Audio By Carbonatix

The Bank of Ghana (BoG) has mopped up GH¢65 billion from circulation since the start of 2025, in what Governor Dr Johnson Asiama describes as a costly but necessary step to maintain macroeconomic stability and curb inflation.

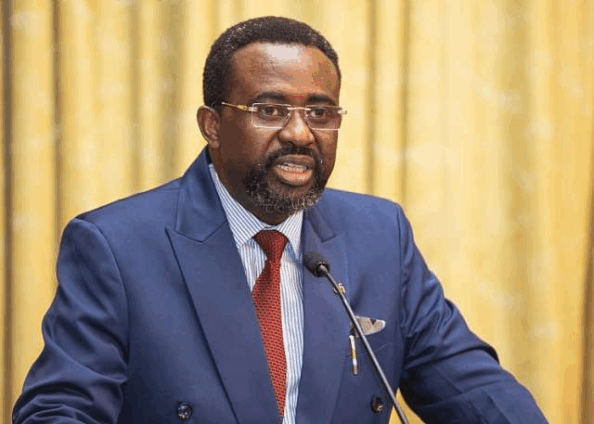

Speaking at the Governor Talks Programme on the sidelines of the IMF/World Bank Annual Meetings in Washington D.C., USA, Dr Asiama revealed that the central bank has undertaken large-scale open market operations to absorb excess liquidity in the economy — a key strategy to keep inflation under control.

However, he admitted that the process has come at a significant financial burden to the Bank of Ghana.

“The cost to the central bank’s balance sheet has been immense,” he said.

“Almost total money supply is around GH¢85 billion currently, and out of that, the sterilisation we have done this year alone accounts for about GH¢65 billion. But there’s a price to stabilisation. There’s a cost to it.”

According to the Governor, the central bank has been issuing high-interest short-term papers and bills to withdraw liquidity from the financial system, a move that helps control inflationary pressures but simultaneously increases the bank’s interest expenses.

Dr Asiama described this balancing act as one of the toughest policy challenges facing the central bank this year.

“We are in discussions with the fiscal authorities for them to assist us, probably to pick up part of that cost,” he said.

“As they always say, stability is a public good. When there’s macroeconomic stability, someone needs to pay for it.”

The Governor emphasised that the central bank’s focus remains on achieving long-term price stability, even if it means short-term financial strain.

He explained that the BoG is simultaneously working to rebuild its balance sheet after years of fiscal dominance and the effects of the 2022/23 domestic debt restructuring programme, which weakened its capital position.

“Remember, at the beginning, I made the point that I needed to rebuild the balance sheet of the central bank,” he said.

“We came in to meet a bank that was hardly solvent, policy-wise, and that is also being tackled alongside the stability we are achieving.”

The Bank of Ghana has been using open market operations — including repurchase agreements, bill issuance, and liquidity sterilisation — to mop up excess money in the system as part of its inflation management strategy.

These interventions have played a crucial role in stabilising the Ghana cedi and moderating price increases, with headline inflation easing in recent months.

Economic analysts say the central bank’s actions have restored some confidence in the monetary policy framework, but they warn that the sustainability of these sterilisation operations depends on support from the fiscal side.

The cost of maintaining stability, they argue, could eventually weigh on the Bank of Ghana’s reserves and profitability if government support does not materialise soon.

Still, Dr Asiama insists that maintaining stability is non-negotiable. He reaffirmed that the central bank will continue to prioritise its price stability mandate even in the face of mounting costs.

“We know the cost is heavy, but stability remains the foundation of growth,” he noted. “We must all share in that responsibility.”

Latest Stories

-

Specialised high court division to be staffed with trained Judges from court of appeal — Judicial Secretary

33 minutes -

Special courts will deliver faster, fairer justice — Judicial Secretary

51 minutes -

A decade of dance and a bold 10K dream as Vivies Academy marks 10 years

1 hour -

GCB’s Linus Kumi: Partnership with Ghana Sports Fund focused on building enduring systems

2 hours -

Sports is preventive healthcare and a wealth engine for Ghana – Dr David Kofi Wuaku

2 hours -

Ghana Sports Fund Deputy Administrator applauds GCB’s practical training for staff

2 hours -

Ghana Sports Fund strengthens institutional framework with GCB Bank strategic partnership

2 hours -

UBIDS to Complete Abandoned Projects Following GETFund Financial Clearance – Vice Chancellor

2 hours -

Nii Moi Thompson questions Anokye Frimpong’s ‘distorted history’ narratives

3 hours -

Anthony O’Neal set to receive Ghanaian citizenship, prepares to launch ‘Class on the Bus’ Initiative

3 hours -

South Tongu MP inspects GH₵500,000 surgical equipment, supports District Court with logistics

4 hours -

Kpasec 2003 Year Group hosts garden party to rekindle bonds and inspire legacy giving

6 hours -

Financing barriers slowing microgrid expansion in Ghana -Energy Minister

6 hours -

Ghana’s Ambassador to Italy Mona Quartey presents Letters of Credence to Pres. Mattarella

6 hours -

KOSA 2003 Year Group unveils GH¢10m classroom project at fundraising event

6 hours