Audio By Carbonatix

Zimbabwe says it will introduce gold coins later this month as it tries to curb soaring inflation amid a slump in its currency.

The country's central bank also outlined plans to make the US dollar legal tender for the next five years.

The central bank's main interest rate was more than doubled this month to 200%, after the annual rate of inflation rose above 190%.

Zimbabwe's dollar has slumped in value against major currencies this year.

The gold coins, which will contain one troy ounce of 22-carat gold, will be available from 25 July, John P Mangudya, the governor of the Reserve Bank of Zimbabwe said in a statement.

A troy ounce is a unit of measure used for weighing precious metals - such as gold, silver and platinum - that dates back to the Middle Ages. One troy ounce is equal to 31.10g.

"The gold coins will be available for sale to the public in both local currency and US dollars and other foreign currencies at a price based on the prevailing international price of gold and the cost production," Mr Mangudya added.

The statement also said each coin will be identified with a serial number and can be easily converted to cash, locally and internationally.

It will be called the "Mosi-oa-Tunya Gold Coin", which means "The Smoke Which Thunders," a reference to Victoria Falls that is located on the border between Zimbabwe and Zambia.

The announcement is part of the Zimbabwe government's measures to tackle the country's currency crisis.

Last month, the annual rate of inflation hit 191.6%, while the Zimbabwean dollar has lost more than two-thirds of its value against the US dollar since the start of 2022.

From 1 July the Reserve Bank of Zimbabwe's main interest rate was raised from 80% to 200% a year, in a bid to deal with the rising cost of living.

Soaring inflation has piled pressure on President Emmerson Mnangagwa in a country that still remembers the economic chaos under Robert Mugabe's almost four decades of rule.

Hyperinflation forced the country to abandon the Zimbabwe dollar in 2009, and it opted instead to use foreign currencies, mainly the US dollar.

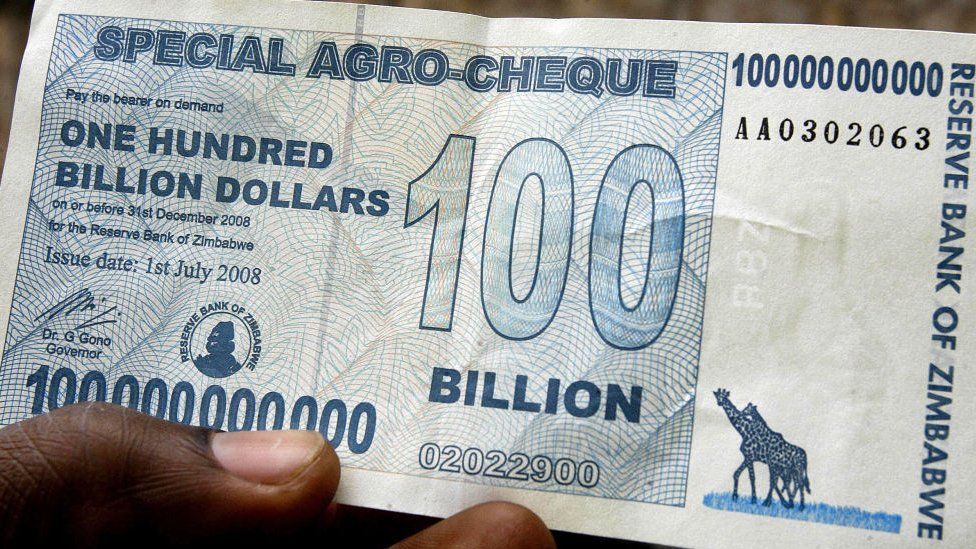

During the worst of the crisis the government stopped publishing official inflation figures but one estimate put the inflation rate at 89.7 sextillion percent year-on-year in mid-November 2008.

At the time, the one hundred billion Zimbabwe dollar bank note was seen as an emblem of the nation's economic collapse.

The local currency was reintroduced a decade later but it has rapidly lost value again.

Latest Stories

-

50-year-old woman killed in bush at Gomoa Potsin; suspect arrested

39 minutes -

GWL moves to restore water supply to Teshie-Nungua as talks advance on desalination plant

41 minutes -

Cocoa Processing Company to leverage AfCFTA for Africa expansion

46 minutes -

Ayawaso East Vote-Buying: Inusah Fuseini warns against ‘self-authorising’ annulment

51 minutes -

5 candidates file nominations for Ayawaso East by-election

56 minutes -

Delay in 24-Hour Economy rollout was to avoid politicisation – Sagnarigu MP

1 hour -

IEAG calls for level playing field in GoldBod operations

1 hour -

Hope arrives in Savannah as GMTF engages Bole Municipal Hospital

1 hour -

Kofi Ofosu Nkansah granted GH¢500K, court appearance cancelled

1 hour -

ECG recovers GH¢4.39m from illegal connections in 2025

1 hour -

MIIF positions Ghana strongly at Indaba 2026

1 hour -

Mahama extends Accountability Series to regional and district levels

2 hours -

GRA clarifies new 20% VAT rate

2 hours -

MPs laud government’s declaration of Wednesdays as National Fugu Day

2 hours -

UCC launches Africa Ocean Institute to boost marine research, sustainability

2 hours