Audio By Carbonatix

The Ghana Cocoa Board (COCOBOD) has settled coupon payments worth GH¢2 billion to investors of its restructured cocoa bills.

Joy Business understands that the payments were made on Monday, September 1, 2025, to investors holding these instruments.

Following the Domestic Debt Exchange Programme, the restructured bills are now classified as bonds.

The restructuring, which mainly affected commercial banks, saw the cocoa bills converted into bonds.

Sources indicate that COCOBOD has assured investors it will honour coupon payments of about GH¢1.9 billion due in 2026 and 2027, as well as the principal, on schedule.

This new arrangement for COCOBOD was facilitated by some local banks acting as transaction advisors.

In recent months, COCOBOD has been implementing measures to clean its books, settle outstanding debts, and strengthen its financial position to support cocoa purchases.

Sources say the steps are already having a positive impact, particularly on debt settlement with some suppliers.

Market analysts argue that the restructuring could position COCOBOD strongly to secure fresh funding at more affordable rates.

This would enhance its capacity to purchase cocoa beans for the next crop season while improving the institution’s credit rating.

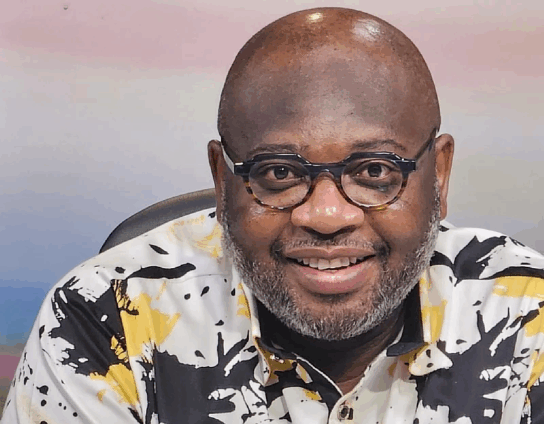

The Chief Executive of COCOBOD, Dr Randy Abbey, told Joy Business he is committed to placing the institution on a solid financial footing by the end of the administration’s first term.

Bank of Ghana Governor, Dr. Johnson Asiama, also revealed to Joy Business that COCOBOD is expecting over $4 billion in inflows from buyers under a new pre-financing deal.

This is expected to support cocoa purchases for the upcoming crop season and could strengthen Ghana’s international reserves as well as the stability of the cedi.

Latest Stories

-

Lower Manya Krobo MP rewards constituents for outstanding contributions to Kroboland development

2 minutes -

Elixir or Placebo? Microeconomics as the litmus test for Ghana’s Macroeconomic Recovery

6 minutes -

I won’t celebrate Ken Ofori-Atta’s troubles – Kofi Amoabeng

15 minutes -

GPRTU announces a crackdown over illegal fare increases

18 minutes -

COPEC urges NPA to scrap fuel price floors to ease costs for consumers

26 minutes -

“Underestimate Dr Adutwum at your own risk” — Adutwum camp fires back at Bryan Achampong video

51 minutes -

The role of curriculum in transmitting societal values: Why NaCCA must be resourced and empowered

59 minutes -

Avance Media unveils first-ever top 100 Ghanaians powerlist for 2025

1 hour -

Benin’s opposition loses all parliamentary seats, provisional results show

1 hour -

New market report reveals 55% of Ghanaian jobs now demand a bachelor’s degree

1 hour -

Aide to National Timber Monitoring Team boss arrested amid intensified crackdown on illegal logging

1 hour -

Tension mounts in Akyem Akroso over plans to sell royal cemetery for supermarket project

1 hour -

Fuel price floor protects consumers, safeguards industry sustainability – COMAC CEO

1 hour -

Ghana welcomes digital platform GHKonnect.com to connect businesses

1 hour -

Heads who shortchange students on meals will be sanctioned – Deputy Education Minister warns

1 hour