Audio By Carbonatix

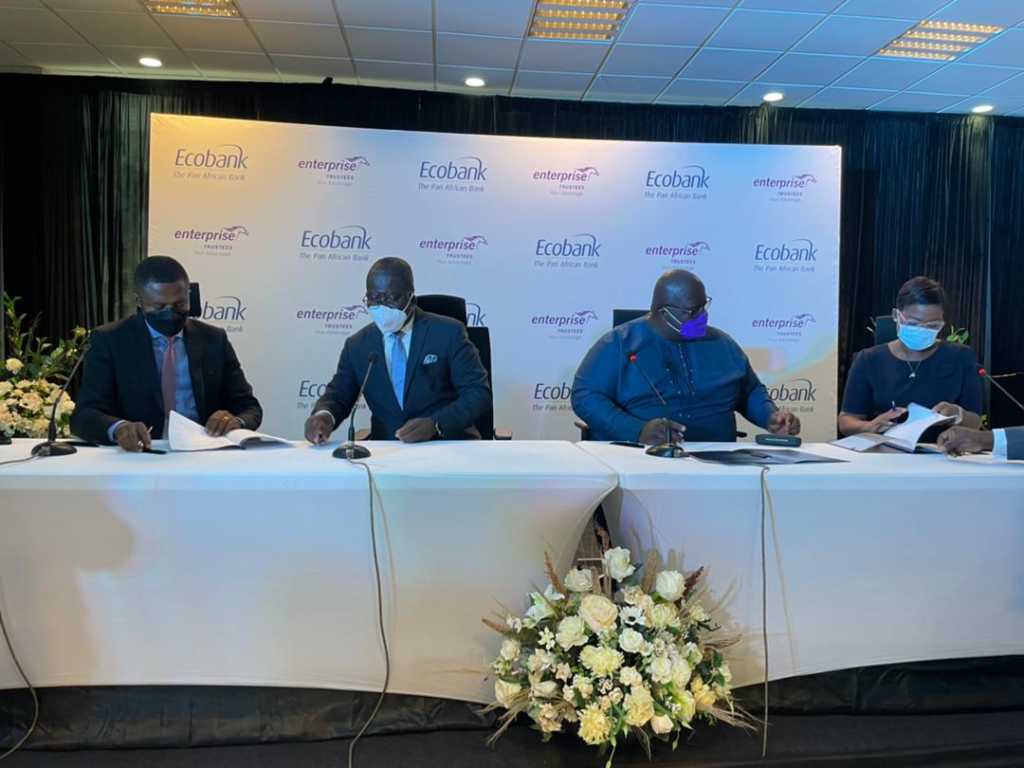

Ecobank Ghana and Enterprise Trustees have signed a partnership agreement to make meaningful contribution towards helping pension contributors acquire affordable homes.

The partnership also seeks to offer customers of both institutions a whole new experience with unending benefits.

Speaking at the signing ceremony, Managing Director of Ecobank Ghana, Dan Sackey said the partnership will enable Enterprise Trustees to make available to all workers, whose pension funds reside at Enterprise, a package that enables them to attract mortgages from Ecobank with zero down payments.

“Under this agreement, Enterprise Trustees will make available to all workers, whose pension funds reside at Enterprise, a package that enables them to attract mortgages from Ecobank with zero down payments. The bank will disburse the mortgage loan to the beneficiaries, who will pay monthly instalments over a 15-year period”, he noted.

He further added that, “this is a novelty for the Ghanaian financial services market, which should be embraced by workers. A regular mortgage will require the borrower to make available at least 20% down payment, but this innovative partnership offers a product that requires the borrower to make no deposit whatsoever. All that the borrower needs to do is to identify the house and Ecobank will provide the funding.”

“With this offer, there is really no excuse for Enterprise Trustees Tier 3 contributors not to own their own homes. There is also no excuse for not accessing the requisite funding for their various projects”, he pointed out.

On his part, Managing Director of Enterprise Trustees, Joseph Ampofo indicated that this new partnership will help workers build an enviable fund towards their retirement.

“It’s been 10 years of running schemes, enabling contributors to build up funds towards their future retirement. This is a collaboration between two industry giants Ecobank Ghana and Enterprise Trustees. We are optimistic that our shared value of Excellence will be our guiding principle as we work together for the betterment of Ghanaian workers to own homes through a unique mortgage solution”, he added.

Latest Stories

-

MTN FA Cup: Defending champions Kotoko knocked out by Aduana

1 hour -

S Korean crypto firm accidentally pays out $40bn in bitcoin

1 hour -

Washington Post chief executive steps down after mass lay-offs

2 hours -

Iranian Nobel laureate handed further prison sentence, lawyer says

2 hours -

U20 WWCQ: South Africa come from behind to draw against Black Princesses in Accra

2 hours -

Why Prince William’s Saudi Arabia visit is a diplomatic maze

2 hours -

France murder trial complicated by twin brothers with same DNA

2 hours -

PM’s chief aide McSweeney quits over Mandelson row

2 hours -

Ayawaso East primary: OSP has no mandate to probe alleged vote buying – Haruna Mohammed

3 hours -

Recall of Baba Jamal as Nigeria High Commissioner ‘unnecessary populism’ – Haruna Mohammed

3 hours -

Presidency, NDC bigwigs unhappy over Baba Jamal’s victory in Ayawaso East – Haruna Mohammed

3 hours -

Africa Editors Congress 2026 set for Nairobi with focus on media sustainability and trust

4 hours -

We are tired of waiting- Cocoa farmers protest payment delays

4 hours -

Share of microfinance sector to overall banking sector declined to 8.0% – BoG

5 hours -

Ukraine, global conflict, and emerging security uuestions in the Sahel

5 hours