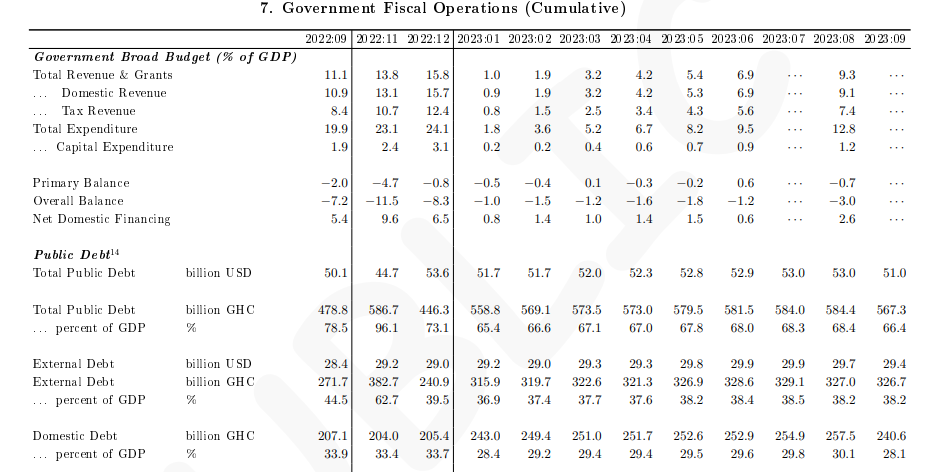

Ghana’s public debt fell by ¢14.2 billion between June 2023 and September 2023 to ¢567.3 billion ($51.0 billion), data from the Bank of Ghana has revealed.

The total public debt stock of the country is equivalent to 66.4% of Gross Domestic Product (GDP).

The reduction in the country's public debt stock during the period was partly due to some marginal gains by the cedi and the suspension of borrowings on the international market.

According to the November 2023 Summary of Economic and Financial Data, the revised debt stock stood at ¢581.5 billion in June 2023, approximately 68.0% of GDP. It then went up to ¢584.0 billion ($53.0 billion) in July 2023, about 68.3% of GDP and subsequently to ¢584.4 billion ($53.0 billion) at the end of August 2023.

The data from the Central Bank also disclosed that the external component of the total public debt stood at $29.4 billion (¢326.7 billion) in September 2023, lower than the $29.9 billion (¢328.6 billion) recorded in June 2023.

In terms of the domestic debt, it stood at ¢240.6 billion in September 2023, about 28.1% of GDP. This is a reduction from ¢252.9 billion recorded in June 2023, approximately 29.6% of GDP.

The report again failed to provide data for the financial sector resolution debt and other liabilities such as the energy sector debt.

Fiscal deficit to GDP stood at 3.0% in August 2023

The report also revealed that the government’s fiscal operations was on target as the deficit-to-GDP stood at 3.0% in August 2023, as against 8.3% of GDP in December 2022.

The primary balance also stood at a deficit of 0.7% of GDP in August 2023.

Ghana suspended interest payment on loans to its external creditors in December 2022, following the economic challenges faced by the country.

The country is currently negotiating a deal with the creditors to pave way for the release of the second tranche of $600 million from the International Monetary Fund by December 2023.

Latest Stories

-

Chelsea come from two goals down to draw against Aston Villa

21 seconds -

Andre Ayew scores in Le Havre’s 3-3 draw with PSG

10 mins -

GPL 2023/24: Kotoko draw with Medeama; Samartex go 7 points clear of Nations FC

23 mins -

Mahama cuts sod for construction of new multipurpose Jakpa palace in Damongo

44 mins -

NSS management assists Papao fire victims

1 hour -

EXPLAINER: Will dumsor end soon?

2 hours -

IMANI Africa takes on EC, accuses it of lying and publishing half truths

3 hours -

Manasseh Azure calls for investigation and prosecution of those responsible for GRA/SML contract

3 hours -

Kwesi Atuahene: Ghana’s health capital depends on HealthTech – Africa Center for Digital Transformation

3 hours -

13 signs your wife is planning on leaving you and you have no idea

3 hours -

IMANI Africa: Ghana’s EC’s dangerous and pathological conduct

4 hours -

If I speak there will be fire – Salah on Klopp row

4 hours -

Grieving after divorce is normal, but this particular kind of grief isn’t

4 hours -

10 beautifully unexpected ways husbands proposed to their wives

4 hours -

Reality zone with Vicky Wireko: Painting Ghana purple: Be aware, May is month of mental health awareness

5 hours