Audio By Carbonatix

Shareholders of Ecobank Transnational Incorporated (ETI) will not receive dividend payments for the Bank’s 2024 financial performance, despite a record-breaking year and balanced growth across all business segments.

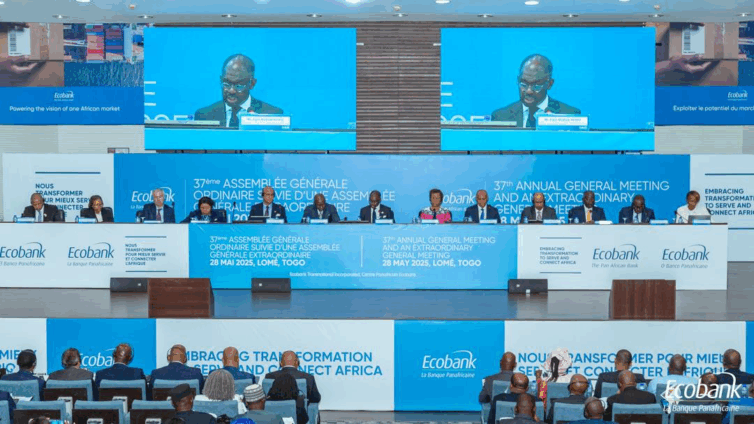

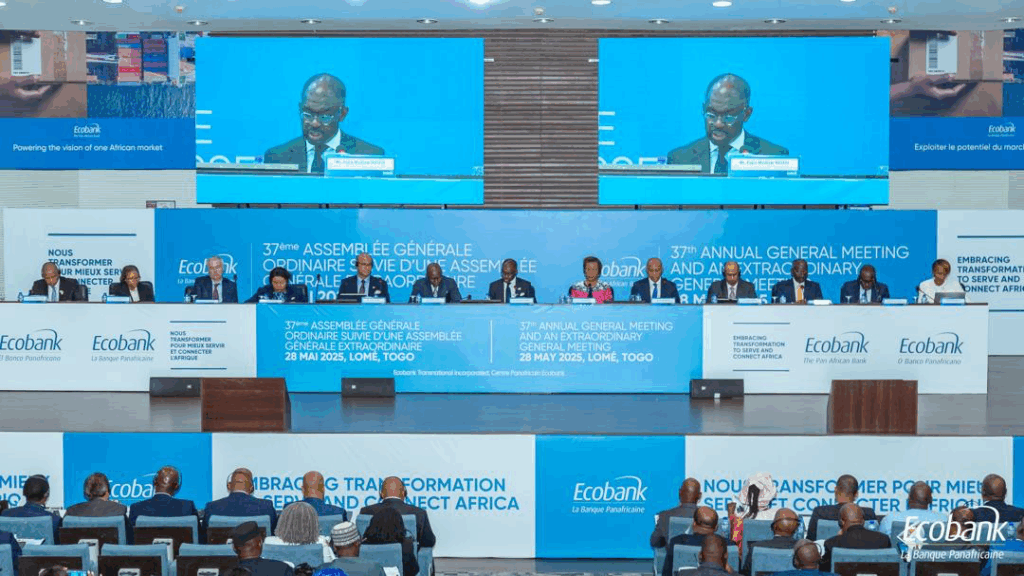

The decision was announced at ETI’s Annual General Meeting (AGM) and Extraordinary General Meeting (EGM) held in Lomé, Togo, on May 28, 2025.

Speaking at the AGM, Board Chairman Papa Madiaw Ndiaye described the move as “very difficult,” acknowledging the importance of dividends to shareholders.

“Of the 641,000 shareholders of ETI, about 600,000 own fewer than 10,000 units and rely on dividend payments,” he noted.

However, the Board emphasised that the decision was made in the best interest of the company.

“We wanted to strengthen the balance sheet to pave the way for accelerated growth. We faced the difficult decision of either servicing the debt and complying with existing debt covenants or paying dividends,” Mr. Ndiaye explained.

He further acknowledged shareholder disappointment, adding, “Not paying dividends again is disappointing, and explaining our reasoning is crucial.”

2024 Financial Performance

ETI, the parent company of the Ecobank Group, delivered over $2 billion in revenue for the second consecutive year in 2024.

Profit attributable to shareholders reached $333 million, representing a 45% increase at constant exchange rates. Profit Before Tax climbed to $658 million, a 33% year-on-year increase when adjusted for currency effects.

Return on equity hit a record 32.7%. Customer deposits totalled $20.4 billion, while total assets stood at $28 billion.

All core business segments reported robust growth:

- Corporate & Investment Banking generated $1.1 billion in revenue, buoyed by trade finance, payments, and cash management.

- Consumer Banking added over 1 million new customers and saw a 15% increase in revenue.

- Commercial Banking grew by 12%, driven by improved lending and transaction banking.

Shareholder Support for Resolutions

Despite concerns raised by some retail investors over the lack of dividend payments, shareholders overwhelmingly approved all resolutions presented at the AGM.

These included:

- Approval of the financial statements and appropriation of profits for 2024.

- Appointment of an additional auditor.

- Re-election and renewal of mandates for several board members.

- Authorisation to raise additional funds and amend the company’s Articles of Association.

CEO Outlines Growth Strategy

Group Chief Executive Jeremy Awori reassured shareholders of ETI’s strategic direction, pledging to expand customer access to current accounts, savings and investment products, faster and more affordable money transfers, and financial planning tools such as mortgages and wealth solutions.

“In 2024, we began reorienting the Bank to achieve these goals, while always remembering that long-term revenue growth remains the key driver of value and sustainably high returns on equity,” Awori said.

He described ETI’s first-quarter performance in 2025 as “encouraging,” citing rising return on equity, falling cost-to-income ratios, and gains from digital investments. He reaffirmed the Bank’s focus on balance sheet strengthening as a foundation for accelerated growth.

Latest Stories

-

Faisal Islam: Trump’s Greenland threats to allies are without parallel

3 minutes -

Ex-GBA President accuses NDC of driving move to remove GBA from constitution

2 hours -

Trump’s double pardon underscores sweeping use of clemency

3 hours -

Morocco and Senegal set for defining AFCON final under Rabat lights today

4 hours -

Trump tariff threat over Greenland ‘unacceptable’, European leaders say

4 hours -

Evalue-Ajomoro-Gwira MP kicks against VALCO sale

5 hours -

Mercy Johnson withdraws alleged defamation case against TikToker

5 hours -

Ghana accepted Trump’s deported West Africans and forced them back to their native countries

6 hours -

No evidence of theft in Unibank Case – A‑G explains withdrawal of charges against Dr Duffour

6 hours -

Labourer remanded for threatening to kill mother

6 hours -

Court remands farmer over GH¢110,000 car fraud

7 hours -

Tension mounts at Akyem Akroso over ‘sale’ of royal cemetery

7 hours -

Poor planning fueling transport crisis—Prof. Beyuo

7 hours -

Ahiagbah slams Prof. Frimpong-Boateng over “fake” party slur

8 hours -

Family traumatised as body of Presby steward goes ‘missing’ at mortuary

8 hours