Audio By Carbonatix

The trade war between the world's two biggest economies shows no signs of slowing down - Beijing has vowed to "fight to the end" hours after US President Donald Trump threatened to nearly double the tariffs on China.

That could leave most Chinese imports facing a staggering 104% tax - a sharp escalation between the two sides.

With a deadline looming in Washington as Trump threatens to introduce the additional tariffs from Wednesday, who will blink first?

"It would be a mistake to think that China will back off and remove tariffs unilaterally," says Alfredo Montufar-Helu, a senior advisor to the China Center at The Conference Board think tank.

"Not only would it make China look weak, but it would also give leverage to the US to ask for more. We've now reached an impasse that will likely lead to long-term economic pain."

Global markets have slumped since last week when Trump's tariffs, which target almost every country, began coming into effect. Asian stocks, which saw their worst drop in decades on Monday after the Trump administration didn't waver, recovered slightly on Tuesday.

Meanwhile, China has hit back with tit-for-tat levies - 34% - and Trump warned that he would retaliate with an additional 50% tariff if Beijing doesn't back down.

Uncertainty is high, with more tariffs, ranging to more than 40%, set to kick in on Wednesday. Many of these would hit Asian economies: tariffs on China would rise to 54%, and those on Vietnam and Cambodia, would soar to 46% and 49% respectively.

Experts are worried about the speed at which this is happening, leaving governments, businesses and investors little time to adjust or prepare for a remarkably different global economy.

How is China responding to the tariffs?

China had responded to the first round of Trump tariffs with tit-for-tat levies on certain US imports, export controls on rare metals and an anti-monopoly investigation into US firms, including Google.

This time too it has announced retaliatory tariffs, but it also appears to be bracing for pain with stronger measures. It has allowed its currency, the yuan, to weaken, which makes Chinese exports more attractive. And state-linked enterprises have been buying up stocks in what appears to be a move to to stabilise the market.

The prospect of negotiations between the US and Japan seemed to buoy investors who were fighting to claw back some of the losses of recent days.

But the face-off between China and the US - the world's biggest exporter and its most important market - remains a major concern.

"What we are seeing is a game of who can bear more pain. We've stopped talking about any sense of gain," Mary Lovely, a US-China trade expert at the Peterson Institute in Washington DC, told the BBC's Newshour programme.

Despite its slowing economy, China may "very well be willing to endure the pain to avoid capitulating to what they believe is US aggression", she added.

Shaken by a prolonged property market crisis and rising unemployment, Chinese people are just not spending enough. Indebted local governments have also been struggling to increase investments or expand the social safety net.

"The tariffs exacerbate this problem," said Andrew Collier, Senior Fellow at the Mossavar-Rahmani Center for Business and Government at Harvard Kennedy School.

If China's exports take a hit, that hurts a crucial revenue stream. Exports have long been a key factor in China's explosive growth. And they remain a significant driver, although the country is trying to diversify its economy with high-end tech manufacturing and greater domestic consumption.

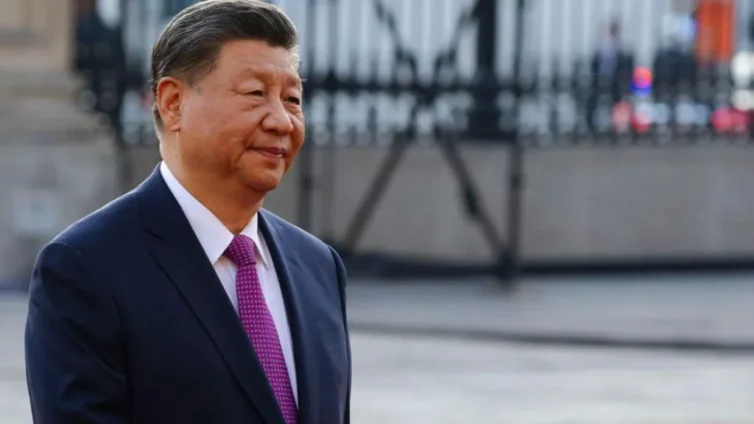

It's hard to say exactly when the tariffs "will bite but likely soon," Mr Collier says, adding that "[President Xi] faces an increasingly difficult choice due to a slowing economy and dwindling resources".

Latest Stories

-

OpenAI changes deal with US military after backlash

34 minutes -

Mexican drug lord ‘El Mencho’ buried in golden coffin

44 minutes -

Building gold reserves, losing hospitals? – Finance professor flags 1% GDP cost

59 minutes -

Trump ‘does not care’ if Iran play at World Cup

4 hours -

Burna Boy’s associate, Rahman Jago confirms singer converted to Islam

4 hours -

Amazon says drones damaged three facilities in UAE and Bahrain

5 hours -

NDC’s Baba Jamal wins Ayawaso East by-election

5 hours -

Integrity over individuals: Economic Fighters League maintains vote-buying stance in Ayawaso East

5 hours -

How to follow European football

5 hours -

A new dawn: Formula One charges into an unpredictable 2026

5 hours -

Trump threatens to halt trade with Spain over military base access

5 hours -

Trump says US Navy will protect ships in Middle East ‘if necessary’

6 hours -

Ghana shines in GSMA DNSI and DPRI 2025 report due to E-Levy repeal and tech neutrality

7 hours -

NJA College of Education inducts 379 students amidst infrastructure gains and calls for professional discipline

7 hours -

GJA President, executives join Sammy Gyamfi to observe One-Week memorial of father-in-law

7 hours