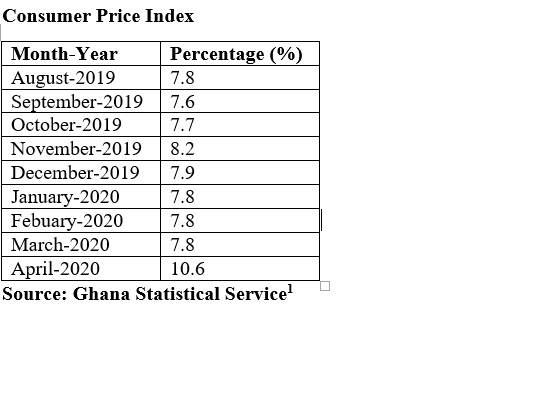

Covid-19 pandemic has affected price stability in Ghana’s economy. Consumer Price Index (CPI) entered double-digit for the first time since the CPI was rebased in August 2019.

In April 2020, Ghana recorded a year-on-year inflation rate of 10.6% from 7.8% in the previous month. The 3.2% increase is significant looking at the trend in the past two years.

The Consumer Price Index (CPI) measures proportionate changes in the prices of a fixed basket of goods and services that households in Ghana consume according to the Ghana Statistical Service (GSS). Food and Non-alcoholic Beverages division recorded the highest year-on-year inflation rate of 14.4% followed by Housing, Water, Electricity and Gas division with 11.2%. Food inflation was the predominant driver of year-on-year inflation contributing 59.6%.

This is significant and needs to be analyzed to inform policy formulation and implementation. Below is the CPI table since rebasing in August 2019.

As part of measures to contain the spread of the Coronavirus, the government of Ghana imposed a three-week partial lockdown from 30th March to 20th April 2020 in the Accra-Tema-Kasoa and Kumasi Metropolitan Areas while borders remain closed to movement of people but not goods.

It is obvious that the restrictions on the movement of persons and the closure of boarders had an impact on the prices of goods and services.

Inflation of imported goods was 4.9%, while the inflation of local goods was 13.1% on average in the aforementioned month. Covid-19 pandemic has impacted negatively on international trade and is expected to remain so for some time.

It is time to pursue aggressively import substitution industrialization as uncertainties of international trade volumes to return to levels before the pandemic remain unlikely in the short to medium term.

The Bank of Ghana has the mandate to formulate and implement monetary policy to achieve price stability. One of the key indicators the Central Bank considers in reviewing the Monetary Policy Rate (MPR) which affects interest rate all things being equal is the inflation rate.

With a 3.2% jump in the CPI, BoG will thread cautiously in reducing the policy rate. The Central Bank as part of measures to increase liquidity and reduce interest rate in the economy reduced MPR for the first time since January 2019 from 16% to 14% in March 2020.

Also, the Prime Reserve requirement for banks was reduced from 10% to 8%. The Bank of Ghana adopted inflation targeting in 2002.

Inflation targeting is a framework for monetary policy characterized by the public announcement of official quantitative targets or target ranges for the inflation rate over one or more time horizons and by the explicit acknowledgement that low, stable inflation is monetary policy’s primary long-run goal[ii]. The medium-term inflation (CPI) target for Ghana is 8% (-/+ 2).

New Policy Measures and Impact on Prices

In April 2020, the government announced to cover electricity bills for lifeline consumers while remaining consumers will enjoy a 50% reduction for April, May and June this year as part of interventions to reduce the burden of Ghanaians during this pandemic. Water bill will be absorbed by the government for the same period as well. The envisaged reduction in inflation in the Housing, Water, Electricity and Gas division might not see the light of day as Ghana Revenue Authority (GRA) has asked power sector firms to charge VAT, GETfund and NHIL levies in a letter dated 4th May 2020.

This will translate to an increase in electricity prices by about 17.5%. More so, the government has reversed the directive which slashed benchmark values for all imports by 50%, and 30% for vehicles. This directive has been implemented since April 2019.

It will likely cause imported inflation to surge whiles price competiveness at Ghana’s port will negatively be affected.

In conclusion, the prices of goods and services might not decline as fast as expected in the short-term as Covid-19 pandemic lingers. The Central Bank in its 94th Monetary Policy Committee Meeting will likely maintain the policy rate at 14.5% as inflation rate increase while the Cedi experiences volatility against other trading currencies.

As revenue mobilization remains low as a result of the pandemic, the government should rationalize expenditure and avert procurement induced corruption in this crisis. Food inflation can be reduced by investing in the agriculture value chain by both government and the private sector. Effective implementation and widening the basket of foods cultivated under the government’s flagship program -Planting for Food and Jobs, during this pandemic will help reduce prices of food.

The author is an economic analyst

Latest Stories

-

2024 polls: Stop fighting over positions in Mahama’s next government – Asiedu Nketiah

4 mins -

Although people may not always listen to the lyrics, there’s still a market for rap in Ghana – E.L.

9 mins -

Passengers appeal to transport operators to officially announce new fares

19 mins -

Damongo: About 400 NPP Members resign over Minister’s alleged meddling in chieftaincy affairs

45 mins -

Next NDC government will pay special attention to women – Naana Opoku-Agyemang

54 mins -

Amerado is singing and it’s good he’s doing that – Lyrical Joe

1 hour -

NDC government will establish a Women’s Development Bank – Prof Opoku-Agyemang

1 hour -

My selection is an affirmation of your belief in women – Naana Opoku tells Mahama

1 hour -

Our ticket will be a pair of experienced individuals – Mahama assures

1 hour -

NDC officially outdoors Prof Naana Opoku-Agyemang as running mate

2 hours -

+233 hosts Int. Jazz Day concert on April 30

2 hours -

Farmer arraigned over threat of death

2 hours -

Education Minister unveils new uniforms for basic schools

2 hours -

8th Ghana CEO Summit scheduled for May 27

2 hours -

Leaked intimate video has severely embarrassed me; I’m sorry – Serwaa Amihere

3 hours