Audio By Carbonatix

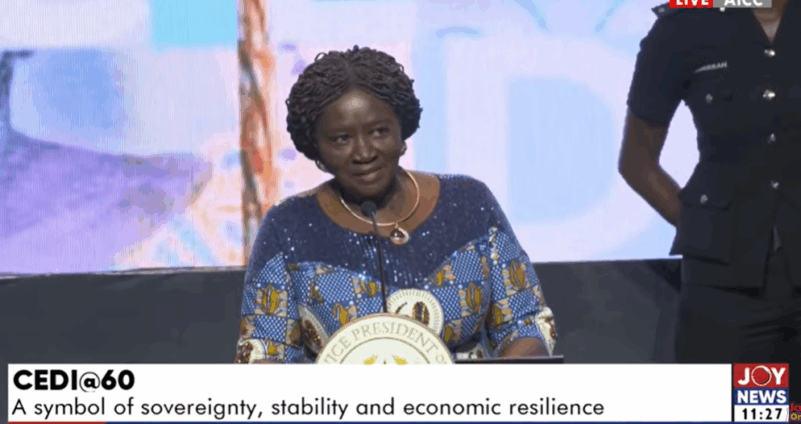

Vice President Professor Naana Jane Opoku-Agyemang has urged Ghanaians to safeguard the independence of the Bank of Ghana, describing it as crucial to ensuring macroeconomic stability and protecting the value of the cedi.

Speaking at the commemoration of the Cedi@60 Anniversary, themed “Sovereignty, Stability, and Economic Resilience” in Accra, she emphasised that the central bank’s autonomy is essential for maintaining economic confidence and sustaining progress.

“We must protect the independence of the central bank. The Bank of Ghana must remain a steward of stability,” she stated.

Prof. Opoku-Agyemang also underscored the need to uphold the legal tender status of the cedi, lamenting the growing trend of quoting goods and services in foreign currencies.

“We must uphold the legal tender status of the cedi. Today, too many goods and services are still quoted in foreign currencies. But if you earn in cedis, you must be able to transact in cedis,” she said.

She took a moment to acknowledge the efforts of the Ministry of Finance and the Bank of Ghana in ensuring macroeconomic stability and restoring market confidence.

“Let me acknowledge the role of the Ministry of Finance under Dr. Cassiel Ato Forson and the Bank of Ghana under the Governor, Dr Johnson Asiamah, and all his generals. I acknowledge all of you. Through tight monetary policy and engagement with the public, the Bank has helped to anchor expectations and restore some level of credibility to our market.”

Prof. Opoku-Agyemang further commended the central bank for regulating virtual asset service providers, promoting fintech innovations, and rolling out the eCedi.

“We must commend the regulation of virtual asset service providers, the promotion of fintech innovations, and the rollout of the eCedi,” she noted.

She urged the Bank of Ghana to deepen its collaboration with key economic actors to make the use of the cedi more seamless and accessible.

“I encourage the BoG to work more closely with businesses, banks, and innovators to make it easier to transact in cedi—at home, online, and across borders,” she added.

Latest Stories

-

No arrangement to send DVLA staff abroad – Foreign Affairs Ministry contradicts DVLA boss

3 minutes -

US and Iran hold talks seen as crucial to prevent conflict

12 minutes -

Spain to check Gibraltar arrivals under post-Brexit deal

16 minutes -

Insurance cover crucial for canoe fishermen – Prof Benjamin Campion

20 minutes -

Communications Minister engages GIFEC staff, pledges support for welfare and institutional growth

23 minutes -

Zenith Bank pledges support for Ghana Medical Trust Fund ahead of April launch

27 minutes -

Ghana needs offshore patrol vessels to counter piracy effectively – Ntim Fordjour

35 minutes -

Atlas Commodities rejects Assafuah’s warehouse claim, says it operates depots in four regions

38 minutes -

KMA bans sale of explosives at Kejetia Market amid security concerns

49 minutes -

E&P controls 45% of Ghana’s mining operations, eyes greater role in economic growth

1 hour -

Ghana Navy and Armed Forces complete rescue of 71 fishermen after armed sea robbery off Central coast

1 hour -

Hillary Clinton to testify she ‘had no idea’ of Epstein crimes and calls for Trump to be questioned

1 hour -

Parliament passes Ghana’s first Accelerated National Reserve Accumulation Policy

1 hour -

Investing adequately in waste can earn Ghana GHS 47.9bn in annual benefit by 2032 – ISSER

2 hours -

OSP says extradition and summons proceedings underway in Kenneth Nana Yaw Ofori-Atta case

2 hours