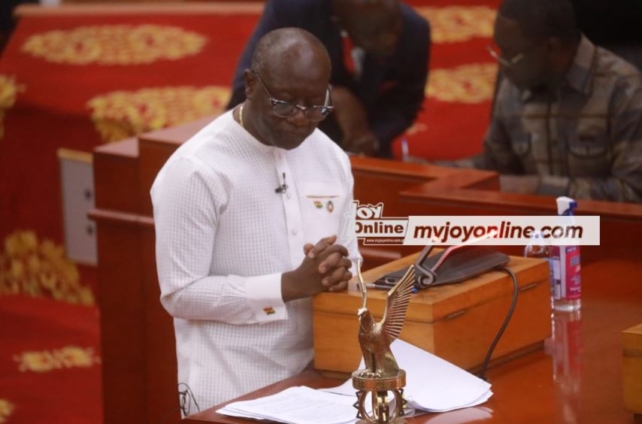

A Lecturer at the University of Developmental Studies (UDS), Dr Michael Ayamga says that Finance Minister, Ken Ofori-Atta's tax reliefs in the 2024 budget are unnecessary.

According to the Development Economist, the Minister of Finance did not do the essential tax cuts as the ones he targeted in his statement had no impact on the already harsh economy.

He accused the Minister of Finance of being cunning by including the e-levy, COVID-19 levy, and communication tax in the budget meant to bring relief to the people.

"There were new taxes but no tax relief in reality if you look at the midst of the aid that he has listed. For example, the first one is to extend the existing VAT which is listed as a new tax relief when in reality it already exists and wants to extend it," he said on Thursday, November 16.

Speaking on the JoyNews’ AM show, he argued that tax relief on electric vehicles was inconsequential as most Ghanaians cannot afford electronic vehicles except a few.

According to him, there are more pressing and demanding matters that need to be tackled such as illegal mining and forest depletion, and not electronic vehicles tax relief.

“If you go to Savannah regions and the rest, are being degraded and we should be tackling these things not even cosmetic tax relief in the name of an electric vehicle”.

According to him, Ken Ofori-Atta's budget lacked concrete steps to reduce the cost of businesses, boost domestic production, and decrease the cost of living.

Latest Stories

-

‘I did not bribe anybody, my action was misconstrued’ – MP involved in Ejisu ‘envelope’ incident

15 mins -

Respect is earned, not commanded – Raymond Atuguba tells public officials

34 mins -

TikTok and Universal settle music royalties dispute

47 mins -

Failure to properly transfer gun ownership can land you behind bars

56 mins -

Reduce over-reliance on imports to stabilise cedi – TUC boss tells Ghanaians

1 hour -

‘We’re taking it game by game’ – Ibrahim Tanko on Accra Lions’ title ambitions

1 hour -

Nigerians pick sides as Wizkid and Davido clash online

1 hour -

Nigeria Workers’ Day: Civil servants get pay rises up to 35%

2 hours -

“I am the Austrian team boss with all my heart,” Rangnick turns down Bayern

2 hours -

Failed asylum seeker given £3,000 to go to Rwanda

2 hours -

Nigerian gasoline prices soar as shortages worsen cost of living crisis

2 hours -

Paris 2024: We will win medal at Olympics if government invests more – GPC President

2 hours -

Akufo-Addo calls for protection of Ghana’s democratic reputation and identity

2 hours -

Apple working to fix alarming iPhone issue

2 hours -

‘You won’t win GPL title without your own stadium’ – Bashir Hayford tells Kotoko, Hearts

2 hours