Audio By Carbonatix

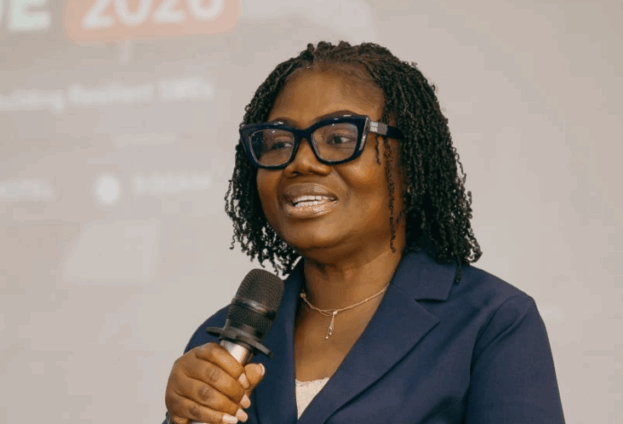

Associate Partner–Advisory at Makers and Partners (MAP), COP Maame Yaa Tiwaa Addo-Danquah, has called for intensified public education on taxation as a critical step toward improving tax compliance and boosting domestic revenue mobilisation.

She noted that revenue mobilisation remains the backbone of national development, stressing that simplifying and demystifying the tax system would help widen the tax net and encourage voluntary compliance.

Speaking at an Executive Business Dialogue organised by MAP, COP Addo-Danquah disclosed that data from the Ghana Revenue Authority (GRA) shows a significant tax gap.

According to the figures, income tax compliance stands at just 33 per cent, leaving a 67 per cent gap, while Value Added Tax (VAT) compliance is at 39 per cent, with a 61 per cent gap.

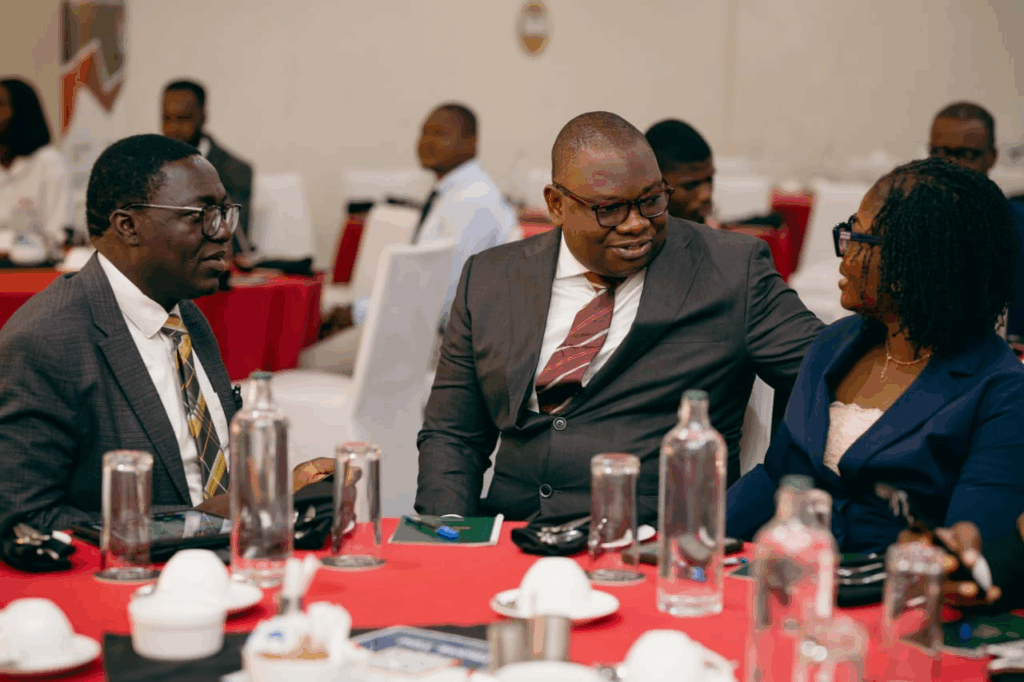

The forum, themed “Navigating Tax and Fiscal Reforms: Building Resilient SMEs,” sought to foster informed engagement among business leaders, experts and stakeholders on how to navigate ongoing tax and fiscal reforms.

Discussions at the event emphasised the need for resilience amid evolving compliance requirements, urging small and medium-sized enterprises (SMEs) to adopt a more proactive, strategic approach to sustainability.

COP Addo-Danquah stressed that, given the critical role of SMEs in Ghana’s economy, it is essential for these businesses to leverage professional advisory services to drive growth and long-term sustainability.

She highlighted MAP’s range of services, including advisory, tax, audit assurance and accountancy, and encouraged businesses to take advantage of these offerings.

Also speaking at the event, the Acting Commissioner of the Domestic Tax Revenue Division (DTRD) of the GRA, Dr Martin Kolbil Yamborigya, revealed that the Authority is rolling out a three-year tax education programme targeting both registered and unregistered businesses.

He said as part of ongoing reforms, the GRA has introduced e-invoicing and will soon launch a National Compliance and Enforcement Team to ensure that all eligible businesses register and pay taxes.

According to him, the initiative is expected to create a fair and efficient tax system in which businesses contribute their rightful share.

Head of Tax Advisory at MAP, Miss Patience Oware, noted that the evolving tax and fiscal environment — characterised by frequent reforms, rising compliance demands, and fiscal consolidation measures — continues to pose challenges to SME sustainability.

She observed that many SMEs struggle with tax filing, understanding tax reforms, maintaining proper records and meeting statutory deadlines, factors which she said continue to constrain their growth.

Miss Oware explained that the Executive Business Dialogue was therefore designed to bring SMEs together to equip them with the knowledge needed to understand tax reforms.

“Some do not have access to the GRA, so we created this platform for them to understand the new reforms,” she said.

Latest Stories

-

Ghana is Failing because The Best Stay Away

41 seconds -

Road contractors have not received a pesewa of their arrears – Akwasi Odike claims

2 minutes -

Politics should be free from religious prophecies– Kwabena Agyepong

6 minutes -

Joy FM Big Workout 2026 records massive turnout as patrons demand regular editions

14 minutes -

They must be allowed to vote – Hawa Koomson on disenfranchised NPP delegates

17 minutes -

NDC may regret appointee resignation policy – Dr Arthur Kennedy warns

31 minutes -

Africa must prioritise processing cocoa locally or lose billions – CEO, Cocoa Marketing Company

36 minutes -

NPP presidential primary proceed smoothly as Joe Wise urges unity

50 minutes -

NDC filed Kpandai petition late – Fatimatu Abubakar

1 hour -

NPP race: Naa Torshie explains shift in support to Ken Agyapong

1 hour -

NPP Flagbearer Race: Breakdown of expected delegates by region

1 hour -

Kpandai rerun cancellation: I wasn’t expecting the Supreme Court ruling, but I was pleased – Osae-Kwapong

1 hour -

Disqualified NPP delegates clash with chairman; attack Joy News journalist at Korle Bu polling centre

1 hour -

NPP Flagbearer Contest: Scenes from Volta Region

1 hour -

NPP race: I expect a fair contest – Ken Agyapong

2 hours