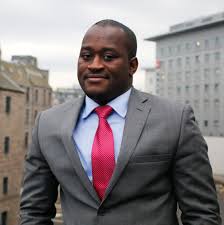

Political Risk Analyst, Dr. Theo Acheampong, has asserted that Ghana does not have a revenue problem.

According to him, the country's current debt distress situation could largely be attributed to not being prudent in managing expenditure.

“Consistently, the story has been made to look like Ghana has a revenue problem, but I have a far bigger problem with expenditure and the quality of spending that we have," he said on Joy FM’s Super Morning Show, on February 7, 2022.

Dr. Acheampong stated that "there’s a lot of published/academic work that shows that sometimes, as much as 30% of spending goes to waste.”

His comment follows the recent downgrade of Ghana's economy by two International rating agencies; Fitch and Moody’s.

Fitch downgraded Ghana’s Long-Term Foreign-Currency Issuer Default Rating (IDR) to ‘B-‘ from ‘B’ with a negative outlook

Subsequently, Moody’s also downgraded Ghana’s long-term issuer and senior unsecured debt ratings to Caa1 from B3 and changed the economic outlook to stable from negative.

The downgrade to Caa1 reflects the increasingly difficult task the government faces addressing its intertwined liquidity and debt challenges.

Moody’s added that Ghana has set more ambitious targets in its fiscal consolidation plan presented in November, 2021.

Moody’s cited for instance a 20% cut in primary spending announced by the government which is equivalent to a 4% cut on a year-on-year basis or 16% in real terms, to compensate for any shortcoming in the government's revenue measures package

According to Moody’s, “such an unprecedented fiscal tightening will be socially, economically, and politically challenging to implement.”

Dr. Acheampong, in reacting to whether government's 20% cut in expenditure is attainable, stated that the target is quite a tough one.

“If you look at the plans to actually cut back on some spending items and to do as much as 20% in this quarter, it is going to have political consequences,” he said.

That notwithstanding, Dr. Acheampong believes it is a good idea to for government to cut expenditure.

“I think the very important thing in terms of signaling to the international market could be to demonstrate that they can make some cuts and even if they did 5% or 7%, that would be a good start,” he said.

Meanwhile, government has questioned the international credit rating agency, Moody’s recent downgrade of Ghana from B3 to Caa1 with a stable outlook on the Long-Term Issuer and Senior unsecured bond ratings.

In an official statement, government explained that the forecast and projections had inaccurate balance of payments statistics, lack of supporting quantitative analysis, or data on Environmental, Social, and governance credentials.

It also complained about the “omission” of key material information such as the 2022 Budget expenditure control measures – 2022 upfront fiscal adjustments.

Latest Stories

-

No printers or PCs, Starbucks Korea tells customers

32 minutes -

No white or cream allowed at Davido, Chioma’s Miami wedding

42 minutes -

Musk threatens Apple and calls OpenAI boss a liar as feud deepens

55 minutes -

M&S restores click and collect services 15 weeks after systems hacked

1 hour -

US deficit grows to $291bn in July despite tariff revenue surge

1 hour -

Judge orders Trump administration to restore part of UCLA’s suspended funding

2 hours -

Newcastle striker Isak still determined to join Liverpool

2 hours -

Liverpool stepping up bid to sign Palace’s Guehi

2 hours -

Newcastle sign defender Thiaw from AC Milan

2 hours -

Alcaraz secures 50th win of 2025 at Cincinnati Open

2 hours -

Everton complete loan deal for Man City’s Grealish

3 hours -

Spurs leave out Bissouma for persistent lateness

3 hours -

Premier League clubs to pay tribute to Jota and brother

3 hours -

Crystal Palace hit out at CAS and UEFA after losing appeal

3 hours -

AI start-up Perplexity makes surprise bid for Google Chrome

5 hours