Audio By Carbonatix

Finance Minister Dr Cassiel Ato Forson has taken a firm stance against using taxpayer money to recapitalise the Bank of Ghana (BoG).

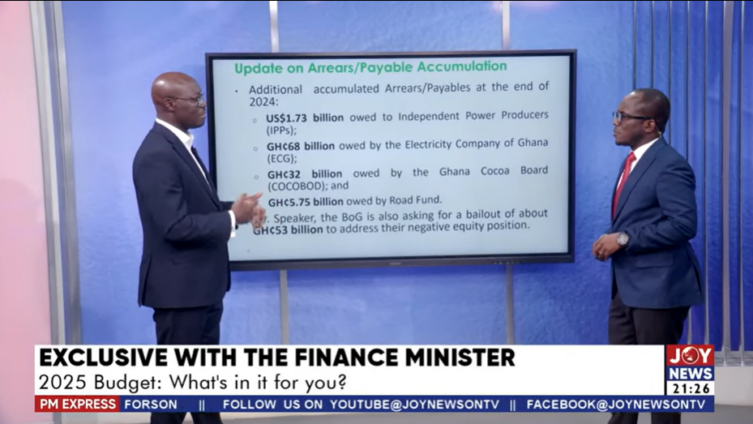

This follows revelations that the central bank had signed a memorandum of understanding (MoU) with the previous administration to receive a ¢53 billion bailout.

Speaking on Joy News’ PM Express on Tuesday, March 11, after presenting the 2025 Budget Statement to Parliament, Dr Forson made it clear that the government could not afford such a move at this time.

"On the back of the report that showed the ¢60 billion hole, remember, in my previous life as the Minority Leader, I kept saying that the Bank of Ghana had generated so much debt, so much deficit. As a result, their balance sheet is not healthy, and they have generated negative equity," he stated.

Dr Forson revealed that despite the financial crisis at the central bank, he had instructed BoG to find internal solutions rather than burdening the taxpayer.

"Apparently, the previous administration in the Bank of Ghana had signed an MoU for the Government of Ghana, or the taxpayer, to recapitalise the central bank with ¢53 billion. I've asked the Bank of Ghana to look within, cut expenditure because the taxpayer cannot afford ¢53 billion."

He questioned the bank’s spending priorities, particularly in light of its recent investments.

"First of all, they have to look within. You know, you've seen their new Head Office, a very big building. They have a choice—a choice to sell and lease back if they want. They have to look within and cut expenditure and reduce events. The taxpayer cannot afford ¢53 billion."

Dr Forson stressed that allocating such a significant sum to the BoG would deprive citizens of essential services and infrastructure.

"Giving ¢53 billion to the central bank will simply mean that we will have to deny the taxpayer some public good, like roads, like schools, like hospitals. Is that what we want? Can we afford it? At this stage, the answer is no. We cannot afford that. And so the central bank must look within.

"They have hotels, like guest houses and others. Why are they in the guest house business? They should sell some of them and use the money to recapitalise. The taxpayer cannot be used as a punching bag."

Despite his firm stance, Dr. Forson hinted at a willingness to negotiate, provided BoG made significant efforts to address its financial problems internally.

"If the central bank is able to come to me with a reasonable offer, we can have a conversation. But it must start from them."

He also suggested an alternative long-term approach for the bank’s recapitalisation.

"I have also said that they may have to consider winding back their profit over the next 10 years to recapitalise. That can also be done."

Latest Stories

-

Africa’s mineral wealth must no longer be a paradox without prosperity — Prof. Denton as UN body releases new Report

9 seconds -

Woman killed on church premises at Twifo Denyase

10 minutes -

2 arrested over alleged gang rape of Osino SHS student – Dept. Education Minister

24 minutes -

Haruna Iddrisu, Mohammed Sukparu survive road crash on Bolgatanga-Tumu Road

31 minutes -

#RoadOfPeril: Residents, commuters demand gov’t action on Kwabenya-Berekuso-Kitase road

37 minutes -

Intelligence opens doors; kindness decides what happens inside

59 minutes -

Government to announce reforms to revamp cocoa sector, boost farmer payments

1 hour -

Court of Appeal orders retrial in Kennedy Agyapong–Kweku Baako defamation case

1 hour -

Thomas Partey charged with two new counts of rape

1 hour -

Polls close in first election since Gen Z protests ousted Bangladesh leader

1 hour -

Kim Jong Un chooses teen daughter as heir, according to reports

2 hours -

Production of ‘Goods and Services’ for November 2025 slows to 4.2% of GDP

2 hours -

Why you should think twice before buying a converted right-hand-drive vehicle

2 hours -

Rotary International President visits Ghana to commission key development projects

2 hours -

Investigative journalism must be impactful not destructive — Charles Osei Asibey

2 hours