Audio By Carbonatix

The insights provided in the articles published by Nii Darko Asante MGhIE, CEng MIChemE | Energy Sector Specialist on the topics Part 1: The Power Sector Payment Gap – Genesis of the CWM, Part 2: First two years of CWM, and Part 3: Challenges, Death & Resurrection on his LinkedIn page as summarized in this article below, about Ghana's ECG and the Cash Waterfall Mechanism (CWM) are extremely enlightening (Asante, 2023; Asante, 2023 & Asante, 2024). I am convinced that now is the critical moment to scrutinize the supply chain and ECG's unilateral distribution of electricity in certain regions of Ghana. Addressing ECG's challenges in revenue collection from the public and its commercial losses should be a top priority for ECG and all involved stakeholders.

It is quite worrying to learn that an increase in electricity prices led to a decrease in ECG's revenue. This outcome does not come as a surprise. Like the effects observed in the taxation Laffer curve, the combination of raised electricity prices and the proposed 15% VAT on electricity charges will likely exacerbate ECG's financial difficulties.

While revenue collection remains a significant issue for ECG, it is worth considering the introduction of competition in power distribution to the consumer. There is a widespread belief, backed by evidence, that competition fosters efficiency. This is evident in the British electricity market. Under the regulation of the electricity spot market, efficiency was obtained in the production and distribution of electricity due to competition (Green & Newbery 1992; Newbery, 1998). Should PURC function as mandated, this is achievable.

Given ECG's critical role, the notion of it failing is not an option. However, it is time to contemplate dividing ECG into smaller, more manageable entities and privatizing their operations. By listing approximately 60% of these entities on the Ghana Stock Exchange (GSE), there could be an enhancement in managerial efficiency and an improvement in their financial health. These smaller companies would then be able to concentrate on enhancing collection efforts and reducing distribution losses.

A summary of Nii Darko Asante’s articles

Background and Problem:

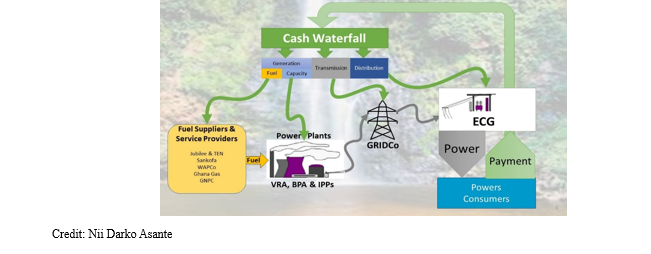

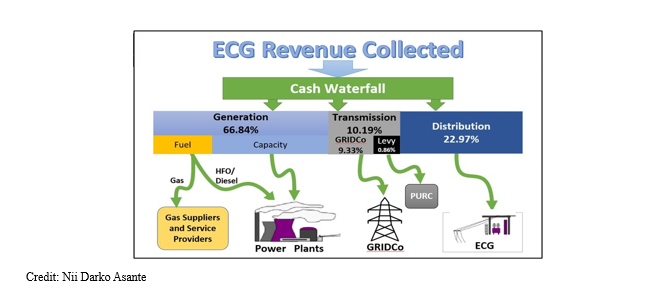

The power sector payment gap in Ghana primarily results from the inability of the Electricity Company of Ghana (ECG) and the Northern Electricity Distribution Company (NEDCo) to collect sufficient customer revenue to pay their electricity suppliers. This shortfall has led to unpaid bills and a growing debt burden, adversely affecting the ability of generation companies to pay for fuel and GRIDCo to pay its regulatory fees. ECG, as Ghana's largest distribution company, contributes significantly to this payment gap. It often paid itself full of collected revenues before distributing any remaining funds to its suppliers, exacerbating the sector's liquidity challenges.

Cash Waterfall Mechanism (CWM) Introduction and Development:

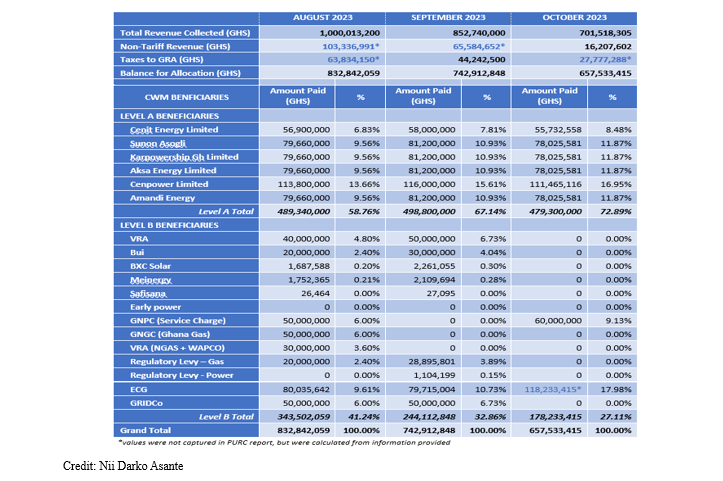

The CWM was introduced to address the payment inequity and liquidity issues in Ghana's energy sector. Its development spanned five years, focusing on simplifying implementation by moving away from securitization towards voluntary compliance. The CWM aimed to ensure equitable payment allocation based on the prevailing PURC tariff, despite challenges in understanding these tariffs. A key principle of the CWM was to make payments directly to ultimate beneficiaries, rather than through ECG's contractual counterparties, to increase liquidity across the value chain.

Implementation and Outcomes:

In its first two years, the CWM improved equity and predictability in payment cycles. However, it didn't resolve the overall payment gap, as a significant portion of the required revenue remained unpaid, leading to substantial debt accumulation. ECG, unable to retain as much revenue as before, became hostile to the CWM. This hostility, along with other challenges, led to the mechanism's virtual collapse after two years.

Issues like delays in disbursement by ECG and a significant drop in declared revenue for allocation further weakened the CWM. Additionally, a ransomware attack on ECG in September 2022 severely impacted revenue collection, leading to ECG's non-compliance with the CWM.

Revised CWM and Continuing Challenges:

In 2023, discussions to restore the CWM led to a revised payment structure. Despite this, ECG did not fully comply with the new formula, impacting the payments to other beneficiaries in the value chain. The situation was exacerbated by declining revenue collections declared by ECG and continued non-compliance with the CWM, indicating ongoing challenges in managing the sector's payment gap and debt.

Overall, the document highlights the complex challenges in Ghana's power sector, particularly around revenue collection, debt management, and the effective implementation of mechanisms like the CWM to address these issues. Despite efforts to improve the situation, problems such as revenue shortfalls, inequitable distribution, and non-compliance persist, affecting the stability and financial health of the energy sector.

Reference:

Asante, N. D. (2023, December 13). The cash waterfall mechanism (CWM): Part 2: First two years of CWM. LinkedIn. https://www.linkedin.com/pulse/cash-waterfall-mechanism-cwm-nii-darko-asante-fwule/?trackingId=z5zyheEbT2ucNmoGL8q8oA%3D%3D.

Asante, N. D. (2023, November 20). The cash waterfall mechanism (CWM): Part 1: The Power Sector Payment Gap – Genesis of the CWM. LinkedIn. https://www.linkedin.com/pulse/cash-waterfall-mechanism-cwm-nii-darko-asante-n3gwe/?trackingId=z5zyheEbT2ucNmoGL8q8oA%3D%3D.

Asante, N. D. (2024, January 23). The cash waterfall mechanism: Part 3: Challenges, Death & Resurrection.LinkedIn. https://www.linkedin.com/pulse/cash-waterfall-mechanism-nii-darko-asante-skqte/?trackingId=CkqyZzhhQlysryfE6mwymQ%3D%3D.

Green, R. J., & Newbery, D. M. (1992). Competition in the British electricity spot market. Journal of Political Economy, 100(5), 929-953. https://doi.org/10.1086/261846.

Newbery, D. M. (1998). Competition, contracts, and entry in the electricity spot market. The RAND Journal of Economics, 29(4), 726. https://doi.org/10.2307/2556091.

Latest Stories

-

Mobile Money Ltd’s Paapa Osei recognised in Legal 500 GC Powerlist: Ghana 2026

17 minutes -

Flights in and out of Middle East cancelled and diverted after Iran strikes

35 minutes -

Dr Maxwell Boakye to build 50-bed children’s ward at Samartex Hospital in honour of late mother

46 minutes -

One killed and 11 injured at Dubai and Abu Dhabi airports as Iran strikes region

52 minutes -

Former MCE, 8 others remain in custody over alleged land fraud in Kumasi

58 minutes -

Black Queens players stranded in UAE over Israel-Iran conflict

2 hours -

James Owusu declares bid for NPP–USA chairman, pledges renewal and unity

2 hours -

Trump threatens strong force if Iran continues to retaliate

2 hours -

Lekzy DeComic gears up for Easter comedy special ‘A Fool in April’

4 hours -

Iran declares 40 days of national mourning after Ayatollah Ali Khamenei’s death

5 hours -

Family of Maamobi shooting victim makes desperate plea for Presidential intervention

5 hours -

Middle East turmoil threatens to derail Ghana’s single-digit gains

6 hours -

Free-scoring Semenyo takes burden off Haaland

6 hours -

Explainer: Why did the US attack Iran?

7 hours -

Peaky Blinders to The Bride!: 10 of the best films to watch in March

8 hours