Audio By Carbonatix

Nigerian banks’ balance-sheet structures have helped to ensure continued compliance with minimum capital requirements despite the devaluation of the Nigerian naira by about 40% since June 2023, Fitch Ratings has disclosed.

According to the UK-based firm, the risks to capital from further currency devaluation and loan quality pressures should not affect ratings for most banks.

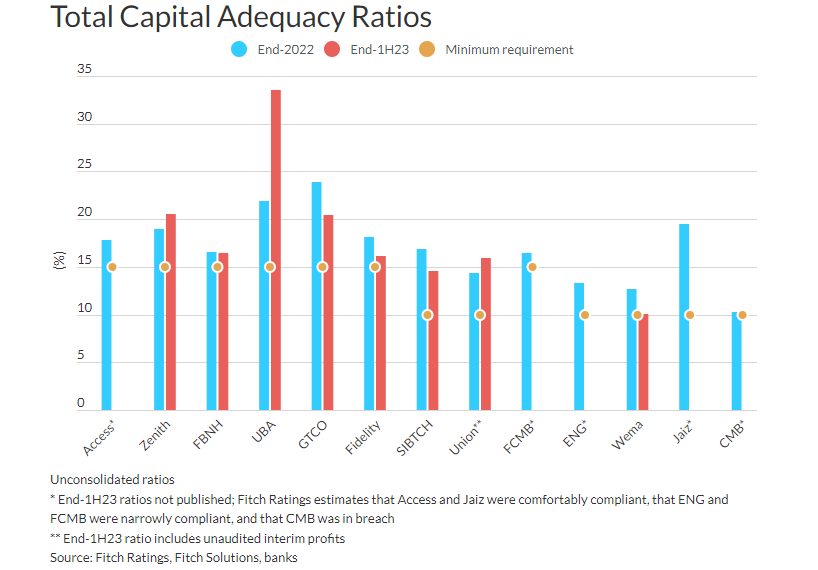

However, the Rating Watch Negatives (RWNs) on the three banks most at risk of breaching minimum total capital adequacy ratio (CAR) requirements remain in place given these risks.

The sharp devaluation of the official exchange rate led to large FX revaluation gains in the first half year due to banks’ long net open positions in foreign currency (FC), it explained.

“FC risk-weighted asset inflation was limited by small FC loan books and low risk-weights on non-loan FC assets, helping banks to remain compliant with CAR requirements. Loan impairment charges increased significantly in 1H23 due to the weaker macroeconomic setting and the increased provisions needed for FC loans, but they were comfortably absorbed by the FX revaluation gains”, it added.

It further said banks with foreign subsidiaries, in particular United Bank for Africa (B-/Stable), also experienced large FC translation gains through other comprehensive income, while the CARs of banks with FC-denominated capital-qualifying debt instruments, notably Access Bank (B-/Stable), benefitted from these instruments inflating in naira terms.

Several banks, it pointed out have had their interim financials audited so that they can incorporate their interim profits into regulatory capital. FBN Holdings, Fidelity Bank, Wema Bank and Jaiz Bank (all rated ‘B-’/Stable) plan to raise core capital to strengthen buffers over CAR requirements.

Latest Stories

-

Mahama announces national airline and major upgrades for Accra, Sunyani, Bolgatanga, and Wa Airports

28 seconds -

Foreign remittances hit $7.8bn in 2025 – Mahama

4 minutes -

Mahama pledges to end ‘no bed syndrome’ and expand hospital capacity nationwide

11 minutes -

No patient must be turned way over lack of hospital beds – President Mahama

12 minutes -

SONA 2026 in Pictures

13 minutes -

Mahama vows to go after ‘big fish’ in galamsey fight, reveals intensified prosecutions

22 minutes -

Alarm Bells in Mogadishu: Security erodes as Al-Shabaab races towards “Greater Somalia”

23 minutes -

Mahama unveils TVET centres, SHS upgrades and 50,000 teachers’ housing plan

25 minutes -

‘December 19, 2022, under Akufo-Addo was one of the darkest days in Ghana’s economic history’ – Mahama

31 minutes -

John Mahama: Cedi soars 40.7% as Ghana’s economy surpasses $100bn

33 minutes -

Ghana clears $500m gas debt, restores World Bank guarantee – Mahama

36 minutes -

Mahama announces plans to reintroduce road tolls using technology

37 minutes -

US$1.1bn debt restructuring in power sector saves US$250m – Mahama

41 minutes -

Mahama announces 600 new classroom blocks nationwide to strengthen basic education

43 minutes -

We are steadily clearing road sector debt — Mahama assures Ghanaians

45 minutes