Audio By Carbonatix

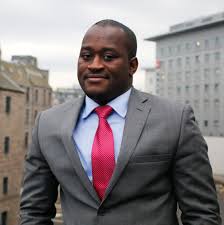

Dr Theo Acheampong, Technical Advisor at the Ministry of Finance, has highlighted the critical role the Ghana Gold Board (GoldBod) is playing in stabilising the cedi by channelling foreign exchange from the artisanal and small-scale mining (ASM) sector into formal banking channels.

Speaking on Channel One TV on Monday, January 5, Dr Acheampong said that before the introduction of the current policy framework, a significant portion of foreign currency generated from small-scale gold mining did not enter the official financial system.

“If you did a proper disaggregation and all the analytical work, I would think that the proportion of those hitherto gold dollars from the ASM sector that was coming into the formal banking channels was probably on a scale of 20 or 30 per cent,” he stated.

He explained that what has changed under the GoldBod arrangement is a deliberate policy decision to compel these inflows into the formal system.

“What is radically different this time is that you are, in essence, through policy, trying to force them to bring those dollars into your formal channels via GoldBod and ultimately to the central bank. This is why this is extremely very important,” Dr Acheampong said.

According to him, Ghana’s currency would have been far weaker if the country had relied solely on reforms under the International Monetary Fund (IMF) programme.

“If it was just the IMF reforms, I can tell you that the cedi would have been in a relatively worse shape than we are now. Your exchange rate would not have ended the year at GH¢10.45 or GH¢10.5; it may have moved from GH¢15 to around GH¢13,” he noted.

To buttress his argument, Dr Acheampong referenced the IMF’s own assessment of Ghana’s foreign exchange management. Quoting from the Fund’s report, he said: “In paragraph 33, the IMF notes that ‘the Bank of Ghana is actively managing the FX market while increasing its footprint. Since programme approval, the bank has taken an increasingly active role as an intermediary in the FX market on the back of stronger balance-of-payments inflows.’”

He added that the report further confirms that “the domestic gold purchase programme has been the key source of these inflows, alongside cocoa and repatriation,” underscoring GoldBod’s importance in sustaining cedi stability.

Latest Stories

-

SHS assault: Produce students in 24 hours or we’ll storm your school – CID boss to SWESBUS Headmaster

10 minutes -

GSTEP inducts Greater Accra finalists, equips young innovators with critical skills for regional showdown

16 minutes -

CID boss warns against school violence after athletics attack in Swedru

25 minutes -

Kotoka Int. Airport to introduce 3D scanners, end shoe removal for passengers

26 minutes -

Mahama urges private sector participation in industrial water supply reforms

26 minutes -

8 injured, 3 in critical condition after SHS violence – Awutu Senya DCE

38 minutes -

Interior Minister supports prison inmates with Ramadan food donation

38 minutes -

COA targets US$10m in investments for blue food sector through innovation hub

44 minutes -

Manufacturing must contribute to 15% of GDP by 2030 – Mahama targets

46 minutes -

Sports Minister orders NSA Director General to revoke 17 staff appointments over due process breach

51 minutes -

Stabilisation alone won’t transform economy – Mahama

53 minutes -

Aaron Kanor appointed Acting Commissioner of Customs

1 hour -

Ashanti police kill suspected robbery kingpin; four accomplices arrested

1 hour -

UK says ‘nothing is off the table’ in response to US tariffs

1 hour -

Fifteen killed after helicopter crashes during Peru flood rescue

1 hour