Some economists have asked the government to increase efforts at improving the relative economic stability gained in the first six months of 2023 to bring relief to Ghanaians.

In their reflections on the mid-year budget review, the economists indicated that despite some signs of the Ghanaian economy stabilising in the first half of the year, the government could not conclude that it had ‘turned the corner’.

“We’ve turned the first corner, but there are a few more to turn,” Professor Peter Quartey, the Director of the Institute of Statistical, Social and Economic Research (ISSER) said.

Speaking at an appraisal forum on the mid-year budget review in Accra, Prof Quartey said the current inflation, exchange rate and budget deficit figures did not call for an excitement that all was well with the economy and citizens.

“We’ve seen inflation decline from 53.6 per cent in January to 42.5 per cent as of June 2023, exchange rate has also shown some stability, and some revenue handles have improved in the first half of the year. However, a good number of the revenue handles have missed their half year targets, and there are still threats of exchange rate depreciation as the government would have to pay its external loans,” Prof Quartey noted.

Dr Patrick Asuming, who is a Senior Lecturer with the University of Ghana Business School (UGBS), also said: “Some of the progresses at the beginning of the year are reversing.”

“From the current developments in the economy, the government has not turned the corner, because when you say you’re turning the corner, you shouldn’t come with a downward revision of your growth targets,” he said.

He explained that following some disinflation in the first quarter of 2023, the country’s inflation rate remained flat, but had in recent times started to marginally inch up.

“Even though the GDP growth for the first quarter was good, you realise that it was necessitated by activities of government and not private sector sustainable growth, so, we can’t say we’ve turned the corner,” he said.

Dr Asuming said the support from the International Monetary Fund (IMF) bailout programme would help in relatively stabilising the local currency against its major trading partners for the rest of the year, but there would be a slow growth in the economy.

“We must not backslide on the short-term goals agreed with the IMF. The government must implement long-term strategies and revive the failing flagship programmes, including the Planting for Food and Jobs (PFJ),” he urged.

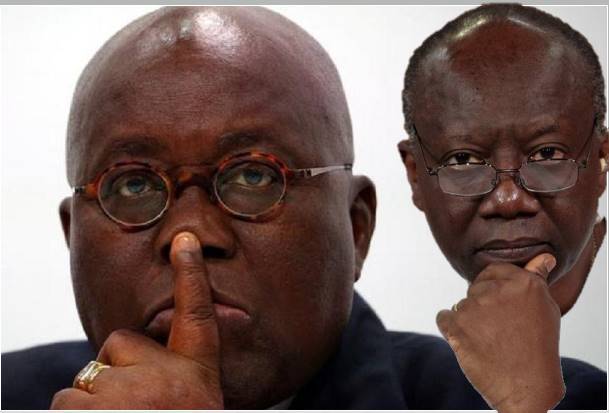

During the presentation of the 2023 mid-year budget to Parliament last Monday, Mr Ken Ofori-Atta, the Finance Minister said despite the headwinds hitting the Ghanaian economy, “we have turned the corner.”

“We have avoided the unimaginable, including empty shop shelves for medicines and other essentials, long queues for fuel and gas, as well as disruptions to power supply as occurred elsewhere,” Mr Ofori-Atta said.

He said: “This turnaround is underpinned by the investments we have collectively made during this difficult period since March 2020,” including the support from the IMF to implement the government’s Post-COVID-19 Programme for Economic Growth (PC-PEG).

He said it was important that going forward, all Ghanaians spoke in the same language of productivity, growth and work closely together to secure a collective success and pledged the government’s resolve to sustain a favourable macroeconomic environment for the benefit of all.

Latest Stories

-

EIU optimistic Ghana’s debt-carrying capacity could easily improve in future

6 mins -

Access Bank Ghana Plc records commendable financial growth in quarter one, 2024

2 hours -

GFA DC charges Bashir Hayford over alleged misconduct in Bechem Utd game

2 hours -

MTN FA Cup: Dreams FC beat Soccer Intellectuals to make semis

3 hours -

Ayorkor Botchwey champions transformative investment, trade agenda

3 hours -

KNUST, University of Rwanda share experiences in implementation of Mastercard Foundation Scholars Program

4 hours -

Top 10 most visited tourist sites in Ghana 2023

4 hours -

Cecilia Dapaah case: I will reopen investigation into alleged acts of corruption – Mahama

4 hours -

GRA boss charges customs officers to be professional ahead of 2024 general elections

5 hours -

NPP thanks stakeholders for successful Ejisu by-election

5 hours -

Bawumia promises to involve chiefs in licensing miners if elected President

5 hours -

Koda should have visited the pastor to avert the prophecy – Ajagurajah

5 hours -

Emotional support alligator taken and released in swamp

5 hours -

A mate is a mate, Bawumia can’t be in the driver’s seat – NDC Communicator

5 hours -

Over 400 million Google accounts have used passkeys, but our passwordless future remains elusive

5 hours