Audio By Carbonatix

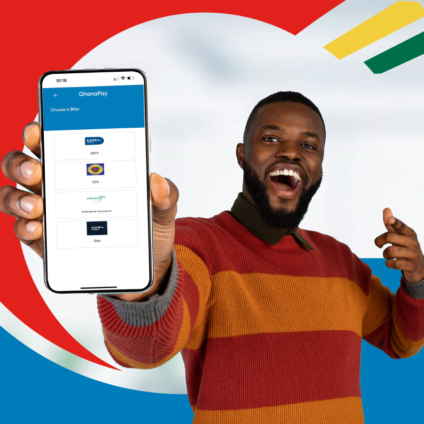

Paying electricity bills has become more convenient with the introduction of the ECG bill payment feature on the GhanaPay mobile money platform.

GhanaPay users can now settle Postpaid Electricity bills and purchase Prepaid Electricity seamlessly with this addition, which is part of GhanaPay’s ongoing efforts to enhance its range of services, making financial management easier for customers nationwide.

GhanaPay, a collaborative mobile money service offered by banks, savings and loans companies, and rural and community banks, is managed in partnership with the Ghana Interbank Payment and Settlement System (GhIPSS).

By integrating mobile money and banking services into a single platform, GhanaPay offers users a streamlined and efficient way to handle their finances.

Samuel Darko, Head of GhanaPay at GhIPSS, says the platform will continue to evolve with more features to improve user experience.

Currently, GhanaPay supports a variety of functionalities, including standing instructions (standing orders) for automated payments. This feature allows customers to schedule recurring payments directly to all mobile money wallets or bank accounts, simplifying the management of regular bills and expenses.

Beyond ECG bill payments, GhanaPay offers up to 5% interest on savings, payment of Enterprise Insurance premiums, a crowdfunding feature for raising funds for various projects, and the ability to purchase airtime and data for all networks (MTN, Telecel and AT).

These offerings provide users with greater flexibility in managing their financial and digital needs.

The Sponsored Wallet service, allows users to allocate funds from their GhanaPay wallet to other GhanaPay users. Beneficiaries can spend the allocated funds directly without requiring a transfer. Sponsors can set daily or monthly spending limits, determine the duration of the sponsorship, and remove beneficiaries at any time, offering unparalleled control and flexibility.

The integration of ECG bill payments underscores GhanaPay’s commitment to simplifying everyday transactions for Ghanaians.

By enabling digital payments for essential services, GhanaPay aligns with Ghana’s broader goal of creating a cash-lite society.

Data from the Bank of Ghana highlights a growing trend in electronic transactions, and GhanaPay is playing a key role in reducing reliance on cash and promoting digital financial inclusion.

Mr. Darko further emphasised that other enhancements are in the pipeline to expand GhanaPay’s functionality and make it even more useful for everyday financial management.

Latest Stories

-

Ghana shines in GSMA DNSI and DPRI 2025 report due to E-Levy repeal and tech neutrality

20 minutes -

NJA College of Education inducts 379 students amidst infrastructure gains and calls for professional discipline

20 minutes -

GJA President, executives join Sammy Gyamfi to observe One-Week memorial of father-in-law

30 minutes -

FDA bans mixed alcoholic energy drinks: VAST-Ghana demands ‘Name and Shame’ list for public safety

40 minutes -

Police probe deaths of teacher and farmer in Assin Fosu

1 hour -

Gov’t reaffirms commitment to safeguard Ghana’s energy supply amid Middle East crisis

1 hour -

What is wrong with us? When containers become our urban plan

1 hour -

Afenyo-Markin referred to Privileges Committee over security recruitment allegations

2 hours -

President Mahama backs private sector push to expand Ghana Wheat Initiative to cut imports

2 hours -

Ghana to declare 21 communities Marine Protected Areas, starting with Cape 3 Points

2 hours -

Women of Valour: I had to save myself from abusive marriage – Diana Hopeson

2 hours -

Women of Valour 2026 Conference sells out ahead of London event

2 hours -

ECG assures the public of meter accuracy amid billing concerns

2 hours -

BBNJ Has Finally Arrived: What next for the world’s oceans?

2 hours -

Low turnout in Ayawaso East by-election won’t change outcome – Mussa Dankwah

2 hours