Audio By Carbonatix

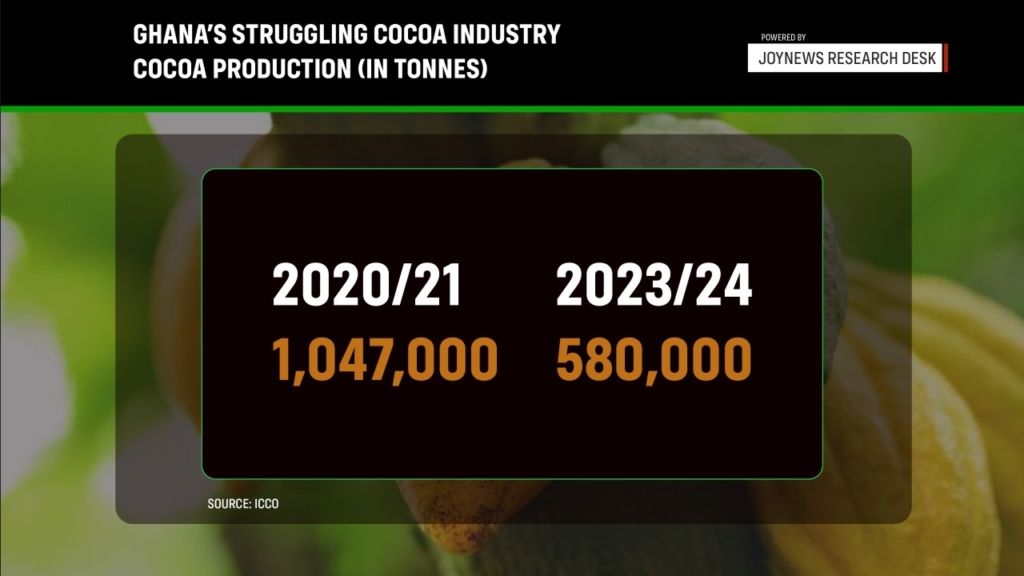

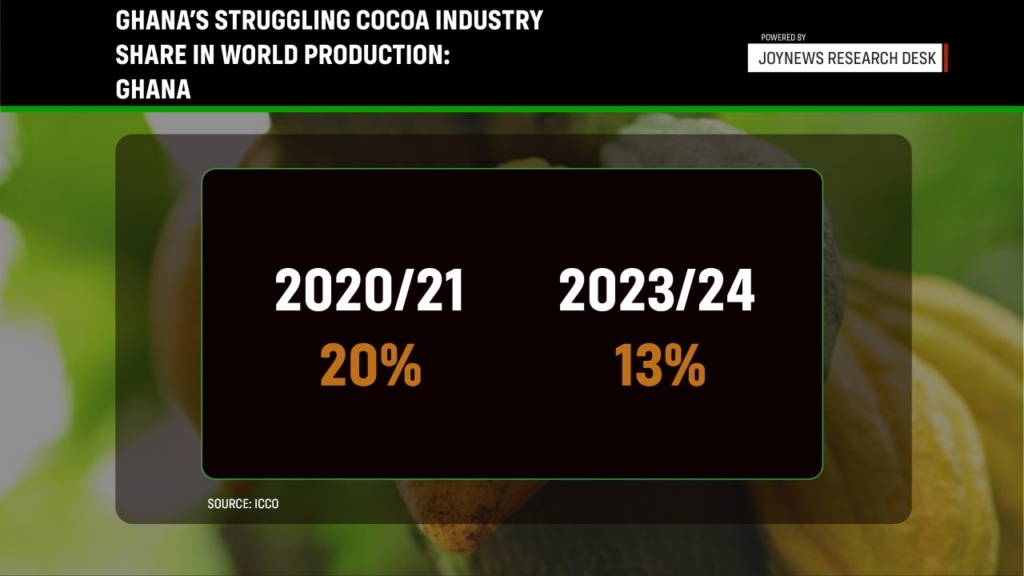

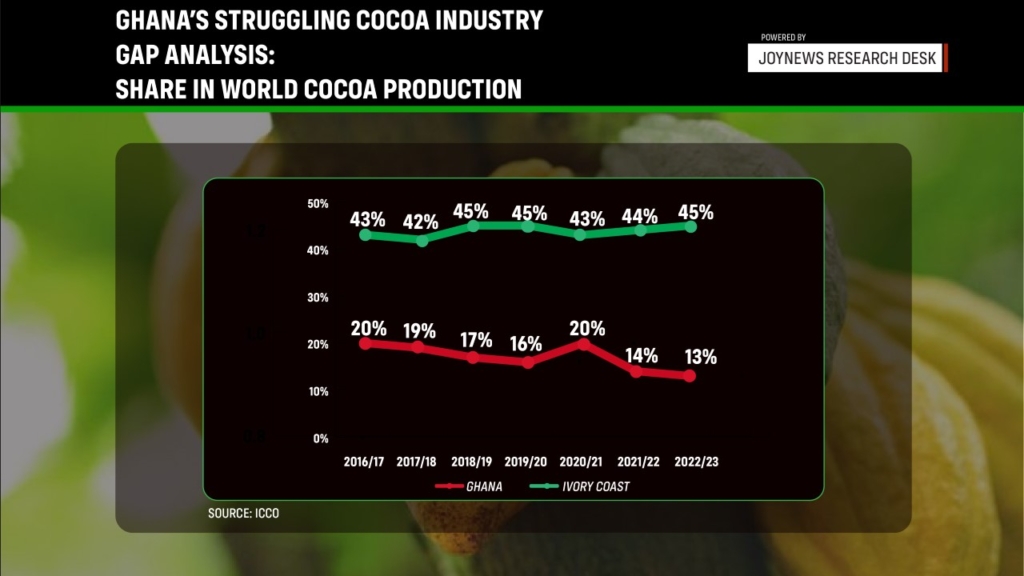

Ghana's cocoa industry, traditionally a mainstay of its foreign exchange earnings, has faced challenges in maximising its potential.

Despite a bold move less than a year ago by the Ghanaian government to increase the price per bag of cocoa beans by 63.5% to incentivise farmers and boost yields, the country's inability to obtain funds from cocoa syndicated loans almost truncated this good news as authorities struggled to fund purchases.

In fact, this was exacerbated by Ghana's economic crisis which compelled it to seek a rework of its domestic and external debt.

Consequently, instead of the over $1 billion, only $800 million was received, leading to delays and disruptions in purchasing beans. According to a Bloomberg report, this is the costliest syndicated facility the board has received since the annual loans started in 1992-93.

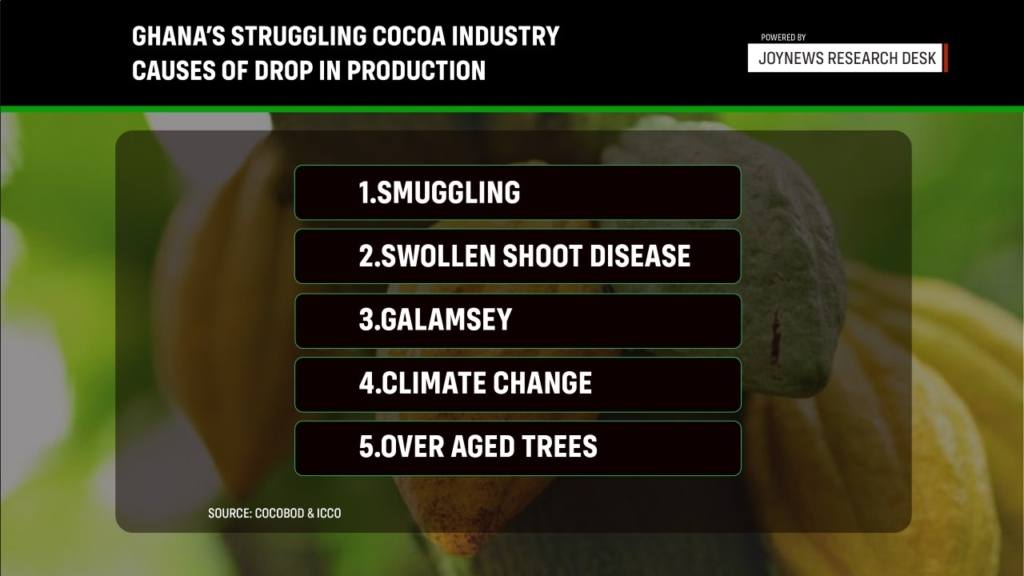

Compounding these issues, galamsey activities plus the sale of cocoa farms to illegal miners by farmers have further threatened Ghana's cocoa yield. This, combined with a significant drop in cocoa yields has led to concerns over smuggling and hoarding, potentially destabilizing the local cocoa market.

In response to the shortage, the management of COCOBOD this year authorized the importation of 3,500 metric tonnes of cocoa beans from Cote d'Ivoire and Nigeria. In Ivory Coast, the Cocoa Council (CCC) has urged cooperatives and buyers to sell their stocks to exporters within 21 days to prevent hoarding, a practice that exacerbates market instability.

COCOBOD and more troubles?

Ghana’s Cocoa Board (Cocobod), the state-owned entity overseeing cocoa production and export monopolies, has been grappling with significant financial setbacks, according to a recent report from the International Monetary Fund (IMF).

This situation has been attributed to various factors, including high rollover costs for outstanding cocoa bills, elevated purchase prices paid to cocoa producers compared to operational costs, and substantial quasi-fiscal activities such as providing fertilizers and developing rural roads, which have added strain to Cocobod’s administrative expenses.

Under Ghana’s ongoing IMF programme, the government has identified Cocobod as one of eight state-owned enterprises facing substantial fiscal risks. This recognition underscores the challenges faced by Cocobod and the urgent need for remedial actions to address its financial sustainability.

The financial performance of Cocobod has been particularly concerning in recent years. Since 2016, Cocobod has reported losses for six consecutive years, with its last profitable year recorded in 2015.

The annual losses have surged from less than GH¢300 million in 2016 to nearly GH¢2.5 billion in 2021, reflecting a substantial escalation in financial strain. Furthermore, Cocobod’s total debt has climbed to approximately 3.8% of the country’s Gross Domestic Product (GDP) in 2021, indicating a significant burden on Ghana’s overall fiscal health.

Are these measures enough?

Government has already told the IMF that it will publish a turnaround strategy, approved by the Cabinet. This strategy according to authorities will include (i) an immediate announcement of joint ministerial supervision of COCOBOD by the Ministry of Finance and the Ministry of Agriculture.

Authorities also informed the fund it will "phase out quasi-fiscal spending of the Board (this will require the announcement of termination of the road concession agreement with the Ministry of Roads, and discontinuation/rationalisation of fertilizer/input subsidy programs including Hi-Tech)."

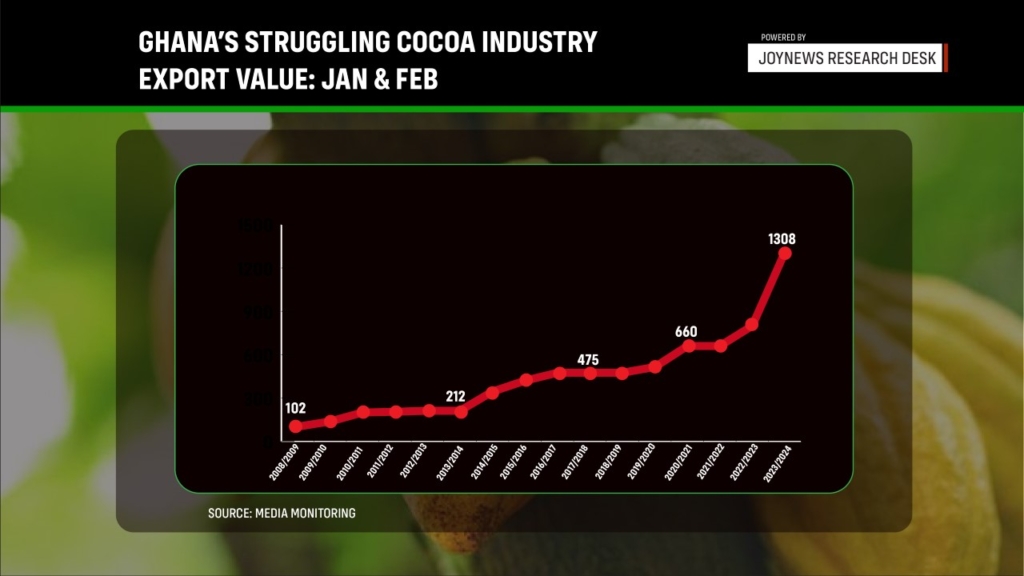

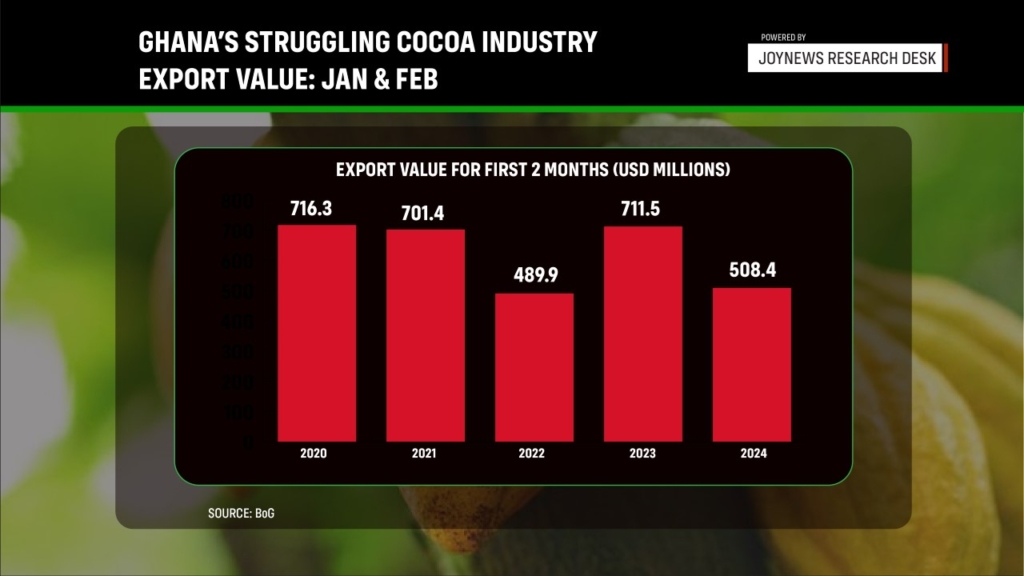

More about Ghana's cocoa industry in graphics

Latest Stories

-

Golden Jubilee Sports Festival opens with call for discipline, unity

57 minutes -

Land guards take over Tuba irrigation farm as farmers protest

58 minutes -

Police arrest 2 cybercrime suspects, rescue kidnapped victims in Tema

1 hour -

Women’s Development Bank rollout at advanced stage – Vice President

1 hour -

Cocoa reforms will safeguard farmers’ interests – Ato Forson assures

1 hour -

Be patient; not everyone can be appointed – Asiedu Nketia to NDC faithful

1 hour -

NAIMOS arrests 3 Chinese nationals, a Ghanaian in Mpohor galamsey swoop

1 hour -

We must work to achieve a Navy that is robust, globally respected – CNS

1 hour -

Community leaders in Ayawaso East urged to act responsibly, safeguard public peace

2 hours -

Parliament launches five-year corporate strategic plan

2 hours -

Water crisis tops concerns of residents at NCCE forum in Tamale

2 hours -

Sky Train Project was never approved- Ex-GIIF Board Secretary

2 hours -

GACL MD calls for stronger international connectivity to position Accra as West Africa’s aviation hub

2 hours -

Airlines, travel consultants pledge support for growth at 5th AviationGhana Breakfast Meeting

2 hours -

Mrs Esther Ami Mensah-Abbey, aka Daavi

2 hours