Audio By Carbonatix

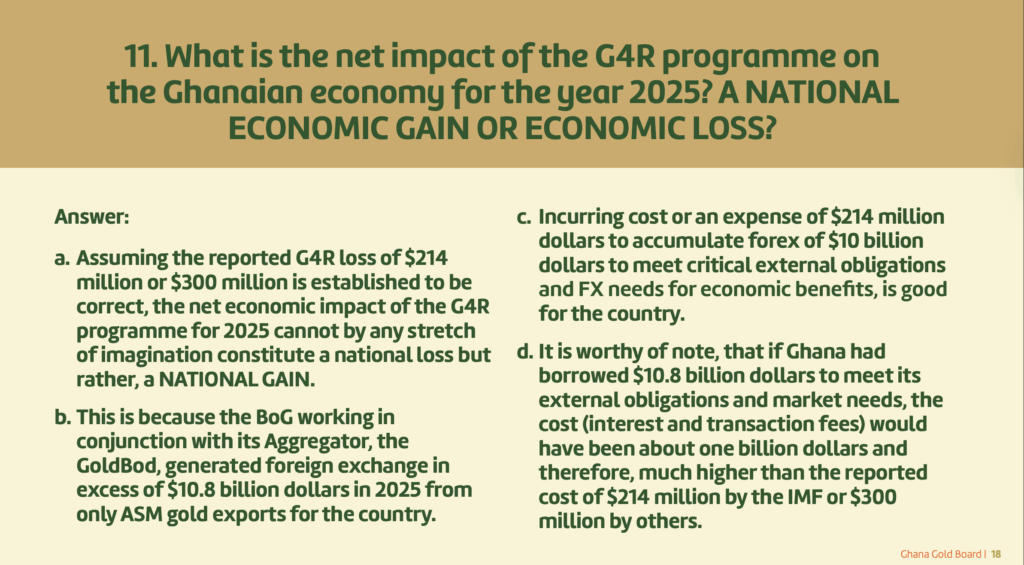

The Ghana Gold Board (GoldBod) has argued that the reported $214 million—or $300 million—loss under the Gold-for-Reserves (G4R) programme in 2025 should not be interpreted as a national setback, but rather as a strategic gain for the country.

In a statement issued on Monday, January 5, the board explained that the Bank of Ghana (BoG), working alongside GoldBod as its aggregator, generated over $10.8 billion in foreign exchange from artisanal and small-scale mining (ASM) gold exports in 2025 alone.

“Even if the cost of the programme is $214 million, the foreign exchange accumulated—over $10 billion—is of immense economic benefit. This is a net gain for Ghana, not a loss,” GoldBod noted, highlighting that the expenditure was part of a deliberate strategy to meet critical external obligations and strengthen reserves.

The board further emphasised that had the country borrowed $10.8 billion to meet similar external obligations, interest and transaction fees would have amounted to approximately $1 billion, far exceeding the reported cost of $214 million cited by the IMF or $300 million by other commentators.

GoldBod concluded that the G4R programme’s financial design, rather than operational inefficiency, underpinned the reported cost, and stressed that such strategic investments are essential for stabilising the economy and ensuring Ghana meets its international obligations efficiently.

Latest Stories

-

Citizen Attoh: The multifaceted voice of Ghana’s media and heritage

50 minutes -

Breaking borders, building futures: How African-led AI is rewriting the rules of global innovation

2 hours -

Guinea orders dissolution of 40 political parties, including three main opposition groups

2 hours -

Dozens killed as Israeli special forces raid Lebanese village in search of 40-year-old remains

2 hours -

Trump demands ‘unconditional surrender’ from Iran as Putin speaks with Iran’s president

3 hours -

Iran Embassy in Ghana opens Book of condolence after death of Supreme leader in US-Israel attacks

4 hours -

GPL 2025/26: Vision FC cruise past Berekum Chelsea with emphatic 3–1 win

4 hours -

GPL 2025/26: Samartex held by Dreams FC as winless run extends to five

4 hours -

New Juaben North MP challenges gov’t to provide evidence of jobs created and cheap loans

5 hours -

Nadowli-Kaleo District marks 69th Independence Day with cultural exhibition, academic awards

5 hours -

Confusion, tension rock NPP polling station registration exercise in Tarkwa-Nsuaem

6 hours -

Burger King opens first Kumasi branch in Ahodwo

6 hours -

Burma Camp Tennis Club hosts successful 12th Ghana–Nigeria Independence Day Tennis Tournament

6 hours -

Rights, justice and action for all women and girls must include women and girls with disabilities

6 hours -

The Lover and the Fighter: China, the west, and Africa’s geopolitical awakening

7 hours