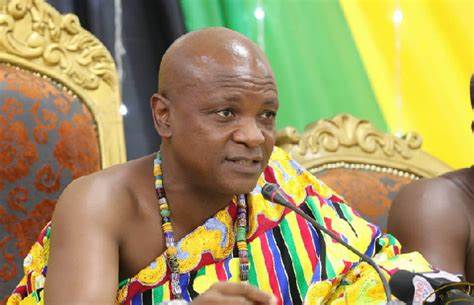

The Paramount Chief of the Asogli State, Togbe Afede XIV, has strongly criticised the recent decision made by the Bank of Ghana (BoG) to reduce the policy rate from 30% to 29%.

According to him, such a reduction will have no impact on the economy thus labelling it as nothing more than a "major mockery."

The BoG's Monetary Policy Committee (MPC) declared this reduction on January 29, 2024, with Togbe Afede expressing skepticism regarding the potential impact of this slight decrease.

In a statement issued, Togbe Afede questioned the reasoning behind the 1% reduction, stating that it is challenging to comprehend how such a minimal adjustment, transitioning from 30% to 29%, would substantially affect lending rates, inflation, exchange rates, or economic growth.

He expressed uncertainty about whether BoG officials have thoroughly evaluated the correlation between interest rates, inflation, and exchange rates within the country.

Expressing astonishment at the conservative rate adjustment, Togbe Afede criticized the Bank of Ghana's (BOG) focus on year-on-year inflation, describing their strategy as responsive; that is reacting to past price fluctuations rather than foreseeing future inflation patterns.

He contended that the policy rate reduction appears to be a response to the 3.2% decline in headline inflation observed in December 2023.

"The Bank of Ghana Monetary Policy Committee (MPC) on Monday, January 29, 2024, announced a cut in the key policy rate of 100 basis points, from 30% to 29%. This sounds like a big joke. It is hard to imagine what impact our BoG officials expect a 1% reduction from 30% to make on lending rates, inflation rate, exchange rate or economic growth, let alone what they expect to learn or observe from it. I wonder whether they have determined the correlation between interest rates, inflation, and exchange rates in our country."

"The hesitant 1% rate cut to 29% is particularly surprising given their expectation that headline inflation would “ease to 15% ± 2% by the end of 2024 and gradually trend back to within the medium-term target range of 8% ± 2% by 2025”.

"I do not see a relationship between the expected or target 15% ± 2% inflation and the high 29% monetary policy rate. It gives the impression that our top economists do not believe in themselves or their own forecasts."

Latest Stories

-

Samson’s Take: Arrogance of Power, Shameful Policing

6 hours -

Burnley score late to draw with Manchester United at Old Trafford

8 hours -

Bayer Leverkusen extend unbeaten run to 46 games after draw with Stuttgart

8 hours -

Chelsea come from two goals down to draw against Aston Villa

8 hours -

Andre Ayew scores in Le Havre’s 3-3 draw with PSG

8 hours -

GPL 2023/24: Kotoko draw with Medeama; Samartex go 7 points clear of Nations FC

9 hours -

Mahama cuts sod for construction of new multipurpose Jakpa palace in Damongo

9 hours -

NSS management assists Papao fire victims

9 hours -

EXPLAINER: Will dumsor end soon?

10 hours -

IMANI Africa takes on EC, accuses it of lying and publishing half truths

11 hours -

Manasseh Azure calls for investigation and prosecution of those responsible for GRA/SML contract

11 hours -

Kwesi Atuahene: Ghana’s health capital depends on HealthTech – Africa Center for Digital Transformation

11 hours -

13 signs your wife is planning on leaving you and you have no idea

12 hours -

IMANI Africa: Ghana’s EC’s dangerous and pathological conduct

12 hours -

If I speak there will be fire – Salah on Klopp row

13 hours