Audio By Carbonatix

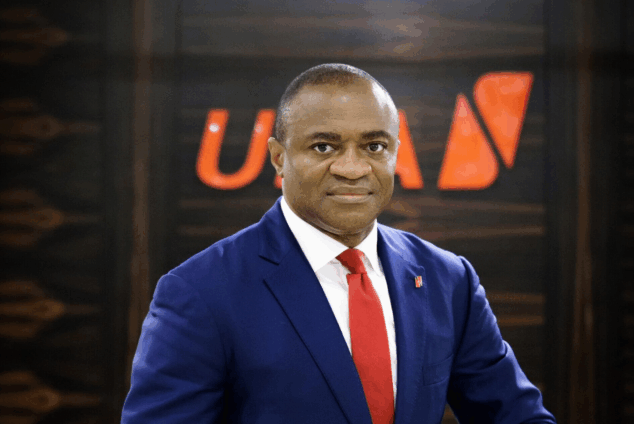

The Group Chief Executive of United Bank for Africa (UBA) has assured that the bank remains fully committed to the highest standards of governance and regulatory compliance in every market it operates.

Oliver Alawuba disclosed this in an exclusive interview with JOYBUSINESS in Washington, D.C., during the launch of the bank’s groundbreaking White Paper, Banking on Africa’s Future: Unlocking Capital and Partnerships for Sustainable Growth.

The assurance comes shortly after the Bank of Ghana announced on October 17, 2025, that it had lifted the suspension of UBA Ghana Limited’s Foreign Exchange trading license, effective October 19, 2025.

Demonstrating Compliance in Global Markets

Mr Alawuba emphasised that compliance is taken very seriously at UBA and the bank will continue to uphold regulatory standards.

He highlighted UBA’s operations in the United States as a testament to the bank’s commitment.

“UBA is one of the few African banks with a presence in one of the most regulated markets in the world. That should convince our clients everywhere, including Ghana, about our commitment,” he said.

He further noted, “The US has one of the highest levels of regulations, and UBA is fully compliant.”

The Group CEO also stressed the bank’s dedication to professionalism, financial strength, and resilience.

Background

On September 4, 2025, the Bank of Ghana announced that UBA Ghana’s forex license would be suspended for one month, effective September 18, citing multiple violations of foreign exchange market regulations.

These included breaches of the Updated Guidelines for Inward Remittance Services by Payment Service Providers, 2023, as amended by Notice No. BG/GOV/SEC/2025/25.

The suspension affected all remittance partnerships between UBA Ghana and DEMIs, PSPs, and MTOs.

On October 17, 2025, the Bank of Ghana lifted the suspension of UBA Ghana’s Foreign Exchange trading license, effective October 19, 2025.

The Central Bank noted that this decision followed UBA’s adherence to the conditions imposed during the suspension and the satisfactory implementation of remedial measures.

UBA’s Operations in Ghana

In his interview with JOYBUSINESS, Mr Alawuba outlined UBA’s plans to expand its presence across Ghana and support digitalisation efforts nationwide.

He also highlighted the bank’s commitment to assisting small and medium-sized enterprises (SMEs) in expanding and growing their businesses.

“We want to play a lead role in service delivery in the country,” he said. “As a bank, we also want to link Ghanaian businesses to all the markets that operate globally.”

Latest Stories

-

You don’t need to have a comfortable bed to save a patient — Mahama to healthcare professionals

4 minutes -

Mahama announces national airline and major upgrades for Accra, Sunyani, Bolgatanga, and Wa Airports

6 minutes -

Foreign remittances hit $7.8bn in 2025 – Mahama

9 minutes -

Mahama pledges to end ‘no bed syndrome’ and expand hospital capacity nationwide

17 minutes -

No patient must be turned way over lack of hospital beds – President Mahama

18 minutes -

SONA 2026 in Pictures

19 minutes -

Mahama vows to go after ‘big fish’ in galamsey fight, reveals intensified prosecutions

27 minutes -

Alarm Bells in Mogadishu: Security erodes as Al-Shabaab races towards “Greater Somalia”

28 minutes -

Mahama unveils TVET centres, SHS upgrades and 50,000 teachers’ housing plan

31 minutes -

‘December 19, 2022, under Akufo-Addo was one of the darkest days in Ghana’s economic history’ – Mahama

37 minutes -

John Mahama: Cedi soars 40.7% as Ghana’s economy surpasses $100bn

39 minutes -

Ghana clears $500m gas debt, restores World Bank guarantee – Mahama

42 minutes -

Mahama announces plans to reintroduce road tolls using technology

42 minutes -

US$1.1bn debt restructuring in power sector saves US$250m – Mahama

46 minutes -

Mahama announces 600 new classroom blocks nationwide to strengthen basic education

48 minutes