Audio By Carbonatix

Africa’s global bank, United Bank for Africa (UBA) Plc, has once again demonstrated its commitment towards driving sustainable growth and economic transformation across the continent with the official launch of its groundbreaking White Paper, Banking on Africa’s Future: Unlocking Capital and Partnerships for Sustainable Growth.

The report, which was unveiled on the sidelines of the ongoing International Monetary Fund (IMF) and World Bank Annual Meetings in Washington on Thursday, provides a comprehensive roadmap for accelerating Africa’s progress through innovative financial solutions, policy reforms, and strategic partnerships, elevating Africa's economic priorities to the forefront of international financial conversations.

The whitepaper delivers a detailed, actionable blueprint designed to harness Africa's enormous economic opportunities while examining essential growth areas including trade facilitation, infrastructure development, digital innovation, climate finance, and inclusive growth.

By advocating for the integration of domestic capital with strategic global alliances, the document aims to unlock an estimated $4 trillion in Africa's domestic financial assets, including $2.5 trillion in commercial bank assets and over $1.1 trillion in long-term institutional capital, while capitalising on the $3.4 trillion potential of the African Continental Free Trade Area (AfCFTA) single market.

For Africa, this white paper signifies a pivotal advancement in financial infrastructure and economic empowerment. It addresses longstanding challenges such as limited access to capital and underdeveloped partnerships, proposing solutions that could accelerate sustainable development across the continent.

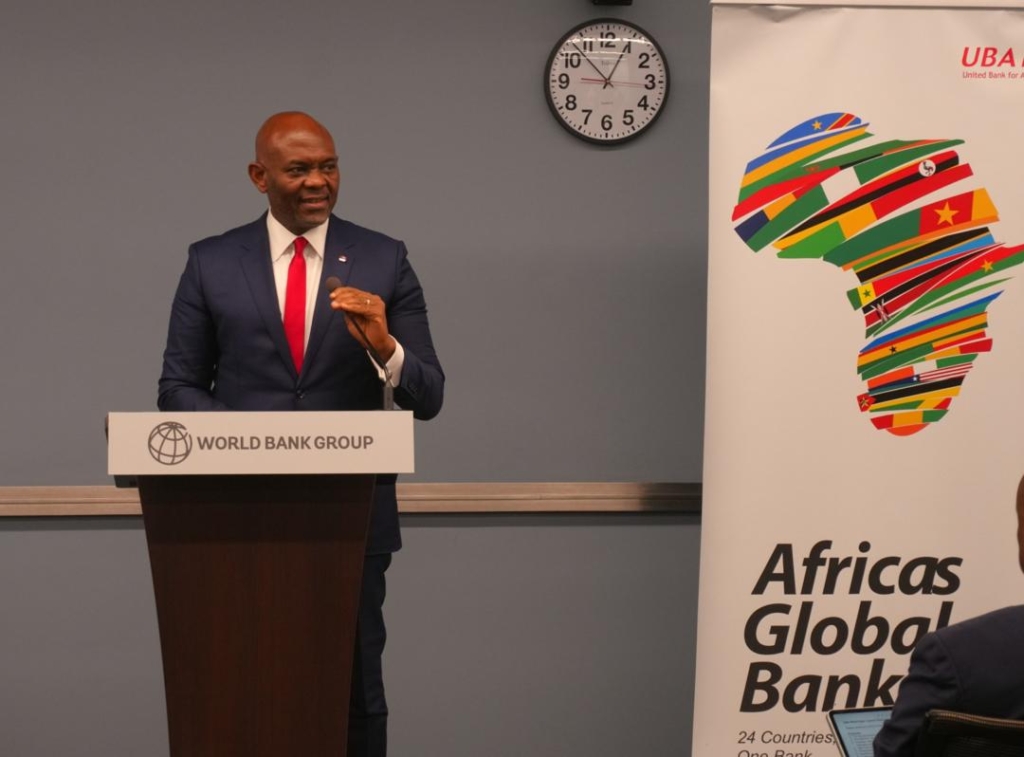

UBA’s Group Chairman, Tony Elumelu, who delivered a bold vision for the continent's future at the launch, said, “Africa stands at a transformational crossroads, rich in resilience, creativity, and untapped potential. With this whitepaper, UBA champions Africapitalism, empowering our private sector to drive sustainable growth that delivers prosperity and social wealth.”

Elumelu, who is also the founder of Heirs Holding Group and the champion of the Africapitalism concept, added that by focusing on inclusive growth and digital innovation, the report promises to enhance financial inclusion for millions, bolster infrastructure projects, and drive climate-resilient initiatives, ultimately fostering job creation, poverty reduction, and regional integration under AfCFTA.

In the global finance space, the unveiling also underscores Africa's rising prominence as a key player in the world economy, where international investors, institutions, and policymakers are invited to engage more deeply with African markets, highlighting mutually beneficial opportunities for capital flows and collaborations.

This, he noted, will help towards reshaping global investment strategies, encouraging a shift toward emerging markets and promoting diversified portfolios that include African assets, thereby contributing to more balanced global economic growth.

Elumelu explained that with this whitepaper, UBA champions Africapitalism, empowering our private sector to drive sustainable growth that delivers prosperity and social wealth, adding that “to investors across Africa and the globe: join us in mobilising our $4 trillion domestic capital alongside strategic partnerships to bridge opportunities, de-risk investments, and build a self-determined future. The era of action is upon us; let us seize it together for Africa's economic sovereignty.”

UBA’s Group Managing Director and Chief Executive Officer, Oliver Alawuba, who spoke further on the whitepaper, pointed out that it redefines development finance, moving from aid dependency to investment highways powered by African innovation.

“UBA, with our deep local knowledge and global reach, is uniquely positioned to unlock capital flows and foster collaborations that transform challenges into opportunities. We call on financial leaders worldwide: partner with us to deploy agile solutions, from digital platforms to blended finance, and co-create resilient growth that benefits millions. Africa's time is now; commit today to be part of this revolutionary journey,” he stated.

United Bank for Africa is one of the largest employers in the financial sector on the African continent, with 25,000 employees group-wide and serving over 45 million customers globally.

Latest Stories

-

The Great African Divergence: Why the dream of a borderless Africa is a dangerous premature reality

5 minutes -

Association of Banks CEO hails “unpalatable” decision to save COCOBOD from collapse

9 minutes -

New nuclear talks between US and Iran begin in Geneva

20 minutes -

Why “good enough” is destroying Ghana’s fashion manufacturing future

21 minutes -

Gov’t is impoverishing cocoa farmers—Awal Mohammed

28 minutes -

US civil rights leader Jesse Jackson dies aged 84

31 minutes -

Bond market: Turnover declines 42.47% to GH¢2.27bn

36 minutes -

Ghana faces 130 million gallon daily water supply deficit — GWL

37 minutes -

Benjamin Asare ‘not at the level’ of Black Stars – Fmr Kotoko management member

40 minutes -

GFA Prez Kurt Okraku targets AFCON triumph

41 minutes -

GWL MD identifies Kasoa as major hub of illegal water connections

43 minutes -

‘He subjected me to constant, severe, chronic violence’ — Woman breaks 50-year silence on alleged abuse by Pastor father

56 minutes -

Illegal connections cost GWL GH₵8.6 Million between August–December 2025

1 hour -

WPL 2025/26: Hasaacas Ladies move to top of Southern Zone as Ampem Darkoa continue lead

1 hour -

Ghana Water Limited needs over GH₵3.5bn to replace ageing pipelines — MD

2 hours