Audio By Carbonatix

The Mahama-led administration, backed by a clear parliamentary majority from the 2024 general election, has a renewed opportunity to drive ambitious economic reforms, according to the World Bank Group’s 9th Economic Update for Ghana.

The June edition of the report emphasises that while this political stability is a significant advantage, the nation must brace for a period of slower economic growth as it implements necessary fiscal adjustments.

The World Bank Group stated that the new government’s mandate has provided a strong impetus for its reform agenda, which is centred on fiscal discipline, macroeconomic stability, and long-term growth, the report highlighted.

The World Bank notes that fully implementing these institutional and legislative changes is crucial to realizing the benefits of poverty reduction and inclusive growth, but warns that any delays could lead to renewed fiscal pressures and a drop in investor confidence.

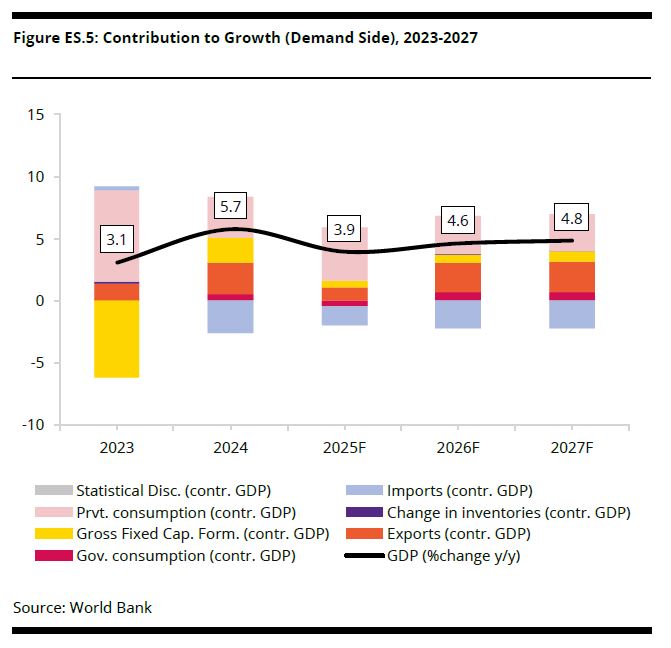

The macroeconomic outlook for 2025 projects a deceleration in economic growth to 3.9 percent, down from the strong 5.7 percent recorded in 2024.

This slowdown is primarily a result of the government’s tough fiscal adjustments, persistent inflation, and high interest rates.

The World Bank acknowledges these measures are essential for stabilising the economy and setting it on a path to a sustainable, long-term growth potential of 5 percent.

Despite the projected slowdown, key sectors are expected to remain resilient:

- Gold Exports: Gold exports will remain high due to favorable international prices, providing a crucial source of foreign exchange.

- External Sector: Ghana's external sector is projected to maintain a current account surplus. This is being driven by strong exports, robust remittance inflows, and sustained Foreign Direct Investment (FDI). According to a recent Bank of Ghana report, remittances alone contribute over $4 billion annually, making them a cornerstone of the country's external balance.

- Inflation: The report anticipates that inflation will continue to subside as the Bank of Ghana maintains its tight monetary policy stance.

The World Bank’s fiscal outlook is optimistic, provided the government remains on its chosen path.

The government is targeting a primary surplus of 1.5 percent of GDP in 2025 and over the medium term.

This means that government revenue will exceed its non-interest expenditures, allowing it to gradually free up fiscal space for critical investments in pro-poor and pro-growth sectors.

Ghana’s debt is assessed as sustainable in the medium term, but this is contingent on two key factors: the completion of external debt restructuring and the full implementation of the planned fiscal consolidation.

While the country still faces a high risk of debt distress, significant progress has been made with a recent agreement already in place with official creditors.

Looking ahead, the government’s borrowing strategy will be primarily limited to domestic sources, with plans to cautiously regain access to external commercial borrowing only in the medium term.

Latest Stories

-

A Plus proposes bill to criminalise paternity fraud

1 minute -

Ga Mantse in stable condition after dawn crash in Oti Region

10 minutes -

The longest I have stayed in a police cell is one month – BullGod

17 minutes -

Alhaji Abubakari Sidick gave me my first media interview in Ghana -Bawumia eulogises doyen

18 minutes -

South Korea’s ex-president jailed for life over martial law attempt

20 minutes -

I’ve spent 2 days in SWAT unit; it’s not a place anyone should be – Bullgod

25 minutes -

Defamation and rap diss culture in Ghana: A study of Drake vs UMG Recordings Inc.

32 minutes -

Terrorist attack on Ghanaian tomato traders in Burkina Faso prompts national security reset in Ghana

33 minutes -

NDC insists EC heads must go despite petition dismissal

34 minutes -

Nana Agyei Baffour Awuah calls for law to standardise prima facie cases

50 minutes -

Cocoa Farmers in Western North demonstrate over price cut

53 minutes -

Australian presenter apologises for drinking before slurred Olympics report

1 hour -

Let history record it right: Name the Radio Univers newsroom after Dr Alhaji Abubakari Sidick Ahmed

1 hour -

I’m a traditionalist and herbalist – Kwaw Kese

1 hour -

Police crack down on wanted robbery gang in Ashanti Region, 3 suspects arrested

2 hours