Audio By Carbonatix

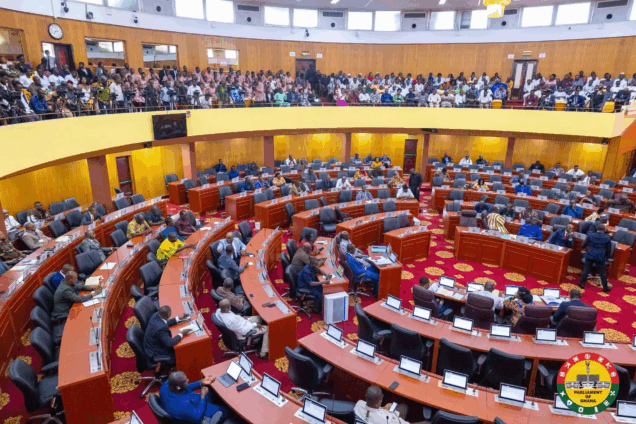

Parliament has approved the Value Added Tax (VAT) Bill, 2025, marking a major step toward overhauling Ghana’s VAT regime to improve clarity, consistency and legal certainty.

The new law replaces the existing flat-rate system with a unified structure designed to simplify the tax framework. It also raises the registration threshold for VAT-eligible businesses — a change expected to exempt many micro and small enterprises from VAT obligations altogether.

But during the debate, Minority Leader Alexander Afenyo-Markin warned that the revised framework could result in additional tax liabilities for businesses and increase the financial burden on the general public.

Deputy Finance Minister Thomas Nyarko Ampem dismissed these concerns, arguing that the reforms will make compliance easier, not harder, and will not introduce new tax burdens on businesses or consumers.

Latest Stories

-

Breaking borders, building futures: How African-led AI is rewriting the rules of global innovation

44 minutes -

Guinea orders dissolution of 40 political parties, including three main opposition groups

50 minutes -

Iran Embassy in Ghana opens Book of condolence after death of Supreme leader in US-Israel attacks

3 hours -

GPL 2025/26: Vision FC cruise past Berekum Chelsea with emphatic 3–1 win

3 hours -

GPL 2025/26: Samartex held by Dreams FC as winless run extends to five

3 hours -

New Juaben North MP challenges gov’t to provide evidence of jobs created and cheap loans

4 hours -

Nadowli-Kaleo District marks 69th Independence Day with cultural exhibition, academic awards

4 hours -

Confusion, tension rock NPP polling station registration exercise in Tarkwa-Nsuaem

5 hours -

Burger King opens first Kumasi branch in Ahodwo

5 hours -

Burma Camp Tennis Club hosts successful 12th Ghana–Nigeria Independence Day Tennis Tournament

5 hours -

Rights, justice and action for all women and girls must include women and girls with disabilities

5 hours -

The Lover and the Fighter: China, the west, and Africa’s geopolitical awakening

6 hours -

UCC student dies in tragic road accident on campus

6 hours -

Health Ministry establishes committee to probe death of hit-and-run victim

6 hours -

RTI Commission, NACOC explore collaboration to promote transparency and accountability

6 hours