Audio By Carbonatix

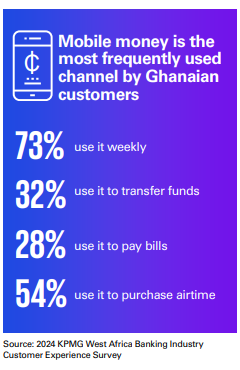

Mobile money is the most frequently used digital platform in 2024, the 2024 West Africa Banking Industry Customer Experience Survey has revealed.

This represented a 7-percentage point increase compared over the previous year.

According to the report, 73% of Ghanaian consumers use it weekly. Thirty two percent use it for transfer of money, while 28% use to pay bills and 54% use it to purchase airtime,

For the second consecutive year, retail banking customers ranked the ease of transferring money between their account and mobile wallet as the most important experience metric highlighting the importance of interoperability between systems.

The survey said mobile money interoperability continues to be a key driver of its adoption with the total value of mobile money interoperability transactions increasing by 23% as of October 2024.

Again, the USSD banking is also driving payment interoperability.

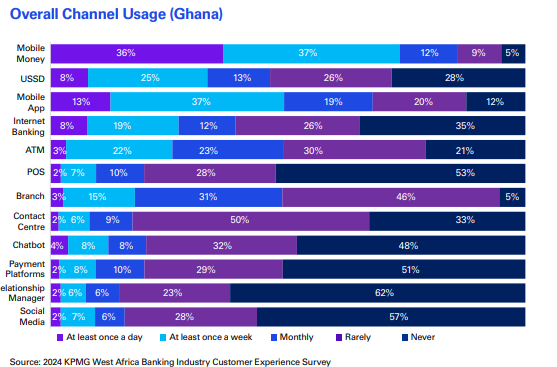

The survey revealed that 33% of retail banking customers use USSD banking services weekly as compared to 28% of respondents in 2023. However, concerns over service reliability persist, with customers reporting intermittent downtime of their USSD banking channels.

Mobile apps, the second most used channel after mobile money, saw a slight decline in usage, with 50% of respondents indicating weekly usage compared to 53% last year.

Availability of service, ease of use and variety of features of mobile apps ranked among the ten most important experience measures for retail customers. While customers appreciate the convenience and features of banking apps, concerns around reliability remain prevalent.

There was a decline in Automated Teller Machines (ATM) usage, with monthly usage dropping from 59% in 2023 to 48% in 2024.

Despite this decrease, customers generally expressed satisfaction with the availability of cash and the service uptime when using ATMs.

While overall usage declined, ATMs remained the second most-used channel among Gen X and Baby Boomers highlighting a generational divide in channel preferences, with older customers continuing to rely on traditional channels for their banking needs while the younger generations prefer digital channels.

Latest Stories

-

‘Samira was Bawumia’s talisman in Ashanti and Greater Accra’ – Hassan Tampuli

25 minutes -

Zito expresses Kotoko’s interest in Lions midfielder Etse Dogli

56 minutes -

Today’s Front pages: Tuesday, February 3, 2026

56 minutes -

South Africa launches annual HPV vaccination campaign

1 hour -

Bawumia deserves a chance – Arthur Kennedy

1 hour -

Nine arraigned for deadly attack in Nigeria that killed over 150

1 hour -

We have high expectations of Adjetey – Wolfsburg Sporting Director

1 hour -

Lands Ministry charts results-oriented agenda for 2026

1 hour -

Run an open-door policy, but be wary of the ‘Judases’ – Atik Mohammed to Bawumia

2 hours -

Ablakwa in Latvia to probe death of Ghanaian student

2 hours -

Gideon Boako hails Bawumia’s victory as true reflection of delegates’ will

2 hours -

Pastor Edwin Dadson, Spikenard Music International donate GH¢50,000 to Little Hearts Foundation

2 hours -

Nkwanta South MCE appeals to Health Minister for renovation of health facilities in Oti Region

2 hours -

Botswana and Ghana point to a new model for African mining

2 hours -

NPP presidential primaries tougher than 2024 polls – Hassan Tampuli

2 hours