In a bold move to reshape the energy sector and alleviate debt burdens while ensuring a steady power supply for industries, the government has initiated a series of measures, including quarterly tariff increments.

To align with the IMF’s revenue mobilization objectives, Ghana unveiled a comprehensive Medium-Term Revenue Strategy in September 2023.

This strategic framework focuses on crucial tax policies and revenue administration measures essential for achieving both Ghana's domestic goals and the IMF's program revenue objectives.

Watch video: JoyNews' Isaac Kofi Agyei explains why Government of Ghana is introducing a 15% VAT of electricity

Ghana has already taken significant strides towards enhancing revenue generation, implementing measures such as quarterly adjustments to electricity tariffs, raising the VAT rate from 12.5% to 15%, restructuring the E-levy, and eliminating discounts on customs benchmark values.

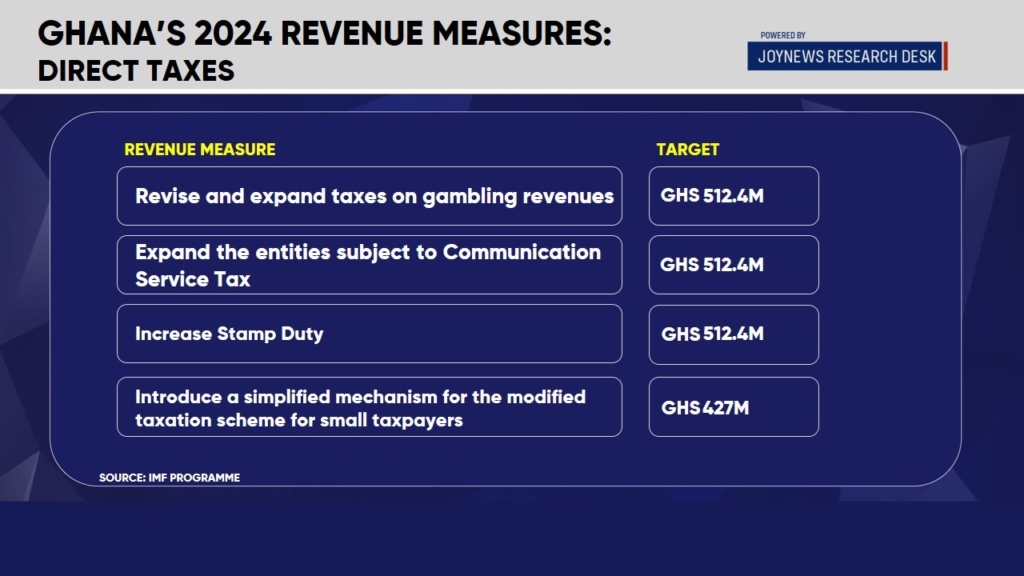

Looking ahead to 2024, the government plans to introduce additional measures, encompassing 12 tax reforms and the implementation of new tax mechanisms.

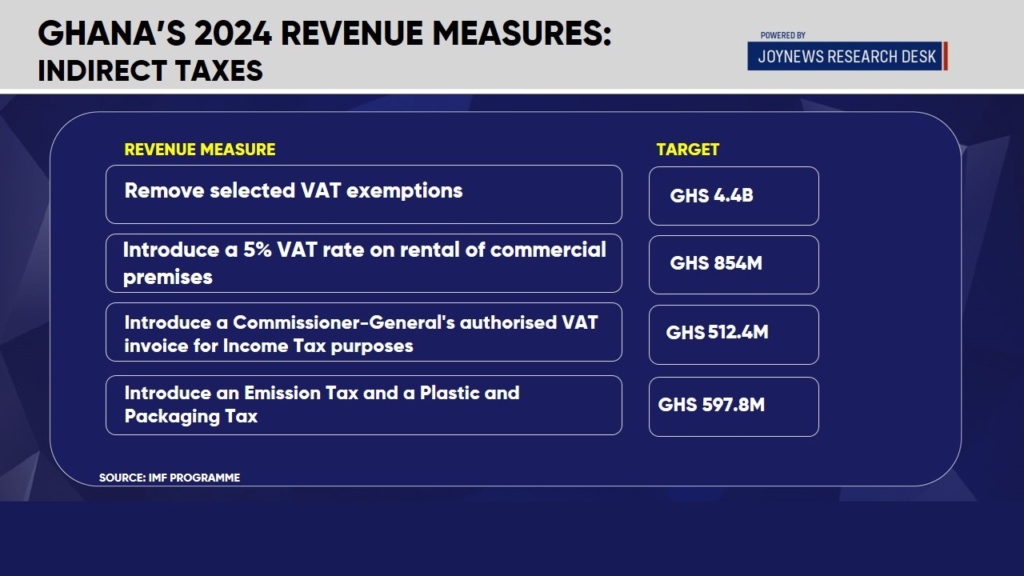

One of the pivotal strategies involves the removal of selected VAT exemptions, amounting to approximately GHS4.4 billion this year.

Also read: VAT on power consumption: From free electricity to taxing times

Additionally, there will be revisions to income-based taxes and a scrutiny of the headline rate of the Communication Services Tax (CST).

The Government of Ghana also aims to expand taxes on gambling revenues, heighten Stamp Duty, introduce a 5% VAT rate on the rental of commercial premises, and unveil new taxes, such as the Emission Tax and the Plastic and Packaging Tax.

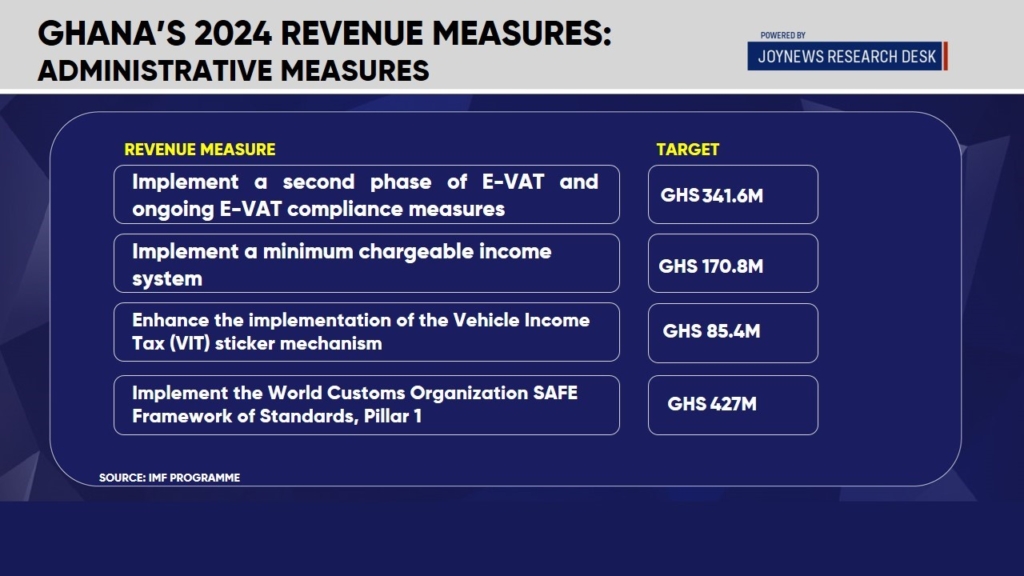

Adding more, the government is set to strengthen the implementation of the Vehicle Income Tax (VIT) sticker mechanism and embark on the reform of corporate income tax by gradually phasing out tax holidays and exemptions.

It is crucial to note that these measures are intrinsic to the government's independent revenue mobilization strategy and not dictated by the IMF.

As Ghana navigates these reforms, stakeholders and citizens alike will closely observe the impact on various sectors and the overall economic trajectory.

Latest Stories

-

Paris 2024: Opening ceremony showcases grandiose celebration of French culture and diversity

3 hours -

How decline of Indian vultures led to 500,000 human deaths

4 hours -

Paris 2024: Ghana rocks ‘fabulous fugu’ at olympics opening ceremony

4 hours -

Trust Hospital faces financial strain with rising debt levels – Auditor-General’s report

5 hours -

Electrochem lease: Allocate portions of land to Songor people – Resident demand

5 hours -

82 widows receive financial aid from Chayil Foundation

5 hours -

The silent struggles: Female journalists grapple with Ghana’s high cost of living

5 hours -

BoG yet to make any payment to Service Ghana Auto Group

5 hours -

‘Crushed Young’: The Multimedia Group, JL Properties surprise accident victim’s family with fully-furnished apartment

6 hours -

Asante Kotoko needs structure that would outlive any administration – Opoku Nti

6 hours -

JoyNews exposé on Customs officials demanding bribes airs on July 29

7 hours -

JoyNews Impact Maker Awardee ships first consignment of honey from Kwahu Afram Plains

8 hours -

Joint committee under fire over report on salt mining lease granted Electrochem

8 hours -

Life Lounge with Edem Knight-Tay: Don’t be beaten the third time

8 hours -

Pro-NPP group launched to help ‘Break the 8’

8 hours