Audio By Carbonatix

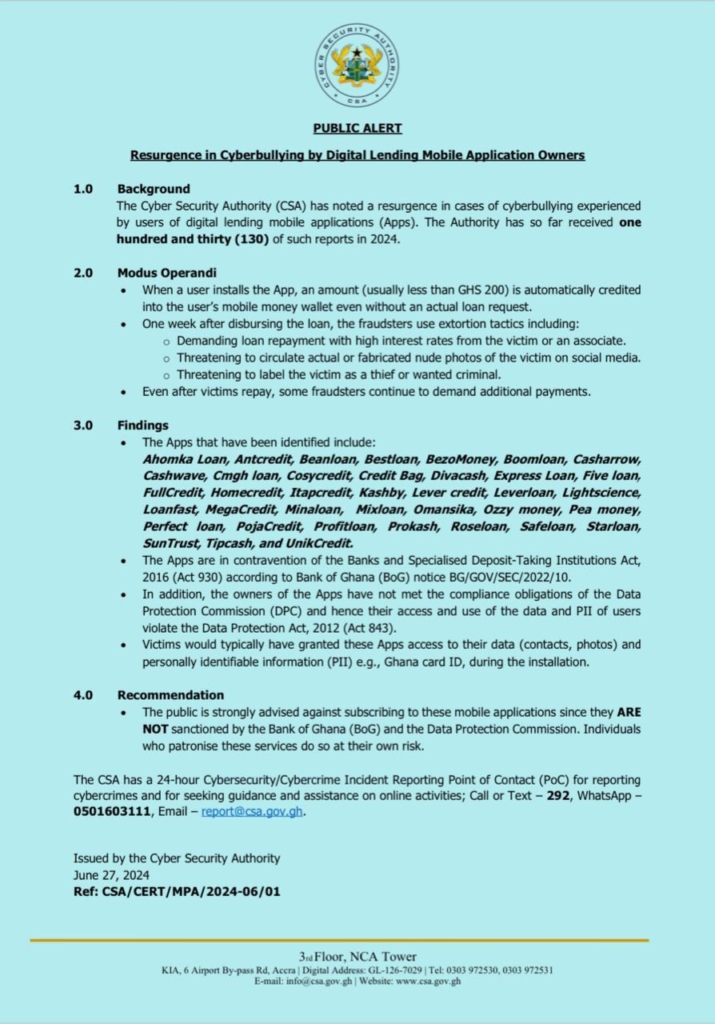

The Cyber Security Authority (CSA) has cautioned the general public against signing up for digital lending mobile applications (Apps) following a resurgence in cases of cyberbullying experienced by their users.

In a press release, the CSA revealed that so far, they have received about 130 reports of cyberbullying from victims who signed up for these apps they say are not sanctioned by the Bank of Ghana and the Data Protection Commission to operate.

“When a user installs the App, an amount (usually less than GHS 200) is automatically credited into the user's mobile money wallet even without an actual loan request.”

“One week after disbursing the loan, the fraudsters use extortion tactics including: Demanding loan repayment with high interest rates from the victim or an associate, threatening to circulate actual or fabricated nude photos of the victim on social media and threatening to label the victim as a thief or wanted criminal.”

“Even after victims repay, some fraudsters continue to demand additional payments…Victims would typically have granted these Apps access to their data (contacts, photos) and personally identifiable information (PII) e.g., Ghana card ID, during the installation,” the CSA disclosed.

The loan apps the CSA found culpable include Ahomka Loan, Antcredit, Beanloan, Bestloan, BezoMoney, Boomloan, Casharrow, Cashwave, Cmgh Loan, Cosycredit, Credit Bag, Divacash, Express Loan, Five Loan, FullCredit, Homecredit, Unik Credit and many others.

The authority noted that the activities of these loan apps are in contravention of the Banks and Specialised Deposit-Taking Institutions Act, 2016 (Act 930) according to Bank of Ghana (BoG) notice BG/GOV/SEC/2022/10.

“In addition, the owners of the Apps have not met the compliance obligations of the Data Protection Commission (DPC) and hence their access and use of the data and PII of users violate the Data Protection Act, 2012 (Act 843),” they added.

The CSA called on the general public to not only stay away from these apps but also report any Cybersecurity/Cybercrime incident to the Authority via text, call or email.

Read the full statement below:

Latest Stories

-

Africa Prosperity Network announces winner of ‘Make Africa Borderless Now!’ logo competition

21 minutes -

Ghana Medical Trust Fund restores hope for midwife after successful brain surgery

35 minutes -

Trump threatens to sue Trevor Noah over Epstein joke at Grammys

36 minutes -

Crown Princess’ son arrested for alleged assault before rape trial in Norway

47 minutes -

Kpandai protest: Be patient, exercise maximum restraint – NDC appeals to Youth Wing

1 hour -

Hindsight: Adjetey’s Wolfsburg move in focus

2 hours -

Sammy Crabbe congratulates Bawumia, urges NPP unity and stakes bid for national chairman

2 hours -

Keep Akufo-Addo close to learn from his mistakes – KTU Researcher advises NPP

2 hours -

Ghana loses US$54.1 billion to commercial illicit financial flow from 2013 to 2022

2 hours -

2026 is a make-or-break year; we must deliver on the reset agenda – Lands Minister to CEOs, directors

2 hours -

Kofi Adams to launch 2026 UG Corporate Football League

2 hours -

Bawumia must break perceived Akufo-Addo control to win public trust, votes – Asah Asante

2 hours -

GRIDCo allays fear of power disruption over Afienya transformer upgrade

3 hours -

GRIDCo announces transformer upgrade at Afienya substation, no disruption to power supply

3 hours -

FDA to shut down food joints operating without hygiene permits

3 hours