Audio By Carbonatix

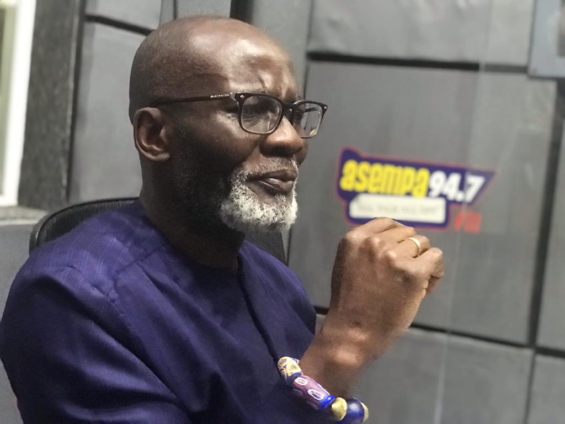

Founder of the Danquah Institute, Gabby Otchere-Darko, says the resistance to government's debt exchange programme will have a far worse impact than opposition to the E-levy policy did.

When the E-levy was first proposed, it was met with mass rejection by sections of the populace.

The critics, including the Minority in Parliament, described it as a 'retrogressive' tax handle designed to worsen the plight of citizens.

The widespread agitations subsequently led to a delay in the passage of the levy, a situation Mr Otchere-Darko claims affected the country's macroeconomic variables.

In a tweet on Sunday, the NPP member explained that if the same resistance is thrown at government's domestic debt exchange programme, the impact will be far worse.

Anticipating the danger, he therefore called on all individual bondholders to soften their stance in order to prevent the economy from further deterioration.

"What we are seeing with the mobilisation of agitation on individual bondholders poses a real and serious risk worse than what we witnessed when opposition to E-Levy succeeded in derailing an already shaky macroeconomic situation from 2021", the tweet said.

"The debt exchange programme is voluntary for individual bondholders but a very necessary evil for our economy.

Its success is critical to restoring macroeconomic stability, securing an IMF prog. It hits those of us holding bonds very hard. A straight no to it is no solution!", he added.

The remarks by the founder of the Danquah Institute comes in the wake of growing public agitations from individual bondholders about government’s proposed domestic debt exchange programme.

In a bid to rescue the economy and secure a deal with the International Monetary Fund (IMF), government has proposed that all bondholders will not receive any interests on their bonds for the 2023 financial year.

The payment of dividends, according to government is likely to begin next year, 2024 at a discounted rate of 5%.

In relation to this, bondholders who may want to transfer their bonds will not be able to get the full principal they initially invested as bonds.

This proposal, since its announcement has been rejected by many bondholders who have expressed frustration about the development.

In their view, if the proposal is implemented, they will suffer a great deal of loss, with many of them stating that their investments may even become unprofitable.

Some of the aggrieved bondholders, who recently interacted with JoyNews have thrown their hands in despair, with others contemplating suicide.

The affected investors say with government’s intended management of their bonds, they may not even be able to meet their expenses such as rent, feeding and the payment of fees for their wards.

They have therefore called on government and other relevant stakeholders to intervene in the matter.

In this regard, policy analyst, Senyo Hosi, who is part of the crusade, is currently mobilising all affected bondholders to collectively resist the move by government.

Speaking on JoyNews‘ PM Express last week, he stated that the proposal by government is ‘insensitive’ and must be outrightly resisted.

Meanwhile, government insists the debt exchange programme is the way to go in rescuing the economy.

Latest Stories

-

JUSAG declares strike on January 19 over unpaid salary arrears

44 minutes -

Anderlecht and QPR join race for Jalal Abdullai after impressive Molde loan spell

47 minutes -

I am confident there won’t be a rerun in Kpandai—Haruna Mohammed

50 minutes -

NPP should’ve invited Prof Frimpong-Boateng for a chat over ‘fake party’ comment – Nyaho-Tamakloe

1 hour -

Ghana Publishing Company in strong financial shape after 10 months – Managing Director

1 hour -

Many NPP members share Frimpong-Boateng’s views; NPP should prepare to expel them too – Dr Nyaho-Tamekloe

1 hour -

I’m not leaving – Prof. Frimpong-Boateng defies NPP expulsion threats

1 hour -

If you know you have misused public funds, be prepared to return it – Asiedu Nketia

1 hour -

Police arrest three over taxi phone-snatching syndicate

1 hour -

NPP’s move against Frimpong-Boateng raises fairness concerns – Asah-Asante

2 hours -

I’m not leaving NPP; the fake people should rather go – Prof. Frimpong-Boateng

2 hours -

‘We have met Pontius Pilate’ – Judge declines state’s bid to drop Abu Trica co-accused charges

2 hours -

Who said Ofori-Atta was picked up from an ICU bed? – Frank Davies questions ‘medically fit’ claim

2 hours -

We’ll win the Kpandai re-run—Tanko-Computer

2 hours -

Ghana facing acute teacher shortage as 30,000 classrooms left without teachers – Eduwatch

2 hours