Audio By Carbonatix

For weeks now, Treasury Bill (T-bill) yields in Ghana have been on a downward spiral. While this spells relief for government borrowing, it also raises critical questions for investors and the broader economy.

Despite declining yields, investor demand remains strong. With the international capital market still inaccessible and the local bond market largely inactive due to domestic debt restructuring, T-bills remain the government’s primary source of financing.

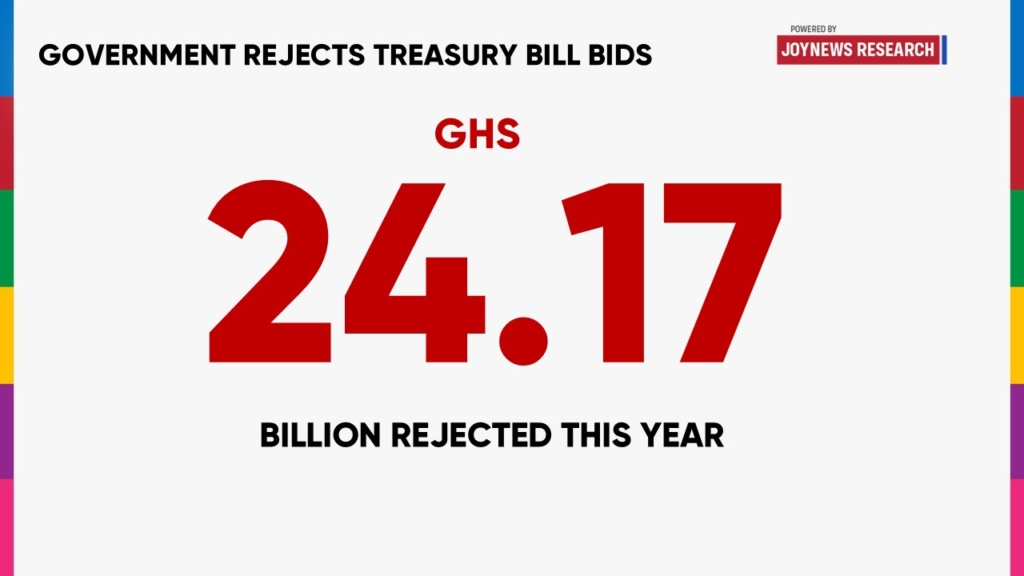

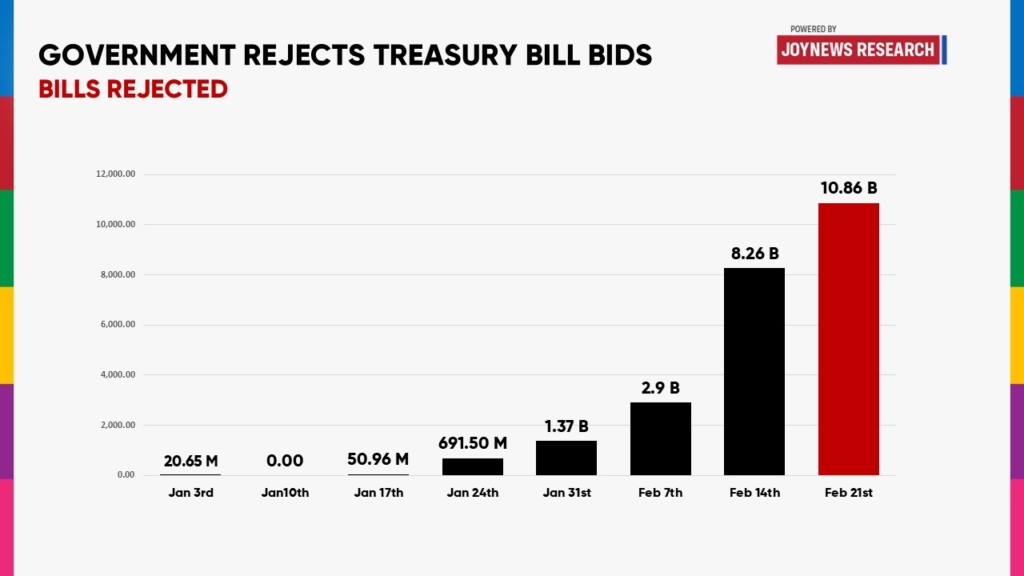

However, a striking trend has emerged—over the last six auctions, the government has rejected bids totaling more than GHS 24 billion. But what does this mean for investors and the economy?

Why is the government rejecting Treasury Bill bids?

So far in 2024, the Bank of Ghana has conducted eight T-bill auctions, rejecting bids in seven of them, according to the latest data published on the Bank of Ghana website. By turning down bids at higher rates, the government is deliberately steering interest rates downward, allowing it to borrow more affordably and potentially reshape the domestic debt market.

This move has contributed to a sharp decline in yields, reducing the government’s debt servicing burden. With limited investment alternatives, authorities could further push rates lower to create a more favorable borrowing environment.

Impact on investors: Winners and Losers

The effects of falling T-bill rates are twofold:

- T-bill Investors: With few attractive investment options, T-bill subscriptions remain high. However, as rates decline, returns for investors relying on these securities are shrinking. This could push institutional and individual investors to explore alternative assets, such as equities, corporate bonds, or foreign investments, potentially reshaping Ghana’s financial markets.

- Businesses & Borrowers: Conversely, falling yields have broader economic benefits. Lower interest rates on government securities typically translate into declining lending rates, making credit more accessible and affordable for businesses and individuals. This could stimulate economic activity and investment in key sectors.

The bigger picture: What’s the endgame?

According to the third review of Ghana’s Extended Credit Facility with the IMF, the government plans to gradually resume domestic bond issuances in 2025, beginning with a two-year bond issuance in Q2.

JoyNews checks indicate that authorities aim to create a more attractive market for these bonds—a strategy that appears to be influencing developments in the T-bill market. By allowing rates to decline, the government is shaping a lower-yield environment that could set the stage for a successful reintroduction of long-term domestic bonds.

What Could Happen Next?

If the strategy succeeds, Ghana could see a gradual return of confidence in longer-term domestic bonds. This would improve government financing options beyond short-term T-bills. However, if inflationary pressures or fiscal risks resurface, investors may remain cautious, limiting the government’s ability to sustain lower borrowing costs.

The coming months will reveal whether this strategy pays off or if market realities force a policy shift. Either way, investors and policymakers must remain vigilant.

Latest Stories

-

Use today’s gold windfall to insure Ghana’s future – Prof Peprah urges gov’t

24 minutes -

Create a Gold Stabilisation Fund now, or pay later – Finance Prof tells gov’t

50 minutes -

Gold Board is good, but Ghana must prepare for the fall – Prof Peprah

1 hour -

Don’t let Gold Board become the next COCOBOD – Finance professor warns

2 hours -

Fake vice presidential staffer remanded over visa fraud

4 hours -

Mobile money vendor in court for stealing

4 hours -

Eleven remanded over land guard case activities

5 hours -

Air Force One set for makeover paint job with new colours

5 hours -

Bodo/Glimt stun Inter Milan to continue fairytale

5 hours -

Ga Mantse stable after early morning accident

5 hours -

Pressure mounts as Arsenal blow 2-goal lead to draw at Wolves

5 hours -

Club Brugge fight back to leave Atletico tie delicately poised

5 hours -

Benfica claim ‘defamation campaign’ against Prestianni

5 hours -

Sinner and Alcaraz reach Qatar quarter-finals

6 hours -

Kenpong Travel and Tours to launch 2026 World Cup travel package on Friday

6 hours