed.

Dr Ayine said such direct evidence of dishonest appropriation made the Capital Bank case prosecutable and distinguishable from others arising from the banking sector reforms.

Turning to Unibank, the Attorney‑General cautioned against equating bank failure with criminal liability, particularly where liquidity support was applied through normal banking channels.

“If liquidity support is applied in accordance with normal banking rules and the bank still collapses, you cannot criminalise the conduct of the owners or directors simply because the risk did not pay off,” he said.

He noted that risk‑taking lies at the heart of banking and that loan defaults and business failures, though undesirable, are not crimes in themselves.

“You cannot turn around and say that because a bank received liquidity support and later failed, its directors must be prosecuted for causing financial loss to the state. It doesn’t happen anywhere.”

Dr Ayine said criminal law cannot be used to punish poor business judgement in the absence of dishonesty, fraud or theft.

Responding to persistent public claims that Unibank’s owners looted depositors’ funds, the Attorney‑General was emphatic that investigators found no such evidence.

“There was no evidence that the Duffours stole money,” he said.

He also dismissed allegations of fraudulent breach of trust, explaining that under Ghanaian law, the relationship between a bank and its customers is contractual rather than fiduciary.

“That is a fundamental principle of law. You cannot say there is a fraudulent breach of trust simply because depositors placed money in a bank and the bank extended loans that later failed,” he explained.

On criticisms that Unibank granted loans to related or affiliated companies linked to its shareholders, Dr Ayine said such transactions, while potentially problematic from a regulatory or governance standpoint, do not automatically amount to criminal conduct.

According to him, criminal liability would only arise where there is proof of dishonesty, diversion of funds or personal enrichment.

The Attorney‑General said these legal realities ultimately informed the state’s decision to discontinue criminal proceedings against Dr Duffour and other Unibank directors.

He stressed, however, that the withdrawal of charges did not absolve the directors of all responsibility. Civil actions initiated by the bank’s receiver remain ongoing, and asset recovery remains an available remedy.

“I said they could either offer assets to cover part of the liability or go and stand trial. But I knew that eventually they would be acquitted because the evidence simply was not there.”

Dr Ayine reaffirmed that the Unibank case was never about theft or personal enrichment, a position he said he continues to defend despite public criticism.

The clarification adds fresh perspective to the highly contentious financial sector clean‑up, which saw the revocation of licences of several banks and financial institutions, and continues to generate debate over accountability, justice and the limits of criminal law in regulating financial failure

Latest Stories

-

Around 1,500 soldiers on standby for deployment to Minneapolis, officials say

29 minutes -

Faisal Islam: Trump’s Greenland threats to allies are without parallel

33 minutes -

Ex-GBA President accuses NDC of driving move to remove GBA from constitution

2 hours -

Trump’s double pardon underscores sweeping use of clemency

3 hours -

Morocco and Senegal set for defining AFCON final under Rabat lights today

4 hours -

Trump tariff threat over Greenland ‘unacceptable’, European leaders say

5 hours -

Evalue-Ajomoro-Gwira MP kicks against VALCO sale

5 hours -

Mercy Johnson withdraws alleged defamation case against TikToker

6 hours -

Ghana accepted Trump’s deported West Africans and forced them back to their native countries

7 hours -

No evidence of theft in Unibank Case – A‑G explains withdrawal of charges against Dr Duffour

7 hours -

Labourer remanded for threatening to kill mother

7 hours -

Court remands farmer over GH¢110,000 car fraud

7 hours -

Tension mounts at Akyem Akroso over ‘sale’ of royal cemetery

7 hours -

Poor planning fueling transport crisis—Prof. Beyuo

8 hours -

Ahiagbah slams Prof. Frimpong-Boateng over “fake” party slur

8 hours