Audio By Carbonatix

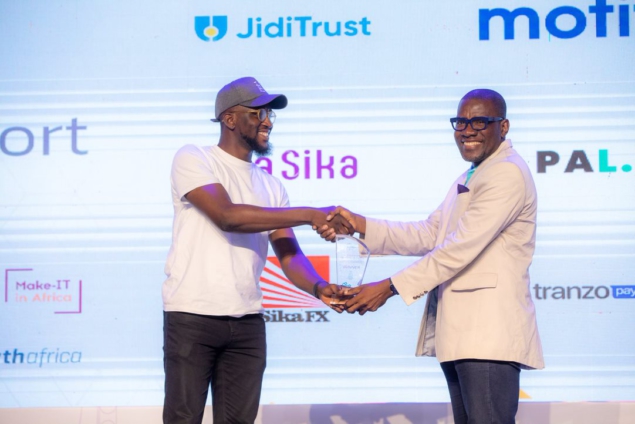

MyFIG was selected as the winner of the Demo Day pitch contest held as part of the climax of the Ghana Digital Innovative Week 2022 after it was selected over 12 other competing startups of the NextGen Fintech Generator.

Figtech Limited’s winning pitch was the showcasing of its flagship app MyFIG, which aggregates and compares offerings in Life Insurance, Investment and Pensions to allow customers to easily purchase packages in their own optimal configuration or portfolio.

The app fills the gap by easing the complexity and information required to make decisions on what pension or financial packages to choose. Some of MyFIG’s unique offerings included a personalised portfolio dashboard and purchasing interface.

Figtech is working with potential partners and service providers in the space to hit the Ghanaian market.

Figtech, a 14-month-old company, successfully made its pitch to a panel of seasoned industry experts, regulators, government agencies and potential partners out of which they were shortlisted with two other companies out of the total 12 startups that participated in the pitch demo competition.

“The company’s vision is to support the Financial Services sector (Life Insurance, Investments, and Pensions) to improve customers' financial health through digital technology to make them and loved ones financially resilient during challenging moments”, the company’s CEO, Festus William Amoyaw said.

According to him, the company has developed the Minimum Value Product (MVP) and is testing the API interface with some Life Insurance Companies.

The future opportunity for the Life Insurance market is estimated between $2.5 billion to $4 billion based on the data from the National Insurance Commission.

Life Insurance penetration can increase in Ghana over the current 0.5% (NIC, 2019).

Again, the National Pension Regulatory Authority (NPRA) says the total workforce in Ghana is about 11 million, with only a little above 2.6 million in a minimum one pension scheme.

He said digital technology would complement the traditional channels of reaching the customer to enhance service delivery.

The award humbles the company, but, at the same time, we are motivated to continue developing the product whiles engaging with the requisite stakeholders for a successful launch.

The NextGen Fintech Accelerator program was an initiative of Stanbic Bank and GIZ and was implemented by Growth Africa.

Latest Stories

-

J.J. Rawlings Foundation mourns the death of June 4 uprising figure Sgt. Peter Tasiri

18 minutes -

Third round of Russia-Ukraine talks to take place as strikes continue

25 minutes -

Kofi Asmah: Cocoa prices, turbulence and the cost of true leadership

27 minutes -

Women in Russian man videos scandal not cheap – Issifu Ali

37 minutes -

Cedi safe amid digital asset growth – BoG

46 minutes -

Photos: EPA busts 14 containers of illegal mining machines at Tema Port

51 minutes -

Harmonious Chorale to represent Africa in Poland and Sweden as it kicks off 20th-anniversary celebrations

52 minutes -

We can’t wait forever for AfCFTA – AGI demands alternative regional trade access

55 minutes -

The Drama of Cocoa politics: When farmers become puppets

55 minutes -

CSIR-BRRI advocates use of local materials in production to reduce cement prices

58 minutes -

Three miners killed in rock collapse at Gbane

1 hour -

Awudome, Osu cemeteries not full — Managers

1 hour -

Africa’s grand stage of honour: Why Ghana hosts POTY 2026

1 hour -

Hillary Clinton accuses Trump administration of a ‘cover-up’ over its handling of Epstein documents

2 hours -

Project C.U.R.E begins 10-day assessment to support Ghana Medical Trust Fund’s NCD fight

2 hours