Audio By Carbonatix

Mobile Money transactions continue to expand rapidly compared with a few years ago, data from the Bank of Ghana has revealed.

In 2021 alone, about ¢905.1 billion transactions were recorded, and if the current trend is to go by, the transactions may reach or exceed ¢1 trillion in 2022.

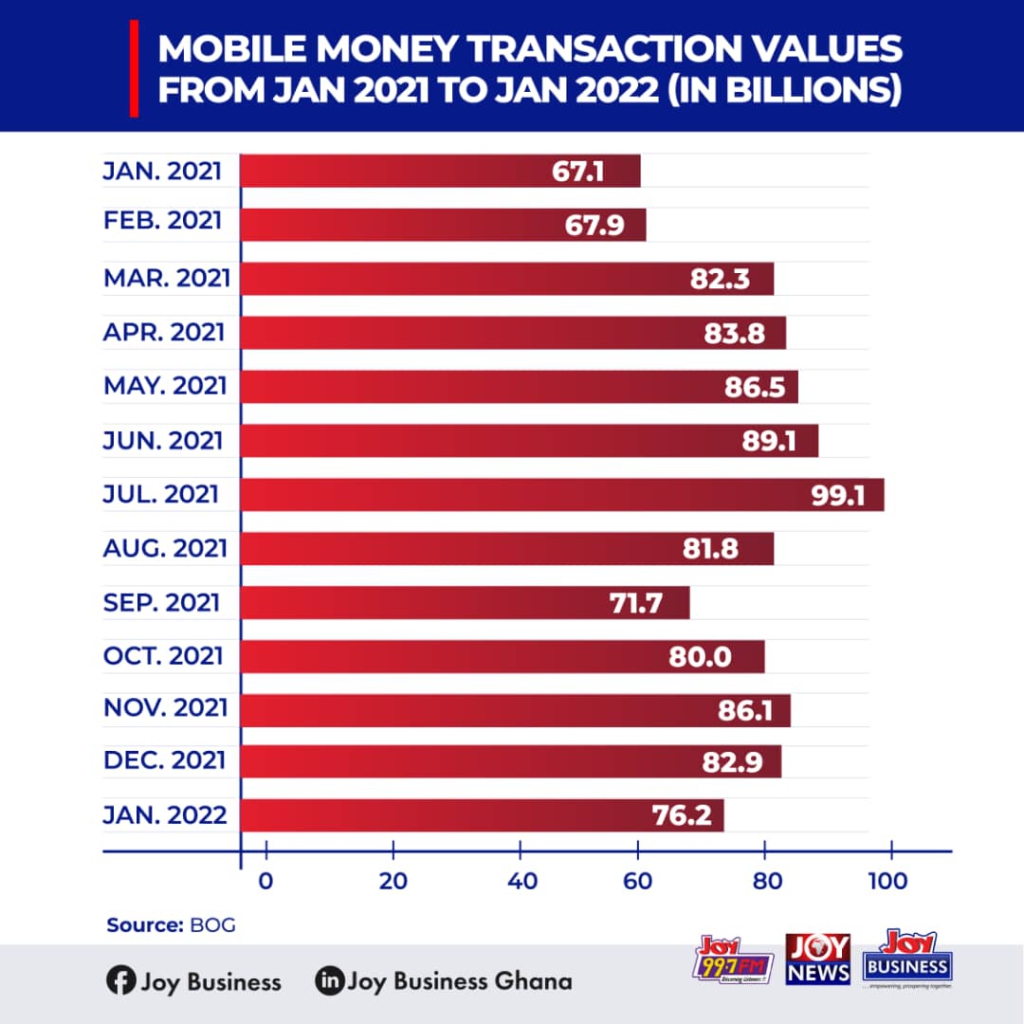

However, a cursory look at the 2021 figures indicates fluctuations in Mobile Money transactions, month-on-month.

For instance, in July 2021, ¢99.1 billion was recorded. It was also actually the month with the biggest transactions.

Right after July 2021, the transactions dipped to ¢81.8 billion in August 2021 and subsequently to ¢71 billion in September 2021, but inched up to ¢80.0 billion in October 2021.

Before July 2021, Mobile Money transactions had surged consistently from March 2021 to June 2021.

In March 2021, it went up to 82.3 billion and then to ¢83.8 billion in April 2021. It later shot up to ¢86.5 billion in May 2021 and subsequently to ¢89.1 billion in June 2021.

¢86.1 billion and ¢82.9 billion were recorded as Mobile Money transactions in October 2021 and November 2021, respectively.

Fast forward, comparing January 2022 (¢76.2 billion) figure to February 2022 (¢67.1 billion) figure, one could deduce that if the trend continues, then Mobile Money transactions will grow significantly this year.

Secondly, according to the Bank of Ghana, registered Mobile Money Accounts have grown from 40 million in January 2021 to ¢48.4 million.

Again, active Mobile Money Accounts went up by 100,000 to 17.4 million as of the end of January 2022.

This indicates that Mobil Money Transactions will continue to soar in the coming months.

However, the Electronic Transaction Levy, which is on hold for now, could impede the growth of mobile money if passed into law.

That is because of the experiences in countries such as Uganda, where mobile money transactions dipped after a tax was introduced on it by the government.

However, for now, mobile money will dominate as the primary mode of payments for many individual and retail consumers in the country.

Latest Stories

-

Minority alleges political targeting in NIB’s handling of Ofosu Nkansah’s probe

2 minutes -

JoyNews to host national dialogue on district assemblies’ role in galamsey fight on Feb 12

6 minutes -

Mohammed Salisu begins rehabilitation from ACL injury

7 minutes -

Mohammed Kudus to work under new boss as Tottenham sack Thomas Frank

9 minutes -

Ghana’s GH¢33 billion cocoa sector debt crisis threatens global chocolate supply chains

23 minutes -

Princess Burland showcases Ghana at Coca-Cola’s FIFA World Cup Trophy Tour in Abidjan

27 minutes -

Uneducated, female-headed households hardest hit by food insecurity — GSS report

45 minutes -

Minority demands immediate release of Kofi Ofosu Nkansah over ‘unacceptable’ detention

46 minutes -

Save and invest at least 20% of your income — EDC Investment boss urges Ghanaians

47 minutes -

Ghanaians are struggling, yet gov’t deploys NIB – Minority calls it a ‘diversion’

49 minutes -

Minority says Ofosu Nkansah’s arrest diverts attention from pressing economic hardships

52 minutes -

CDM demands transparency over NIB detention of former NEIP boss Kofi Ofosu Nkansah

1 hour -

Kaizen Gaming launches Betano in Ghana

1 hour -

MTN Ghana Foundation and Cal Bank launch 2026 Save a Life blood donation drive

1 hour -

Kojo Antwi, Medikal to headline Ghana @69 Independence concert in Paris

1 hour