Audio By Carbonatix

Hollard Life Assurance has partnered with pan-African fintech company, Cassava Fintech and Vodafone to launch a micro-insurance product providing funeral and disability cover to the underserved.

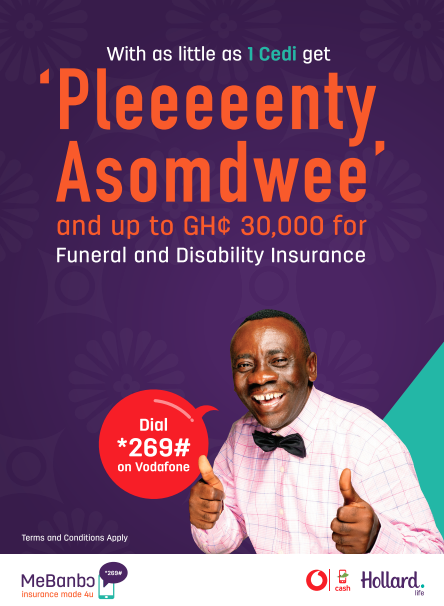

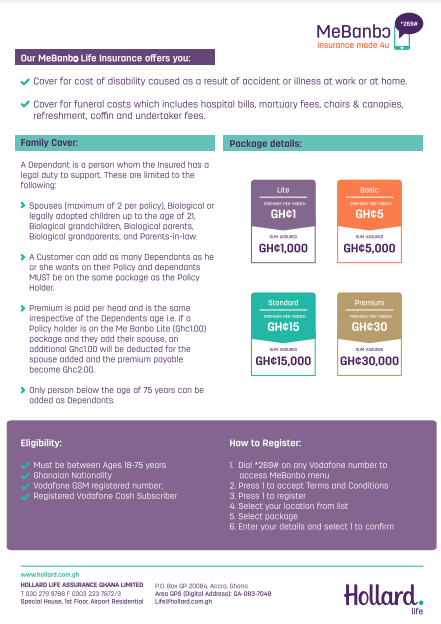

The insurance product, called ‘MeBanbɔ’ – loosely translated to ‘My Protection’ – can be easily accessed via a mobile phone by dialing USSD code *269#.

MeBanbɔ offers tailored packages of ¢1000, ¢5000, ¢15000 and ¢30000 funeral and disability cover for premiums as low as ¢1, ¢5, ¢15 and ¢30 respectively.

It is the first micro-insurance product of its kind offering packages that suit different personal needs. It is open to persons older than 18 years who use the Vodafone mobile network.

Patience Akyianu, Group CEO of Hollard Ghana, the parent company of Hollard Life Assurance, described the launch of MeBanbɔ as a significant milestone in the business’ quest to enable more people to create and secure a better future.

Patience said: “Our business goals are tied to our purpose to ensure access to insurance as a social good and an enabler of better futures. We make it a point to be a catalyst for enduring change by providing insurance products that serve the needs of our customers. MeBanbɔ is a prime example of this, and we are proud to bring it to market in partnership with Cassava Fintech and Vodafone Cash.”

Nashiru Iddrisu, Managing Director of Hollard Life, said: “We developed MeBanbɔ after engaging with potential customers in underserved markets who expressed interest in securing their financial wellbeing against unexpected incidences, such as funerals and disability.

“However, they also revealed a reluctance to sign up for traditional life insurance products because of the seemingly unaffordable premium amounts, modes of payment and claims collection process. MeBanbɔ eases these concerns. It is made for them, affording everyone the opportunity to plan their future wellbeing simply viamobile money, in amounts that suit their pockets and with an equally simple claims process,” Iddrisu said.

MeBanbɔ is currently available via Vodafone Cash and made possible through a partnership with Vodafone.

Head of Vodafone Cash, Martison Obeng-Agyei, said: “Our decision to partner the MeBanbɔ Insurance initiative was intuitive because this is yet another example of an innovative and affordable insurance product for Ghanaians.

This creates a golden opportunity for scores of hitherto underserved persons and communities to avail themselves of the benefits of insurance to secure themselves and their loved ones against future upheavals, and ultimately improve their quality of life. Inclusion is one of our pillars as a purpose-led organisation and undoubtedly a critical prerequisite for equitable growth as a country.’’

In a statement,Godwin Mashiri, the Head of Cassava Fintech International’s Mobile Insurance Business, the platform provider for MeBanbɔ, said: “We are very excited to be a part of this partnership with Hollard Life Assurance to launch MeBanbɔ in Ghana. This partnership demonstrates and underscores our commitment towards a socially and financially inclusive future that leaves no African behind.

"It is our hope that the launch of MeBanbɔ in Ghana will enable those who could not access affordable insurance cover to benefit from this product. This partnership will not be the last as we continue to provide a platform which improves the lives of everyday people across the continent.”

MeBanbɔ’s product messaging campaign in English, Twi, Ga, and Dagbani languages encourages the public to sign up for “plenty asomdwee, toinjol3 or suh'doooo” via *269# on the Vodafone network.

It features the popular comedian and TV personality Akrobeto, and local boxing champion, comedian and TV presenter Bukom Banku, as taxi drivers discussing the financial wellbeing that funeral and disability insurance cover brings.

Latest Stories

-

Ghana shines in GSMA DNSI and DPRI 2025 report due to E-Levy repeal and tech neutrality

57 minutes -

NJA College of Education inducts 379 students amidst infrastructure gains and calls for professional discipline

58 minutes -

GJA President, executives join Sammy Gyamfi to observe One-Week memorial of father-in-law

1 hour -

FDA bans mixed alcoholic energy drinks: VAST-Ghana demands ‘Name and Shame’ list for public safety

1 hour -

Police probe deaths of teacher and farmer in Assin Fosu

2 hours -

Gov’t reaffirms commitment to safeguard Ghana’s energy supply amid Middle East crisis

2 hours -

What is wrong with us? When containers become our urban plan

2 hours -

Enterprise Group attains ISO 27001 Certification, reinforces commitment to data security

2 hours -

Afenyo-Markin referred to Privileges Committee over security recruitment allegations

2 hours -

President Mahama backs private sector push to expand Ghana Wheat Initiative to cut imports

2 hours -

Ghana to declare 21 communities Marine Protected Areas, starting with Cape 3 Points

2 hours -

Women of Valour: I had to save myself from abusive marriage – Diana Hopeson

3 hours -

Women of Valour 2026 Conference sells out ahead of London event

3 hours -

ECG assures the public of meter accuracy amid billing concerns

3 hours -

BBNJ Has Finally Arrived: What next for the world’s oceans?

3 hours