Audio By Carbonatix

Africa’s global bank, United Bank for Africa (UBA) Plc, has once again demonstrated its commitment towards driving sustainable growth and economic transformation across the continent with the official launch of its groundbreaking White Paper, Banking on Africa’s Future: Unlocking Capital and Partnerships for Sustainable Growth.

The report, which was unveiled on the sidelines of the ongoing International Monetary Fund (IMF) and World Bank Annual Meetings in Washington on Thursday, provides a comprehensive roadmap for accelerating Africa’s progress through innovative financial solutions, policy reforms, and strategic partnerships, elevating Africa's economic priorities to the forefront of international financial conversations.

The whitepaper delivers a detailed, actionable blueprint designed to harness Africa's enormous economic opportunities while examining essential growth areas including trade facilitation, infrastructure development, digital innovation, climate finance, and inclusive growth.

By advocating for the integration of domestic capital with strategic global alliances, the document aims to unlock an estimated $4 trillion in Africa's domestic financial assets, including $2.5 trillion in commercial bank assets and over $1.1 trillion in long-term institutional capital, while capitalising on the $3.4 trillion potential of the African Continental Free Trade Area (AfCFTA) single market.

For Africa, this white paper signifies a pivotal advancement in financial infrastructure and economic empowerment. It addresses longstanding challenges such as limited access to capital and underdeveloped partnerships, proposing solutions that could accelerate sustainable development across the continent.

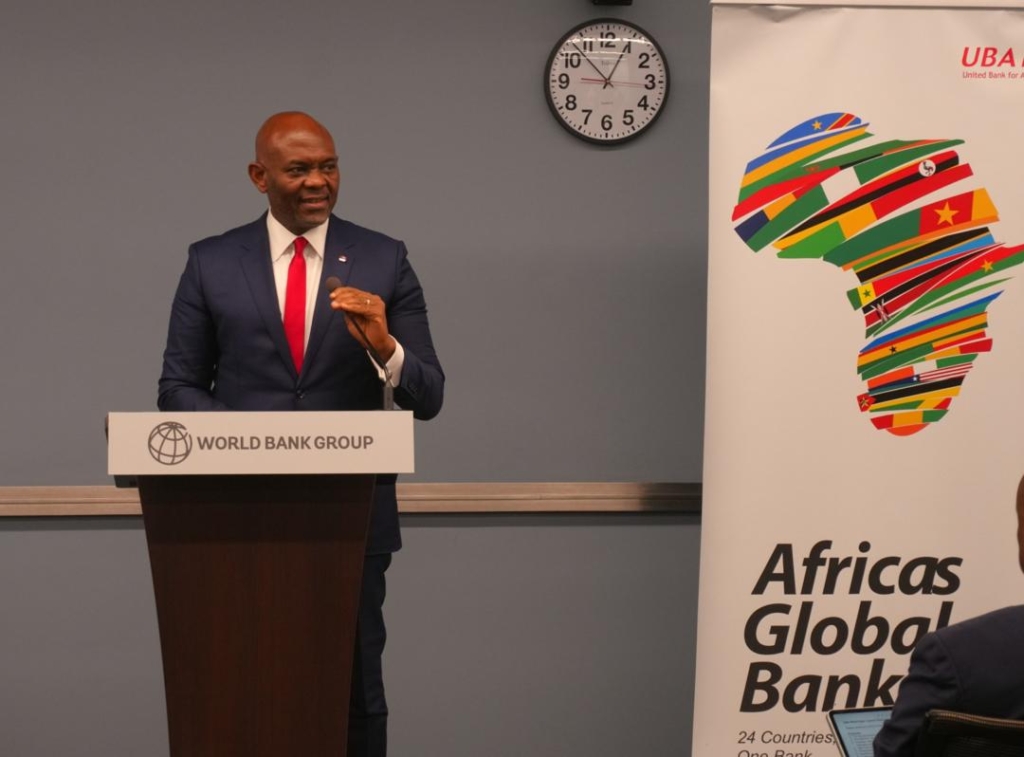

UBA’s Group Chairman, Tony Elumelu, who delivered a bold vision for the continent's future at the launch, said, “Africa stands at a transformational crossroads, rich in resilience, creativity, and untapped potential. With this whitepaper, UBA champions Africapitalism, empowering our private sector to drive sustainable growth that delivers prosperity and social wealth.”

Elumelu, who is also the founder of Heirs Holding Group and the champion of the Africapitalism concept, added that by focusing on inclusive growth and digital innovation, the report promises to enhance financial inclusion for millions, bolster infrastructure projects, and drive climate-resilient initiatives, ultimately fostering job creation, poverty reduction, and regional integration under AfCFTA.

In the global finance space, the unveiling also underscores Africa's rising prominence as a key player in the world economy, where international investors, institutions, and policymakers are invited to engage more deeply with African markets, highlighting mutually beneficial opportunities for capital flows and collaborations.

This, he noted, will help towards reshaping global investment strategies, encouraging a shift toward emerging markets and promoting diversified portfolios that include African assets, thereby contributing to more balanced global economic growth.

Elumelu explained that with this whitepaper, UBA champions Africapitalism, empowering our private sector to drive sustainable growth that delivers prosperity and social wealth, adding that “to investors across Africa and the globe: join us in mobilising our $4 trillion domestic capital alongside strategic partnerships to bridge opportunities, de-risk investments, and build a self-determined future. The era of action is upon us; let us seize it together for Africa's economic sovereignty.”

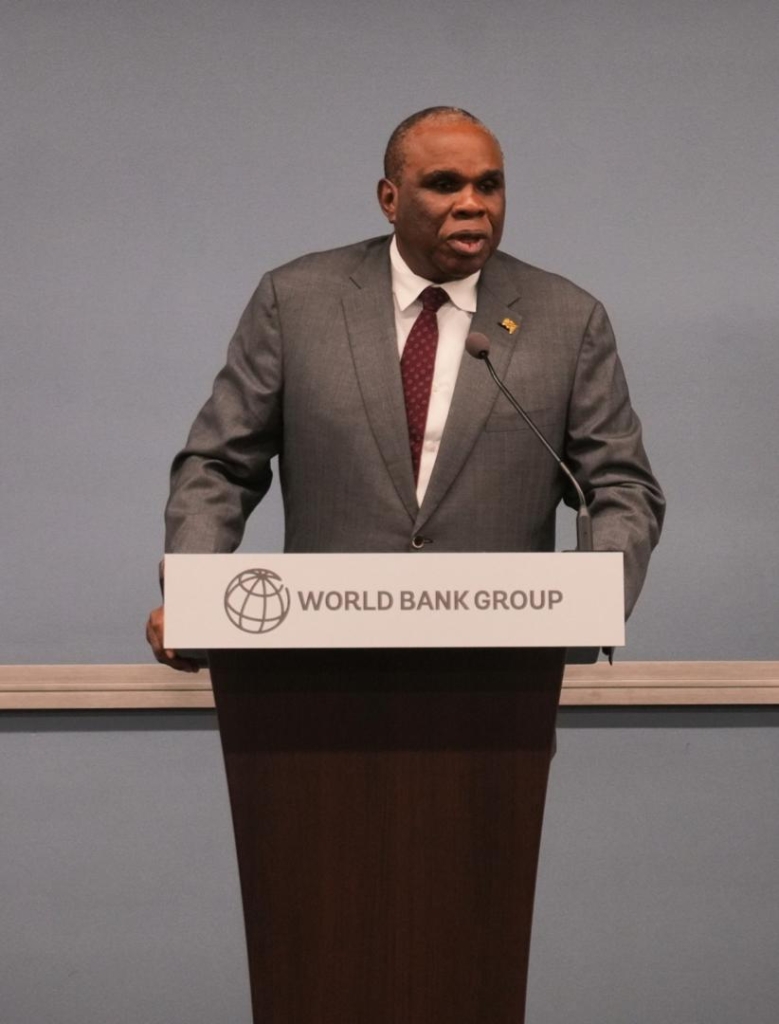

UBA’s Group Managing Director and Chief Executive Officer, Oliver Alawuba, who spoke further on the whitepaper, pointed out that it redefines development finance, moving from aid dependency to investment highways powered by African innovation.

“UBA, with our deep local knowledge and global reach, is uniquely positioned to unlock capital flows and foster collaborations that transform challenges into opportunities. We call on financial leaders worldwide: partner with us to deploy agile solutions, from digital platforms to blended finance, and co-create resilient growth that benefits millions. Africa's time is now; commit today to be part of this revolutionary journey,” he stated.

United Bank for Africa is one of the largest employers in the financial sector on the African continent, with 25,000 employees group-wide and serving over 45 million customers globally.

Latest Stories

-

Kwame AI launches ‘Eskwai Pro Bono’ to improve access to free legal aid in Ghana

9 minutes -

Energy Minister: Ghana to phase out imported LPG cylinders

20 minutes -

GES clarifies circular, assures teachers their rights are not restricted

23 minutes -

Manasseh Azure Writes: Ibrahim Mahama’s jet, lecturer’s girlfriend, and conflict of interest

41 minutes -

If the NPP have repented, they must advocate with apology, not arrogance

47 minutes -

Foreign Affairs Ministry warns Ghanaians against QNET and travel fraud schemes

47 minutes -

NDPC chairman stresses anti-corruption as key to effective development planning

51 minutes -

Kwadaso MCE urges residents to partner with police in fight against rising crime

55 minutes -

GACL–McDan dispute largely political, not purely legal — NPP’s Awal Mohammed

1 hour -

City of Prince George in Canada marks second annual Ghana flag-raising ceremony

2 hours -

KsTU commissions new Creative Arts Complex to boost innovation and skills

2 hours -

ECG, police intensify crackdown on theft and vandalism of electricity installations in Ashanti region

3 hours -

President Mahama awarded an honorary doctorate by South Korea’s Yonsei University

3 hours -

Ghana Embassy in Doha calls on citizens to submit travel details amid flight suspension

3 hours -

Fairway Cares Foundation supports 1,000 residents with meals during Ramadan outreach in Maamobi

3 hours