Audio By Carbonatix

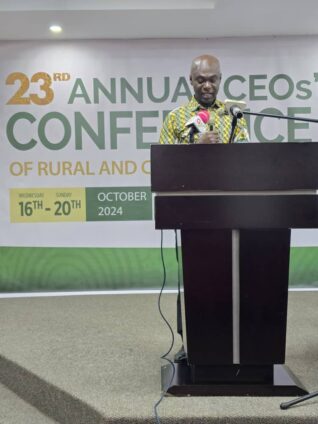

In a significant gathering of financial leaders, the 23rd Annual National CEOs Conference of Rural and Community Banks (RCBs) commenced today, Thursday, October 17, 2024, at the Volta Serene Hotel in Ho, bringing together key stakeholders in Ghana's banking industry.

The conference, themed “Positioning Rural Banking at the Centre of the National Financial Inclusion Agenda,” focused on leveraging the pivotal role of RCBs in driving financial inclusion and fostering economic growth across the country.

Challenges and Resilience in the Wake of Economic Strain

Delivering the keynote address, Mr Alex Kwasi Awuah, Managing Director of ARB Apex Bank, highlighted the remarkable resilience of RCBs despite the heavy toll from the recent economic challenges.

Among these were the COVID-19 pandemic and the government’s Domestic Debt Exchange Programme (DDEP), which forced RCBs to restructure GHS1.2 billion worth of debt. In addition, a significant sum of GHC350 million remains locked in Securities and Exchange Commission-regulated companies, hampering the banks' operations.

“These twin events constitute a major drawback to the big potential of the rural banking sector,” Mr Awuah noted. However, he expressed optimism that the sector is recovering and poised to expand financial intermediation, support economic growth, and deepen financial inclusion in Ghana’s rural areas.

Embracing Digital Transformation: A Pathway to Growth

A key highlight of Mr Awuah’s remarks was the recent digital revolution within the RCB sector. Thanks to the Financial Sector Development Project (FSDP), supported by the government of Ghana and the World Bank, the long-awaited digital banking platforms for rural banks are now operational. These innovations are set to revolutionize the way RCBs serve their customers.

Through a dedicated USSD code (*992#), customers can now access a variety of services directly from their mobile phones, including fund transfers, bill payments, and account statement requests.

Additionally, the rollout of a new RCB Mobile Banking App is imminent, further enhancing customer convenience. Mr Awuah proudly reported that 81,246 customers have already been enrolled in the pilot phase of the USSD platform, with over GHS323 million worth of transactions recorded.

Moreover, as part of the FSDP initiative, the ARB Apex Bank is distributing 5,000 Point of Sale (PoS) devices to RCB agents nationwide. These devices will allow customers to perform banking transactions at locations like restaurants, supermarkets, and schools, reducing the need to visit distant branches. So far, 2,000 devices are ready for deployment, with the remaining 3,000 expected to be distributed by the second quarter of 2025.

The introduction of these PoS devices has also enhanced the traditional Susu savings system. The devices, linked to the T24 Core Banking Application, allow real-time transactions for Susu Mobile Bankers, eliminating cash suppression issues that have plagued the system in the past. To date, nearly half a million transactions valued at over GHS111 million have been recorded.

A Call for Commitment to Financial Inclusion

In his concluding remarks, Mr Awuah called on the CEOs of RCBs to fully embrace these digital platforms and integrate them into their banking operations to ensure the successful expansion of services. "It is our cardinal duty to assist the Government of Ghana in achieving the objectives of its financial inclusion strategy," he emphasized, urging the CEOs to prioritize reaching underserved populations to bring about economic growth.

The conference, attended by distinguished figures such as Dr Toni Aubynn, Chairman of the ARB Apex Bank, and Your Worship Eric Daning, President of the National Association of Rural Banks, promises to chart a forward-looking course for rural banking in Ghana. As the RCBs continue to adopt cutting-edge solutions, they remain well-positioned to drive financial inclusion and foster greater economic empowerment in the country's rural areas.

This year’s event underscores the importance of rural banks as key players in Ghana's broader national financial inclusion agenda, and with these innovations, they are set to bring sustainable and impactful banking solutions to millions of Ghanaians.

Latest Stories

-

Dealing with weed is still illegal – Interior Minister warns

1 minute -

Wa West health crisis: District hospital named “best in region” despite running on only 5 midwives and broken theatre table

3 minutes -

Eight out of 10 cardiac hospitalisations in Ghana caused by heart failure

18 minutes -

Fisheries Commission to roll out insurance; Navy training for fishermen after sea attack

47 minutes -

Failure to appoint Defence Minister has made Ghana vulnerable to external threats – Ntim Fordjour

51 minutes -

Sanction fishermen who go beyond the demarcated fishing zones – Dr Doke

52 minutes -

Gov’t seizes 500 excavators, impounds 490 at Tema Port

59 minutes -

No ready market, no licence: Gov’t sets strict entry rules for cannabis business

1 hour -

Minority MPs demand solutions on issues confronting Ghanaians ahead of SONA

1 hour -

6,530 Delegates endorse APN’s 12-Point compact, push for visa-free Africa

1 hour -

MahamaCare to embrace natural health solutions backed by science

1 hour -

Gov’t approves payment plan for nurses and midwives’ salary arrears

2 hours -

No arrangement to send DVLA staff abroad – Foreign Affairs Ministry contradicts DVLA boss

2 hours -

US and Iran hold talks seen as crucial to prevent conflict

2 hours -

Spain to check Gibraltar arrivals under post-Brexit deal

2 hours