A lower-than-targeted primary deficit indicates that Ghana’s fiscal adjustment is underway, IC Research, the analytical arm of IC Securities has stated.

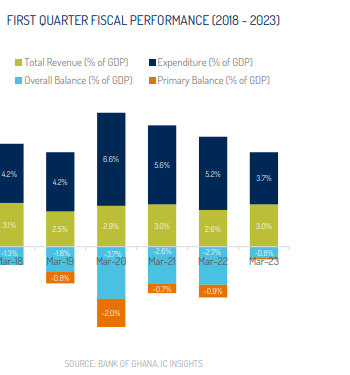

The country recorded a primary deficit of ¢596 million (0.1% of Gross Domestic Product) in the first quarter of 2023, against the target deficit of ¢4.6 billion (0.6 percent of GDP).

According to IC Research, fiscal adjustment is underway, with the help of expenditure containment.

The revenue and expenditure dynamics revealed that the fiscal adjustment in quarter one of 2023 was largely driven by expenditure controls instead of the revenue-based consolidation envisaged in the 2023 budget.

The Treasury’s budget execution for the first 3- months of 2023 showed a lower overall fiscal deficit of ¢6.7 billion (0.8% of GDP) against a target of 2.3% in quarter 1, 2023.

Total revenue and grants in the first quarter of 2023 turned out at ¢26.0 billion (3.3% of GDP), falling short of the target by 0.9% of GDP. Total expenditure amounted to ¢32.7 billion (4.1% of GDP), sufficiently below the target of ¢52.1 billion and supported the faster-than-expected compression in the budget deficit.

“Specifically, we observed a year-on-year fiscal adjustment equivalent to 0.8% of GDP as the primary deficit narrowed to 0.1% of GDP in quarter 1, 2023 compared to the target of -0.6% and outturn of -0.9% in quarter 1, 2022”, IC Securities explained.

Furthermore, it said “We attribute the ¢19.4 billion (2.3% of GDP) spending suppression to the impact of the Domestic Debt Exchange (DDE) and the suspension of external debt service”.

Falling revenue attributed to tax administration challenges

On falling revenue, IC Research attributed it to lingering challenges with tax administration and compliance as well as the softening of economic activity.

“We also believe the adverse impact of the DDE on banks’ financial results exerted a negative spillover to tax obligations toward the Treasury. In our view, the weakening economic activity and the medium-term impact of the DDE on banks’ financial position will pose a downside risk to the Treasury’s plan for a revenue-based fiscal adjustment”, it added.

Latest Stories

-

South Africa bursary scandal suspects granted bail

20 mins -

Ecobank successfully repays $500m Eurobond due April 18

23 mins -

Re: Doe Adjaho, Torgbui Samlafo IV, call for Unity among Paramountcies in Anlo

27 mins -

Extortion and kidnap – a deadly journey across Mexico into the US

30 mins -

Rihanna says fashion has helped her personal ‘rediscovery’ after having children

47 mins -

Development Bank Ghana targets GH¢1bn funding for commercial banks in 2024

1 hour -

Shatta Movement apologises to Ghana Society of the Physically Disabled after backlash

2 hours -

Sammy Gyamfi writes: Tema-Mpakadan Railway Project; A railway line to nowhere

2 hours -

Bright Simons: Is the World Bank saving or harming Ghana?

2 hours -

CAF Cup: RS Berkane banned from entering Algeria because of a map of Morocco with its Sahara

3 hours -

The media isn’t doing what is expected of journalism – Sulemana Braimah

3 hours -

Truck driver who caused train accident jailed 6 months

3 hours -

Music review: Okyeame Kwame proves rap dexterity on ‘No Competition’

3 hours -

How a 23-year-old fooled the internet with an AI Kendrick Lamar diss track

4 hours -

No man should be intimidated by the strength of a woman – Charlotte Oduro

4 hours