Audio By Carbonatix

Every time we shout for quick results, we quietly steal from children who cannot yet cry.

There are institutions built to impress the living. And there are institutions built to protect the unborn. The tragedy of our time is that we keep confusing the two. We clap for what makes noise. We doubt what grows quietly. We celebrate what shines today, and interrogate what is still learning how to stand. Sovereign and generational wealth funds were never meant to be judged by political election calendars or entertain us. They were meant to outlive us. Yet we judge them as though their greatest crime is silence, and their greatest virtue is visibility.

That is the uncomfortable reality we avoid: We distrust anything that does not flatter our impatience. Institutions like the Minerals Income Investment Fund (MIIF) and GoldBod were not created to satisfy the emotional hunger of election seasons. They were created to feed generations that cannot yet speak, protest, vote, or complain. They exist for children whose names are yet to be known. They exist for futures that cannot defend themselves today.

Yet we keep dragging these institutions into the theatre of politics, demanding that they perform, entertain, and prove themselves to crowds who will not be alive to see their true purpose fulfilled. That is the first inconvenient truth: We are using the clocks of politics to measure the work of history. And history does not move at the speed of slogans.

WHY AT LEAST TEN YEARS IS A MORE HONEST MEASURE

Ten years is not magic. It is maturity. In the life of any serious sovereign wealth fund, the early years are not about glory. They are about building foundations.

Years one to three are for building systems, people, governance frameworks, risk controls, and institutional culture.

Years four to six are about learning through market cycles, mistakes, and adjustments. Only after six or seven years do patterns begin to emerge. By YEAR 10, citizens can see whether an institution is truly healthy or quietly broken. Judging MIIF or GoldBod after two, three, or four years is like judging a child who cannot yet carry heavy loads. A tree must grow roots before it bears fruit.

WHY ELECTION CYCLES CORRUPT JUDGMENT

Election cycles are emotional. They are impatient. They reward noise over discipline.

They demand quick wins, visible drama, and instant praise.

Generational funds demand silence, patience, and discipline. When sovereign funds are tied to election moods, three dangers arise. Investment decisions become political. Discipline gives way to performance theatre. Long-term logic is sacrificed to short-term applause. No serious generational fund in the world is measured by campaign calendars. Norway, Singapore, Alaska, and Botswana did not build generational wealth by asking what would impress voters this year. They asked what would protect citizens in fifty years.

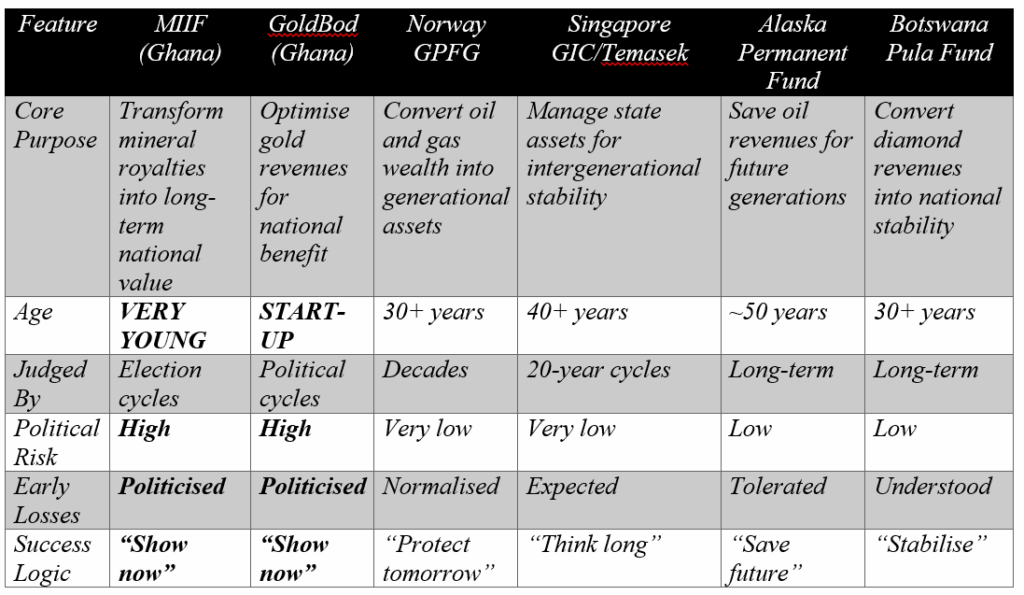

MIIF, GOLDBOD AND GLOBAL GENERATIONAL FUNDS: A COMPARATIVE VIEW

The table tells a quiet but powerful story. MIIF and GoldBod are being asked to behave like Norway and Singapore, yet are treated very differently. Successful funds are protected from politics and election cycles from the outset!. Young Ghanaian institutions are forced to grow under political microscopes. This is not technical. It is cultural.

EARLY LOSSES ARE NOT FAILURE

There is nothing morally wrong with a sovereign or generational fund making losses in its early years, as long as those losses are not corruption-related.

Markets fluctuate. Learning curves exist. Strategies evolve. Early-stage funds test asset classes, adjust risk frameworks, and build institutional memory. Losses from markets are tuition fees for maturity.What is unacceptable is loss from theft, weak controls, or political favouritism. Loss from markets is part of the complex dynamics of the market.

Loss from corruption is a moral issue that must be addressed through the law, processes and systems.

PROFIT IS NOT ALWAYS THE FIRST SIGN OF SUCCESS

One of the most dangerous myths is that profit is the only proof of success. Take Amazon. Founded in 1994, it did not make its first meaningful annual profit until around 2003–2004. Nearly ten years of losses, reinvestment, and learning. Critics mocked it. Analysts predicted a collapse. Today, Amazon earns over USD 500 billion in annual revenue. If Amazon had been judged like a political project, it would have been buried before it became a giant.

MORE PROOF: TESLA, NETFLIX, NORWAY, SINGAPORE

Tesla was founded in 2003 and only achieved consistent profits around 2020. Seventeen years of losses, experiments, and ridicule. Today it leads electric mobility. Netflix started in 1997 and only became a global powerhouse after long years of losses, reinvention, and heavy debt. Norway’s oil fund lost over USD 150 billion in 2008 and again in 2022 during global downturns. No one called it a failure. Today it exceeds USD 1.6 trillion. Singapore’s GIC measures success over 20-year cycles, not annually. The pattern is clear: Early losses are not failure. Impatience is.

WHY TIGHT CONTROLS ARE NON-NEGOTIABLE

Patience without discipline is an invitation to abuse. If MIIF and GoldBod are to be judged every ten years, then: Controls must be daily. Audits must be routine. Transparency must be normal. Oversight must be fearless. Every cedi wasted today is a classroom not built tomorrow. Every dollar stolen today is a hospital denied to children not yet born.

THE PSYCHOLOGY OF IMPATIENCE

Impatience is emotional. It is loud. It is contagious. Yet everything that lasts is born from waiting. No civilisation was built in one term. No tradition became sacred in one generation. MIIF and GoldBod are seeds. Seeds grow underground first. Their silence and sometimes mistakes are not failures. It is nature.

WHEN POLITICS MEETS LONG-TERM CAPITAL

Politics is about winning now. Generational funds are about surviving forever. When politics dominates long-term capital, leaders fear headlines more than children not yet born. Decisions become defensive, not wise. Institutions become reactive, not visionary.

THE SILENT COST OF SHORT-TERM THINKING

Short-term thinking produces motion, not progress. It steals from those who cannot vote. It weakens institutions before they mature. It makes leaders famous today and forgotten tomorrow. Power without generational impact fades like noise after a drumbeat.

WHY GENERATIONAL THINKING IS A MORAL CHOICE

Generational thinking is not a technical skill. It is a moral position. It is not learned from spreadsheets. It is learned from conscience. It begins when a leader asks a question that brings no applause: What happens to people I will never meet because of what I do today?

Every society is quietly shaped by two groups: those who consume the present, and those who protect the future. The difference between them is not intelligence. It is ethics. Short-term thinking feels kind because it responds quickly. It gives handouts, ceremonies, announcements, and noise. Generational thinking feels cold because it withholds applause in exchange for foundations. But kindness that forgets tomorrow is cruelty in disguise. MIIF and GoldBod ask Ghana a difficult question: do we love our future enough to be uncomfortable today? Generational thinking chooses patience over popularity, structure over spectacle, depth over drama. It stops performing and starts planting. Generations are the true constituency of leadership. When a nation learns to protect what it will never enjoy, it becomes truly civilised.

THE FINAL INCONVENIENT TRUTH

The real problem is not judging too slowly or too quickly.

The real problem is judging with the wrong clock. Election clocks are loud. Generational clocks are silent. Short-term thinking will always be popular because it speaks the language of hunger. Long-term thinking will always be lonely because it speaks the language of responsibility. Short-term thinking builds projects that die with their founders.

Long-term thinking builds institutions that bury their founders and continue. The enemy of long-term success is not poverty. It is impatience. It is an addiction to applause. It is the fear of being misunderstood. Short-term thinking feels productive. It moves fast. It announces often. But it leaves fragile systems and disappointed generations. Long-term thinking feels slow, but it builds what outlives its builders.

MIIF and GoldBod are not just funds. They are mirrors. They show Ghana who it really is: a nation that loves tomorrow, or one addicted to today. If we measure generational institutions by election calendars, we will turn them into political toys. If we protect them with generational thinking, we will turn them into national treasures.One day, people will live with what we protect or destroy today. They will not know our speeches. They will not know our slogans. They will only know the systems they inherit. They will ask silently: did they think of us? Did they care enough to wait? Leadership is not proven by what you control, but by what survives you. Short-term thinking will always promise comfort. Long-term thinking will always demand courage. But only one of them builds a future. And history will never forgive those who traded tomorrow for applause today.

About the Author

Ing. Professor Douglas Boateng is a Chartered Director (UK) and Chartered Engineer, and a leading African voice on governance, industrialisation, and generational leadership. He is a Pan-Africanist, Generationalist and Agenda 2063 advocate who believes nations must be built for the unborn, not for applause.

He is the Convenor of the Boardroom Governance Summit, one of Africa’s largest governance platforms, the creator of NyansaKasa, a widely followed series of reflective civic wisdom, and the founder of the MYO Foundation (My Future, Your Future, Our Future), which supports youth mentorship, education, and generational upliftment.

His past and present advisory and board roles span organisations with revenues and valuations ranging from about USD 1 million to over USD 40 billion. He serves as a professional chairman and non-executive director, advising boards, governments, and institutions on governance, strategy, and long-term value creation.

He is the author of several ground-breaking books, including the world’s only nationally approved Practical Perspectives on Boardroom Governance, as well as influential works on negotiations, the UN Sustainable Development Goals, strategic sourcing, and the widely read NyansaKasa series.

He has received over six Lifetime Achievement Awards for his contributions to critical thinking on development, industrialisation, and governance. His core belief is simple: leadership is measured not by today’s praise, but by tomorrow’s inheritance.

His core belief is simple: leadership is measured not by today’s praise, but by tomorrow’s inheritance

Latest Stories

-

Iran Embassy in Ghana opens Book of condolence after death of Supreme leader in US-Israel attacks

2 hours -

GPL 2025/26: Vision FC cruise past Berekum Chelsea with emphatic 3–1 win

2 hours -

GPL 2025/26: Samartex held by Dreams FC as winless run extends to five

2 hours -

New Juaben North MP challenges gov’t to provide evidence of jobs created and cheap loans

3 hours -

Nadowli-Kaleo District marks 69th Independence Day with cultural exhibition, academic awards

3 hours -

Confusion, tension rock NPP polling station registration exercise in Tarkwa-Nsuaem

4 hours -

Burger King opens first Kumasi branch in Ahodwo

4 hours -

Burma Camp Tennis Club hosts successful 12th Ghana–Nigeria Independence Day Tennis Tournament

4 hours -

Rights, justice and action for all women and girls must include women and girls with disabilities

4 hours -

The Lover and the Fighter: China, the west, and Africa’s geopolitical awakening

5 hours -

UCC student dies in tragic road accident on campus

5 hours -

Health Ministry establishes committee to probe death of hit-and-run victim

5 hours -

RTI Commission, NACOC explore collaboration to promote transparency and accountability

5 hours -

Three dead as truck overturns near Asenema Waterfalls

6 hours -

Four Ghanaian UN peacekeepers recovering after Lebanon missile attack — Defence Ministry

6 hours