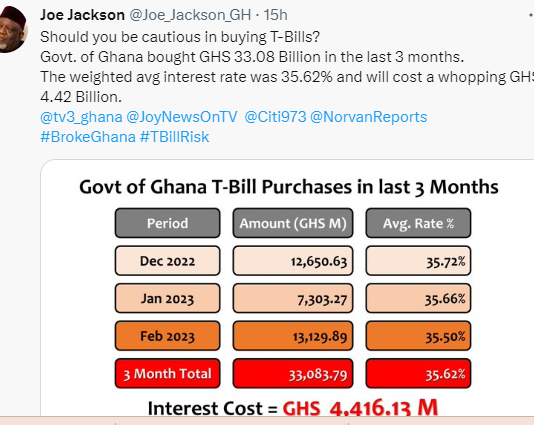

Interest cost on Government of Ghana Treasury bills for the last three months (December 2022, January 2023 and February 2023) is estimated at ¢4.416 billion.

The government bought a total of ¢33.08 billion worth of T-bills in the last three months.

The treasury instruments were sold by government at an average yield of 35%.

In December 2022, the government secured ¢12.60 billion at an interest rate of 35.72%.

Interestingly, the government in January 2023 reduced its appetite for the short-term securities, mobilising ¢7.3 billion at a rate of 35.66%.

However, the government borrowing from T-bills significantly shot up to ¢13.1 billion in February 2023 at an interest cost of 35.50%.

Executive Director of finance firm, Dalex, Joe Jackson in a tweet said “should you be cautious in buying T-bills?”

“Government of Ghana bought 33.08 billion in the last three months. The weighted average interest rate was 35.62% and will cost a whopping ¢4.42 billion”.

The government only source of borrowing for now is the treasury market, hence the significant borrowing on the short term market.

T-bills action: Government to borrow ¢2.78bn this week

The government will this week borrow ¢2.78 billion from Treasury bills to refinance maturing bills worth ¢2.55 billion.

Latest Stories

-

Burnley score late to draw with Manchester United at Old Trafford

2 hours -

Bayer Leverkusen extend unbeaten run to 46 games after draw with Stuttgart

2 hours -

Chelsea come from two goals down to draw against Aston Villa

2 hours -

Andre Ayew scores in Le Havre’s 3-3 draw with PSG

2 hours -

GPL 2023/24: Kotoko draw with Medeama; Samartex go 7 points clear of Nations FC

3 hours -

Mahama cuts sod for construction of new multipurpose Jakpa palace in Damongo

3 hours -

NSS management assists Papao fire victims

3 hours -

EXPLAINER: Will dumsor end soon?

4 hours -

IMANI Africa takes on EC, accuses it of lying and publishing half truths

5 hours -

Manasseh Azure calls for investigation and prosecution of those responsible for GRA/SML contract

5 hours -

Kwesi Atuahene: Ghana’s health capital depends on HealthTech – Africa Center for Digital Transformation

5 hours -

13 signs your wife is planning on leaving you and you have no idea

5 hours -

IMANI Africa: Ghana’s EC’s dangerous and pathological conduct

6 hours -

If I speak there will be fire – Salah on Klopp row

7 hours -

Grieving after divorce is normal, but this particular kind of grief isn’t

7 hours