Audio By Carbonatix

Attorney-General and Minister for Justice, Dr. Dominic Ayine, has announced that former Chief Executive Officer of the National Food and Buffer Stock Company, Abdul-Wahab Hannan, acquired several high-value properties with proceeds from alleged financial crimes.

The revelations were made during a briefing under the Government Accountability Series at the Jubilee House.

According to Dr. Ayine, investigations show that the former CEO used illicit funds to purchase luxury properties in Accra and Tamale, worth several million dollars and Ghana cedis.

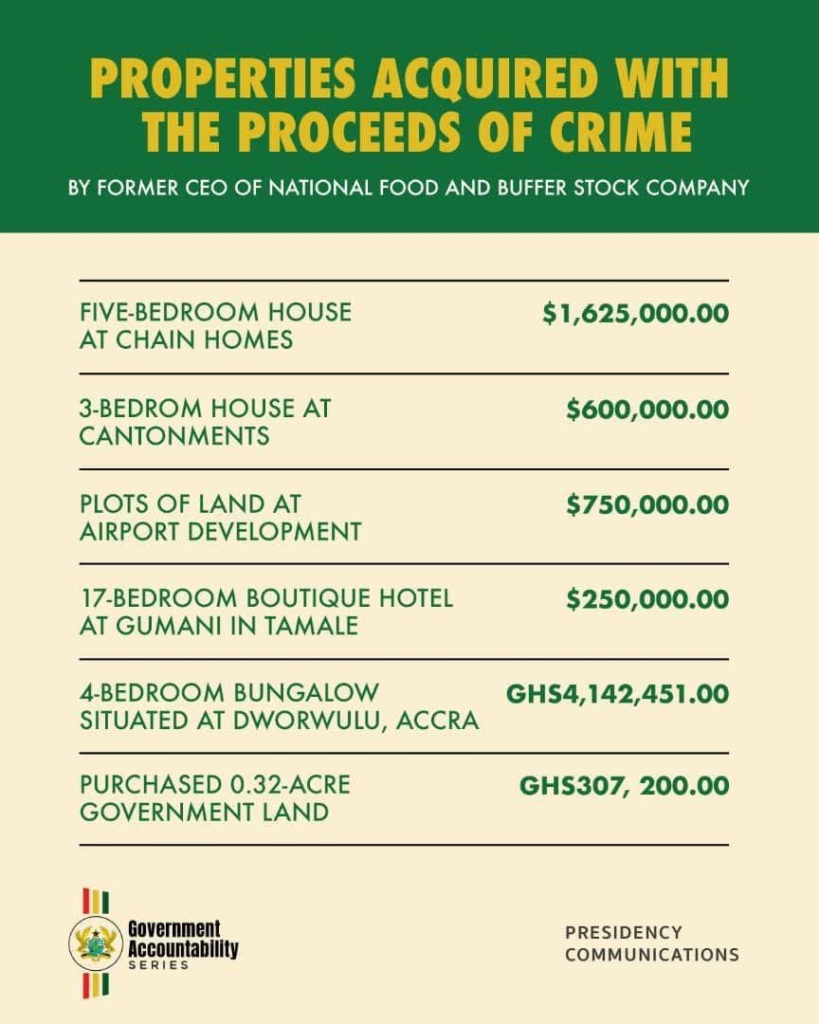

The list of assets uncovered includes:

- A five-bedroom house at Chain Homes valued at $1.625 million

- A three-bedroom house at Cantonments worth $600,000

- Plots of land at Airport Development estimated at $750,000

- A 17-bedroom boutique hotel at Gumani in Tamale valued at $250,000

- A four-bedroom bungalow at Dworwulu, Accra, costing GHS 4,142,451

- A 0.32-acre government land purchased for GHS 307,200

Additionally "Bank documents obtained by EOCO will reveal that within the period that the suspects operated this criminal enterprise, Mr Abdul-Wahab and his wife and their entities became the largest depositors at Republic Bank and the branch was at Labone."

"Lastly, we have also, we have frozen all the assets of Hannan that I've listed, including a GHs10 million fixed deposit account at Republic Bank Labone branch. That is the liquid assets. They also have a lot of bags. I didn't want to list them, the wife has over 61 luxury bags… He himself was buying watches, some costing as much as GHs1.5 million Ghana and so on.”

Dr. Ayine explained that the findings are part of a broader probe into a GHS 40.5 million money-laundering scheme involving Sawtina Enterprise, a company linked to Mr. Hannan.

The Attorney-General said the government is taking steps to retrieve all assets acquired through criminal proceeds and ensure accountability in the management of public funds.

Latest Stories

-

Sophia Akuffo questions government debt trust after DDEP haircut

32 minutes -

‘You don’t sit there’ – Sophia Akuffo on speaking out against what she calls unlawful

56 minutes -

Netflix drops bid for Warner Bros, clearing way for Paramount takeover

1 hour -

Hillary Clinton tells House panel she ‘had no idea’ of Epstein’s crimes

1 hour -

‘If I had to do it again, I would’ – Sophia Akuffo defends bold DDEP picket decision

2 hours -

Italy arrests Burundi man over 2014 murders of three Catholic nuns

3 hours -

‘We should be doing more’ – Former CJ Sophia Akuffo challenges think tanks to step up

4 hours -

Singer D4vd confirmed as ‘target’ of investigation into murder of teen

4 hours -

Police vow crackdown as court bans ‘Stop Galamsey’ protest on SONA day

4 hours -

US aims to bring in 4,500 white South Africans per month as refugees, document says

5 hours -

A new chapter begins: MotoGP roars into 2026

5 hours -

Netflix declines to raise offer for Warner Bros

5 hours -

Chamber of chaos: Chicago braces for a WrestleMania-defining night

5 hours -

Russia and Ukraine exchange more than 1,000 soldiers’ bodies

5 hours -

First writing may be 40,000 years earlier than thought

5 hours