Audio By Carbonatix

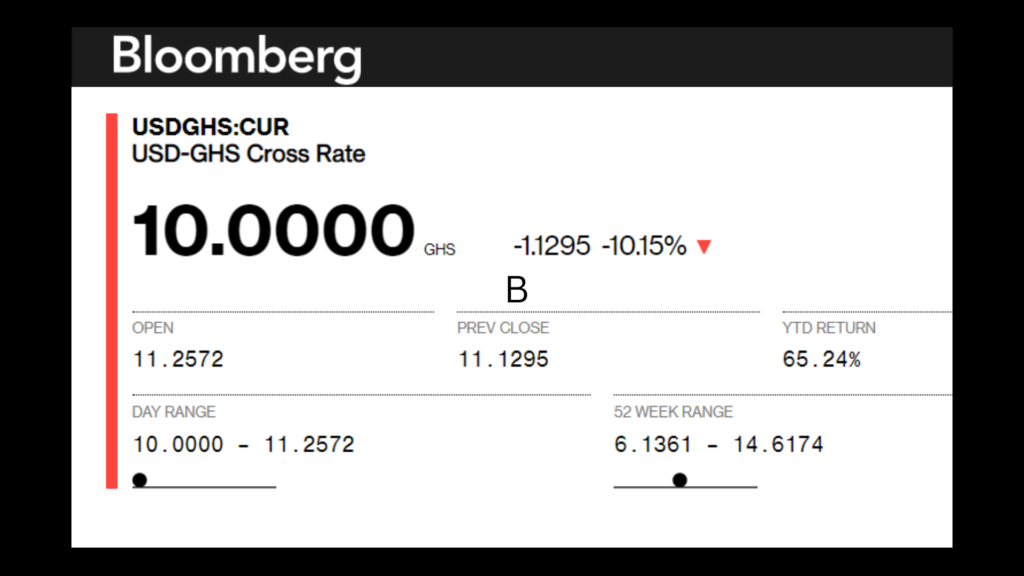

Bloomberg's currency dashboard has pegged $1.00 to ¢10.00, solidifying the cedi's position as the best performing currency against the dollar in the month of December 2022.

Within a span of two weeks, the cedi has regained more than 40% of its lost value since the arrival of the International Monetary Fund's team in Accra on December 1.

According to Bloomberg's currency dashboard, the forex market opened the day with $1 trading at approximately GH¢11.25 after closing at GH¢11.13 the previous day.

Through out the day, it's been a nosedive for the dollar giving the cedi an advantage to gain some additional 12%.

The IMF staff-level agreement, US Fed monetary policy easing, and investors turning bearish on the dollar for the first time since July 2021 have been outlined by some financial experts, as possible factors fueling the dollar's continuous depreciation against the Cedi. The 'greenback' shed more than 4% in the first 20 days of the fourth quarter, paving way for currencies such as cedi to find some comfort in a forlorn position.

According to Goldman Sachs' 2023 outlook, "markets are anxious for signs of a fundamental shift, and investors are increasingly fearful of missing out since corrections after a peak tend to be swift and steep,"

The cedi slumped by more than 54% against the dollar this year. However, it has strengthened by more than 40% since the start of December after Finance Minister, Ken Ofori-Atta disclosed government’s domestic debt exchange programme, followed by the latest IMF visit and the announcement of the Fund’s staff-level agreement of a bailout package worth some $3 billion.

After more than four months of negotiations, Ghana finally sealed a $3 billion programme with the Bretton Wood institution, pending the approval of its Executive Board.

According to Stéphane Roudet, Mission Chief for Ghana, his team “reached staff-level agreement with the Ghanaian authorities on a three-year program supported by an arrangement under the Extended Credit Facility (ECF) in the amount of SDR 2.242 billion or about $3 billion".

"The economic programme aims to restore macroeconomic stability and debt sustainability while laying the foundation for stronger and more inclusive growth. The staff-level agreement is subject to IMF Management and Executive Board approval and receipt of the necessary financing assurances by Ghana’s partners and creditors.”

Latest Stories

-

Minority warns against ‘artificial stability’ in assessment of Mahama administration

4 minutes -

Daily Insight for CEOs: Leading with Consistency and Credibility

11 minutes -

An injury to one is an injury to all – TUC Chairman slams COCOBOD pay cuts

18 minutes -

A Modern Blueprint to end Ghana’s “No Bed Syndrome”: A Systems Approach for a new era of emergency care

27 minutes -

Minority questions 24-hour economy and job creation claims

32 minutes -

US Supreme Court rules that Trump’s sweeping emergency tariffs are illegal

35 minutes -

Symphonic Music releases ‘King of Kings’ EP

38 minutes -

Developing Ghana’s steel base will power infrastructure and jobs – Mahama

48 minutes -

Trump directs US government to prepare release of files on aliens and UFOs

52 minutes -

Apam-Mankessim Highway blocked after fuel tanker accident

53 minutes -

24-Hour Economy, a major boost for private sector—GUTA President

58 minutes -

Ghana’s housing challenge: A Historical, structural, and policy perspective

1 hour -

GIPC CEO calls for strategic investment in coconut value chain

1 hour -

Pink Ladies Cup: Three home-based players named in Black Queens squad

1 hour -

GES and NIA step up plans for nationwide registration of children

1 hour