Audio By Carbonatix

Elon Musk has denied that his prolific use of Twitter, the social media platform he owns, is damaging the electric vehicle maker Tesla.

The automotive firm announced sales and profits for the October-to-December period ahead of expectations.

On a call with investors, Mr Musk was asked if his "political influencing" on Twitter is hurting Tesla's brand.

"I think Twitter is actually an incredibly powerful tool for driving demand for Tesla," Mr Musk said.

The billionaire, who is chief executive and product architect of Tesla, said his 127 million followers on the social media platform "suggests that I'm reasonably popular".

Mr Musk is currently embroiled in a court case where he stands accused of defrauding investors following a tweet in 2018 stating he was considering taking Tesla private. The firm's share price spiked before falling back when a deal failed to materialise.

More recently, he provoked a backlash when he tweeted a peace plan to end the Russia-Ukraine war. One suggestion was for Ukraine to cede control of Crimea, which Russia annexed in 2014, to the Kremlin.

He told investors: "I would really encourage companies out there of all kinds, automotive or otherwise, to make more use of Twitter and to use their Twitter accounts in ways that are interesting and informative, entertaining, and it will help them drive sales just as it has with Tesla."

Tesla's share price tumbled by nearly two-thirds last year, amid concerns that the company was losing its edge, while Mr Musk was increasingly involved with his drawn-out $44bn (£35.5bn) takeover of Twitter and its subsequent reorganisation.

On Wednesday, Tesla announced that sales for the final quarter of 2022 rose by 37% to $24.3bn compared to the same period the year before. Revenues had been expected to rise by $24bn.

Profits increased by 59% to $3.7bn.

Commenting on the results, Sophie Lund-Yates, lead equity analyst at Hargreaves Lansdown, said: "Elon Musk's foray into social media leadership through the Twitter takeover has threatened to unpick a lot of confidence as investors fretted about Elon's ability to lead both companies."

She added that the court case was "another distraction".

"The last thing serious investors want is to see their chief executive in a witness stand. The worst of the damage is done but there's likely to be little room for error or sentiment roulette for some time," she said.

For the whole year, Tesla delivered a record 1.3 million cars to customers, a rise of 40%.

The company recently cut prices on some vehicles such as the Model 3 and the cheapest Model Y car. It prompted criticism from some people who had bought those cars at full price last year.

Mr Musk acknowledged questions about how the firm will be affected by higher borrowing costs and a weaker economy.

But he said the price cuts are working to bring in buyers, with orders this month so far outpacing production.

"Price really matters," he said. "We think demand will be good despite, probably, a contraction in the automotive market as a whole."

Looking ahead, Mr Musk said that he expected Tesla's share price to recover over the long-term, though warned that he anticipated a "pretty difficult recession" in 2023 which could lead to setbacks.

"There's going to be bumps along the way and we'll probably have a pretty difficult recession this year, probably," he said. "I hope not, but probably."

Tesla's results were released at a critical time for the company.

Sales of electric vehicles rose last year, bucking a wider decline in the global car market.

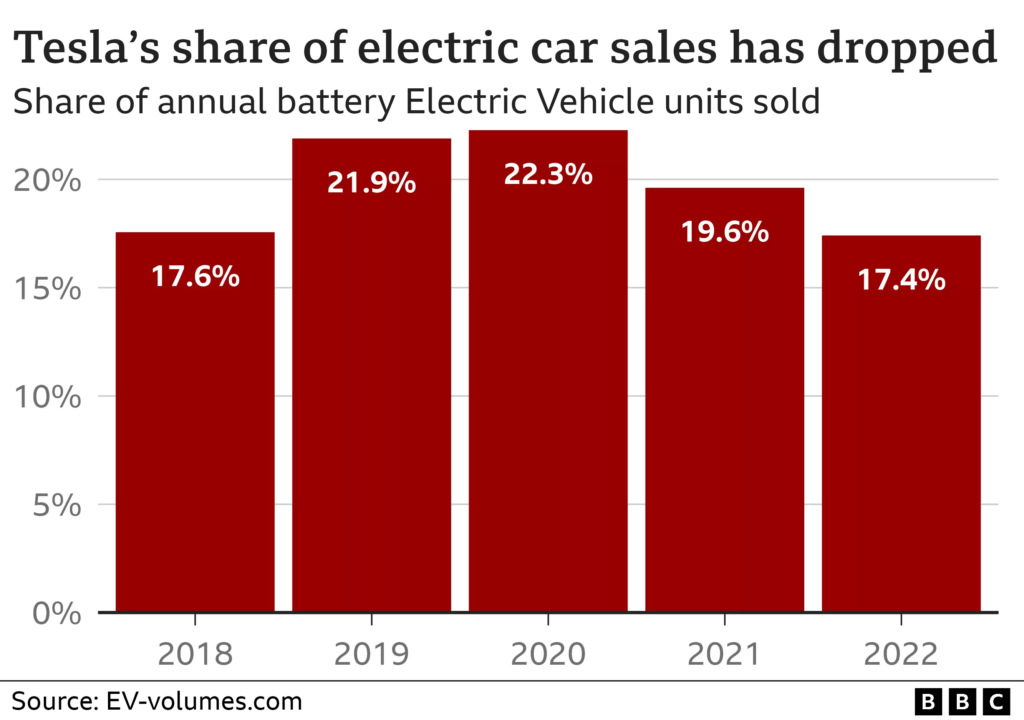

But Tesla's lead has been challenged by increased competition from traditional motor manufacturing giants such as Ford and General Motors, as well as newer entrants to the market like Rivian and Lucid in the US and China's BYD and Nio.

Ms Lund-Yates said: "It's incredibly telling that Tesla is moving to make its vehicles more affordable.

"This enables the group to entice more customers despite inflation fears, and tempts them away from the competition who are largely at a lower price-point."

Executives said that in the months ahead Tesla would be focused on increasing production as quickly as possible, while bringing down costs.

They said they believed its operating margins would remain among the highest in the industry - though warned they would shrink because of the price cuts - and that the firm's much-anticipated cyber-truck was on track to start production later this year.

Latest Stories

-

Ghana launches revised Early Childhood Care and Development Policy to strengthen child development framework

5 minutes -

AI to transform 49% of jobs in Africa within three years – PwC Survey

18 minutes -

Physicist raises scientific and cost concerns over $35m EPA’s galamsey water cleaning technology

30 minutes -

The road to approval: Inside Ghana’s AI strategy and KNUST’s leadership

1 hour -

Infrastructure deficit and power challenges affecting academics at AAMUSTED – SRC President

1 hour -

Former US diplomat sentenced to life for abusing two girls in Burkina Faso

1 hour -

At least 20 killed after military plane carrying banknotes crashes in Bolivia

1 hour -

UK reaffirms investment commitment at study UK Alumni Awards Ghana 2026

2 hours -

NCCE pays courtesy call on 66 Artillery Regiment, deepens stakeholder engagement

2 hours -

GHATOF leadership pays courtesy call on Chief of Staff, Julius Debrah

2 hours -

KiDi unleashes first single of the year ‘Babylon’

2 hours -

Ghana Boxing Federation unveils new logo at Accra Sports Stadium

2 hours -

Pink Ladies Cup: Agejipena scores debut goal as Black Queens thump Hong Kong

2 hours -

Ghana pays tribute to 1948 heroes at 78th anniversary observance

3 hours -

Allowance payout will strengthen Ghana’s decentralization framework – Tano North Assembly Members

3 hours