Audio By Carbonatix

Ghana’s Growing Scam Problem: What the Numbers Say?

Mobile money fraud is on the rise in Ghana, and the numbers are telling.

According to the Bank of Ghana’s 2023 Financial Stability Review, there were 13,451 reported cases of fraud across the financial sector. Of these, mobile money fraud accounted for 20%, translating to nearly 2,700 cases involving mobile wallets like MTN MoMo, Vodafone Cash, and AirtelTigo Money.

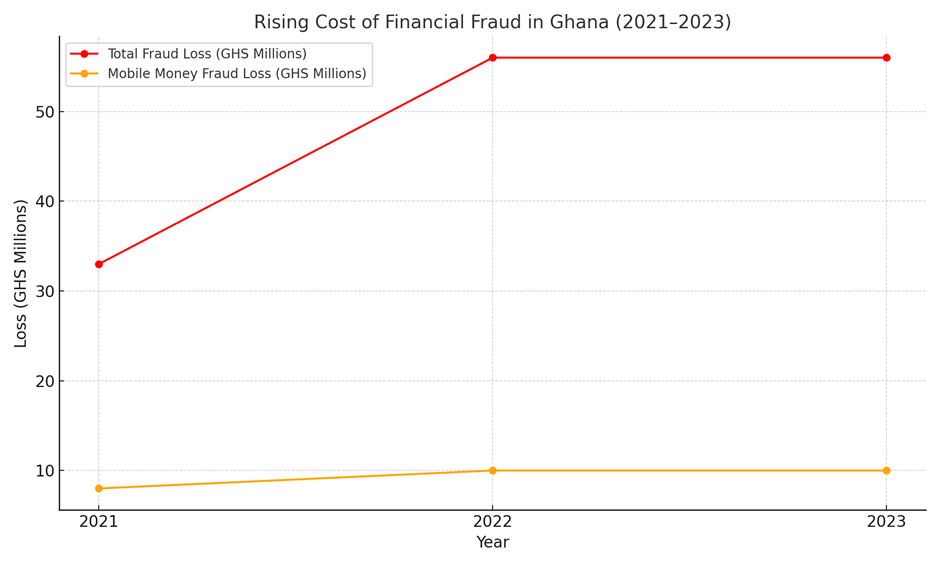

In financial terms, Ghana lost an estimated GH¢56 million to fraud in 2022—a sharp rise from GH¢33 million in 2021. Of this, over GH¢10 million came from mobile money-related scams.

Rising cost of financial fraud in Ghana from 2021 to 2023, with a spotlight on mobile money fraud losses.

Between January and August 2024, the Cyber Security Authority (CSA) reported 149 cases of online investment fraud, resulting in losses exceeding GH¢1.9 million. This marks a sharp increase from 63 cases during the same period in 2023.

These figures only reflect the reported cases. Many others go unreported due to shame, fear, or simply not knowing where to turn.

How Are People Getting Scammed?

Unlike the old days of brute-force hacking, modern scammers are relying on something more powerful: human error.

A tactic known as social engineering has become one of the top ways fraudsters operate in Ghana today. In simple terms, it’s when a scammer tricks you into giving away confidential information, like your MoMo PIN, one-time passwords (OTP), or even access to your phone.

Here’s how it usually works:

- You receive a call from someone pretending to be a telco or bank agent.

- They sound professional. They say there's a problem with your account or that you’ve won a prize.

- They convince you to “verify” your identity or dial a USSD code.

- In doing so, you unknowingly authorise a transaction, and your money disappears.

It happens fast. And to anyone.

The MTN MoMo Case That Sparked National Conversation

A few weeks ago in April, a Ghanaian woman made headlines after revealing that GH¢11,000 vanished from her MoMo account. She insisted she hadn’t shared her PIN or clicked any strange links. The case stirred major concern online, with many Ghanaians demanding answers from MTN.

MTN Ghana responded, stating their systems had not been breached. Instead, they pointed to social engineering—meaning the customer may have unknowingly exposed sensitive information that allowed the fraudsters access.

This single story has since become a national case study on digital trust, platform responsibility, and personal caution.

Who’s Protecting the Public?

Telcos like MTN and Vodafone routinely send public alerts advising customers never to share their PINs or OTPs. The Cyber Security Authority of Ghana also runs periodic education campaigns.

But data from the Ghana Chamber of Telecommunications shows a gap: over 50% of mobile money users have limited awareness of digital scam tactics. Many people, especially in rural areas or among the elderly, don’t fully understand how scammers operate.

This leaves a significant portion of the population exposed.

5 Data-Backed Tips to Stay Safe

- Never share your MoMo PIN or OTP, even if the caller claims to be from your service provider.

- No telecom agent will ask you to dial a USSD code to fix a problem or win a prize.

- Enable two-factor authentication (2FA) on your email and financial apps.

- Don’t store sensitive info like passwords on your phone’s notepad or in unsecured apps.

- Report scams immediately to your mobile money provider or to the Cyber Security Authority via 292.

In conclusion, financial scams are not just robbing Ghanaians of their money—they’re eroding trust in digital systems that are meant to make life easier. With more services going cashless, this issue must be tackled with data, public education, and stricter regulation.

As Ghana moves toward a more digitised economy, staying informed and alert isn't optional—it’s essential.

Written by:

David Nii Armaah

Researc Analyst & Industry Voice

About the author:

David Nii Armaah is a top-tech Researcher and an Industry voice. He possess analytical skills of an applied researcher and expertise in data, technology, innovation, and digital entrepreneurship.

Connect via LinkedIn: https://www.linkedin.com/in/david-nii-armaah-7bbba8155/

Latest Stories

-

Samini’s ORIGIN8A surges to no. 1 on Ghana Shazam chart, hits over 1 million streams on Audiomack

9 minutes -

Chad shuts border with Sudan after cross-border incursion kills its troops

20 minutes -

Poison in our cooking pots: study links Ghana’s aluminium cookware to lead exposure: A policy commentary

21 minutes -

TCDA celebrates success of first Ghana Tree Crops Investments Summit with Thanksgiving Service

24 minutes -

Richmond Eduku: Unlike before, Central Bank’s financing of government’s deficit has been curtailed

32 minutes -

Support youth to venture into farming – Gov’t urged

37 minutes -

Nsarkoh criticises NPP, NDC over inequality and galamsey failures

55 minutes -

KATH Orthopaedic Unit raises alarm over surge in road accident cases

1 hour -

Joseph Abaa Akaseke: Bongo DCE dies after short illness

1 hour -

Poor storage, expensive seeds driving Ghana’s tomato shortages and glut – PFAG

1 hour -

David Mensah’s debut Single ‘darkest style’ featuring Lasmid hits No.1

1 hour -

Government reports strong fiscal gains in 2025 economic turnaround

1 hour -

Ayawaso East: Fighters urges voters to punish NDC at the polls over vote buying scandal

1 hour -

2026 FIFA World Cup: H.E. Paskal A.B. Rois pays courtesy call on Sports Minister

1 hour -

Finance Ministry highlights falling inflation, stronger Cedi in 2025

1 hour